- GBP/USD meets with some supply on Wednesday amid a modest pickup in the USD demand.

- The mixed technical setup warrants caution for bears and before positioning for further losses.

- A sustained move beyond the 1.2700 mark is needed to support prospects for additional gains.

The GBP/USD pair comes under heavy selling pressure following the previous day's two-way directionless price moves and drops to the 1.2665 region during the Asian session on Wednesday.

Despite Tuesday’s disappointing release of the US Durable Goods Orders, investors seem convinced that the Federal Reserve (Fed) will wait until the June policy meeting before cutting interest rates. This helps revive the US Dollar (USD) demand, which, in turn, is seen as a key factor exerting downward pressure on the GBP/USD pair. The downfall, meanwhile, seems unaffected by the overnight hawkish remarks by the Bank of England (BoE) Deputy Governor Dave Ramsden, saying that he wanted more evidence that inflationary pressures were easing to consider a cut in interest rates.

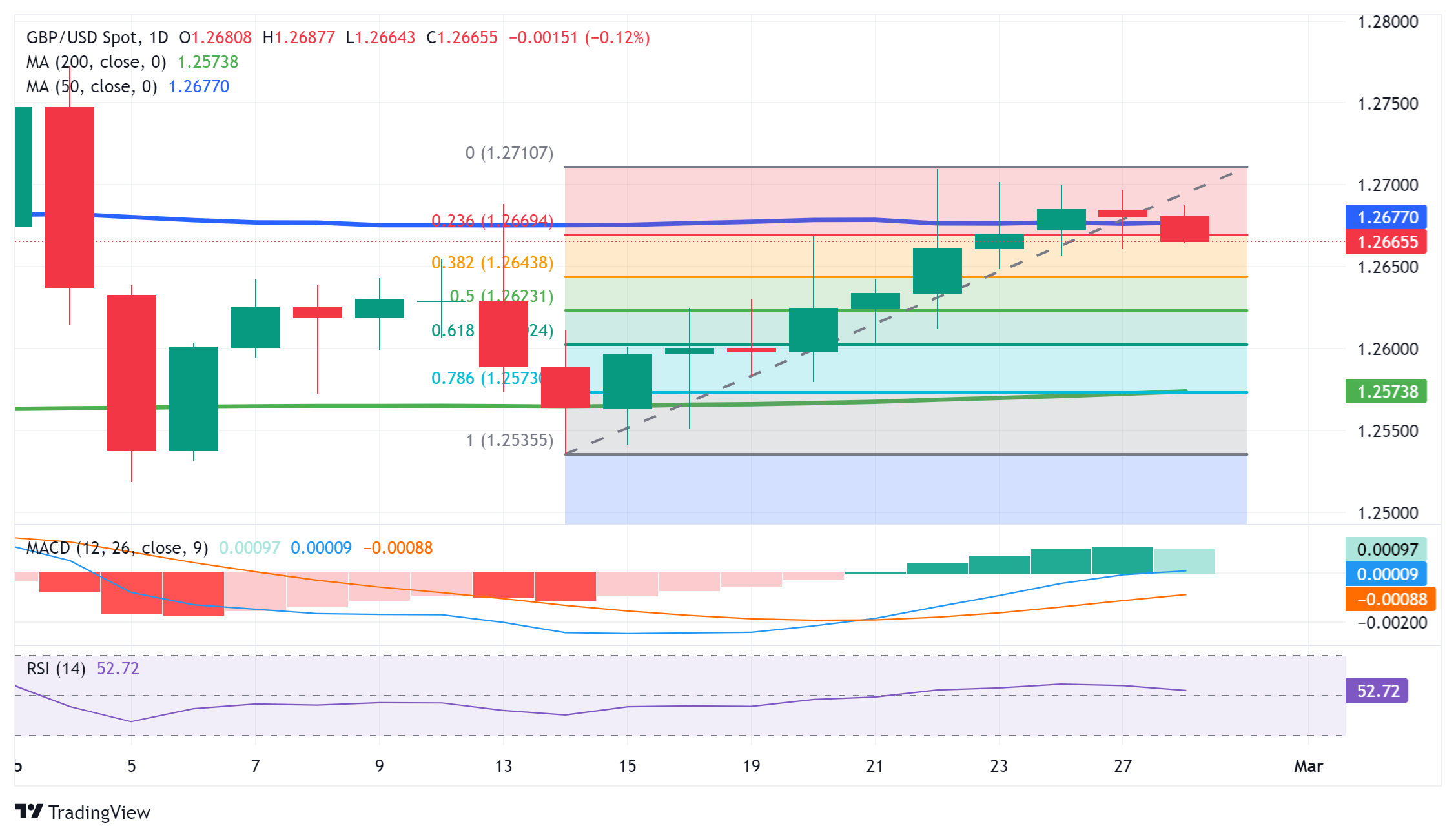

From a technical perspective, the recent repeated failures to find acceptance above the 50-day Simple Moving Average (SMA) and a slide below the 23.6% Fibonacci retracement level of a nearly two-week-old uptrend favours bearish traders. That said, oscillators on the daily chart are holding in the positive territory and warrant some caution. Hence, any subsequent decline is more likely to find decent support near the 1.2645 area, representing 38.2% Fibo. level. A convincing break below, however, will set the stage for a further near-term depreciating move for the GBP/USD pair.

Spot prices might then accelerate the slide towards the 50% Fibo. level, around the 1.2625 region, before dropping to the 1.2600 mark, or the 61.8% Fibo. level, and the 1.2575 confluence. The latter comprises the 78.6% Fibo. level and the very important 200-day SMA, which if broken decisively will be seen as a fresh trigger for bearish traders and prompt aggressive technical selling around the GBP/USD pair.

On the flip side, momentum beyond the 50-day SMA might continue to confront some resistance ahead of the 1.2700 mark. Some follow-through buying beyond last week's swing high, around the 1.2710 area, however, could trigger a short-covering rally and lift the GBP/USD pair back towards the monthly swing high, around the 1.2770 supply zone. A sustained strength beyond the latter has the potential to lift spot prices beyond the 1.2800 mark, towards the December 2023 peak, around the 1.2825-1.2830 region.

GBP/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.