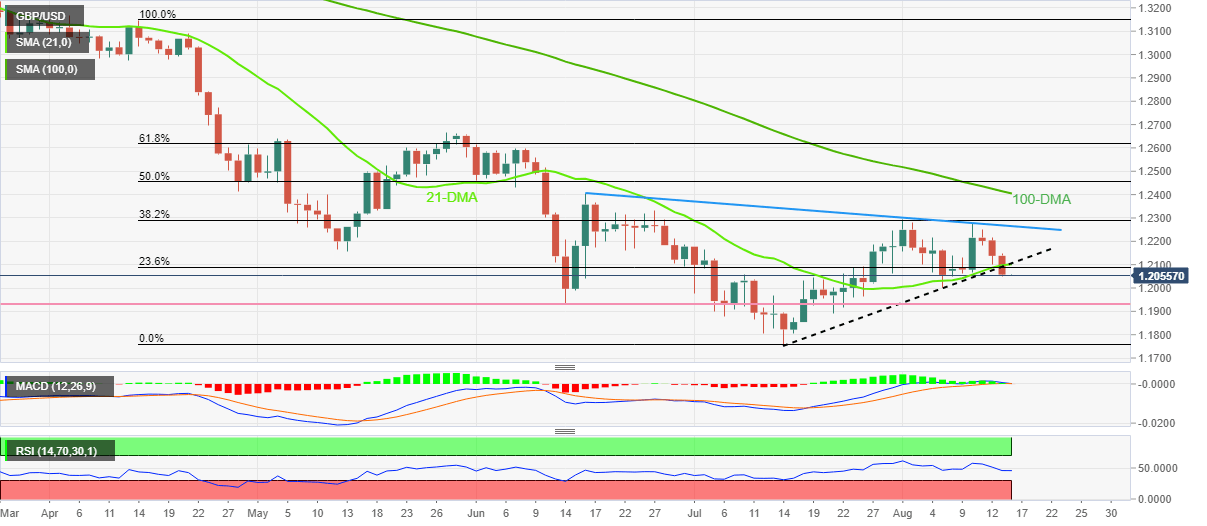

GBP/USD Price Analysis: Bears take a breather on the way to 1.1930

- GBP/USD remains depressed around one-week low after breaking short-term key support.

- Steady RSI, impending bear cross on MACD also keep sellers hopeful.

- Buyers need validation from two-month-old resistance line, 1.2000 can test intraday sellers.

GBP/USD dribbles around mid-1.2000s as the Cable traders lick their wounds during Tuesday’s Asian session, after the biggest daily fall in a week. Even so, the quote remains on the bear’s radar as it stays beneath the 1.2110-2100 support-turned-resistance.

A clear downside break of the convergence of the 21-DMA and an upward sloping trend line from mid-July keep GBP/USD sellers hopeful. Also suggesting the pair’s further downside is the descending RSI (14), not oversold, as well as a looming bear cross on the MACD.

That said, the pair is likely declining towards the horizontal area comprising multiple levels marked since June, around 1.1930. However, the 1.2000 psychological magnet may offer an intermediate halt during the anticipated fall.

In a case where the GBP/USD prices drop below 1.1930, the odds of witnessing a slump towards the yearly low of 1.1760 seem acceptable.

Alternatively, a corrective pullback need not only to cross the 1.2100-2110 immediate hurdle but a two-month-old descending trend line resistance, close to 1.2265 by the press time, to convince GBP/USD buyers.

Even so, the 100-DMA level surrounding 1.2415 could challenge the quote’s further advances.

GBP/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.