GBP/USD Price Analysis: Bears engage at a key 61.8% ratio

- GBP/USD bears firm-up in early Asia and eye a test below 1.1300.

- There are risks of lower still while below a 61.8% ratio on the hourly chart.

GBP/USD has come under pressure to test the 1.1300 level following a resurgence in the US dollar on Wednesday. The US dollar index, DXY, was last seen up near to 1% at 111.21 but it had been as high as 111.735 overnight.

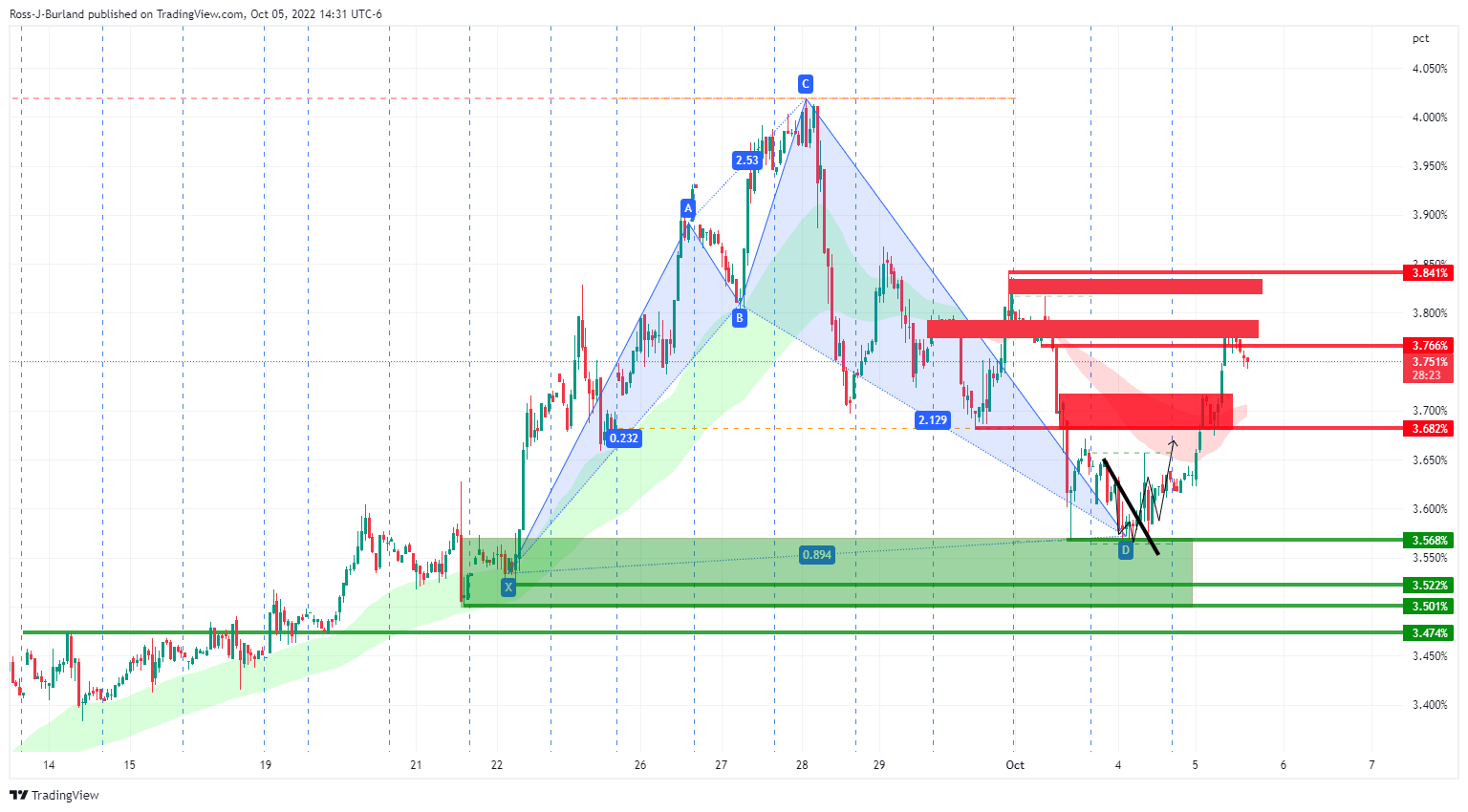

US yields rallying has helped to prop up the US dollar as the money markets price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of 3.78%.

The following illustrates the price action across the assets resulting in the sell-off in the pound and offers scenarios for the rest of the week leading to the Nonfarm Payrolls event on Friday.

US yields

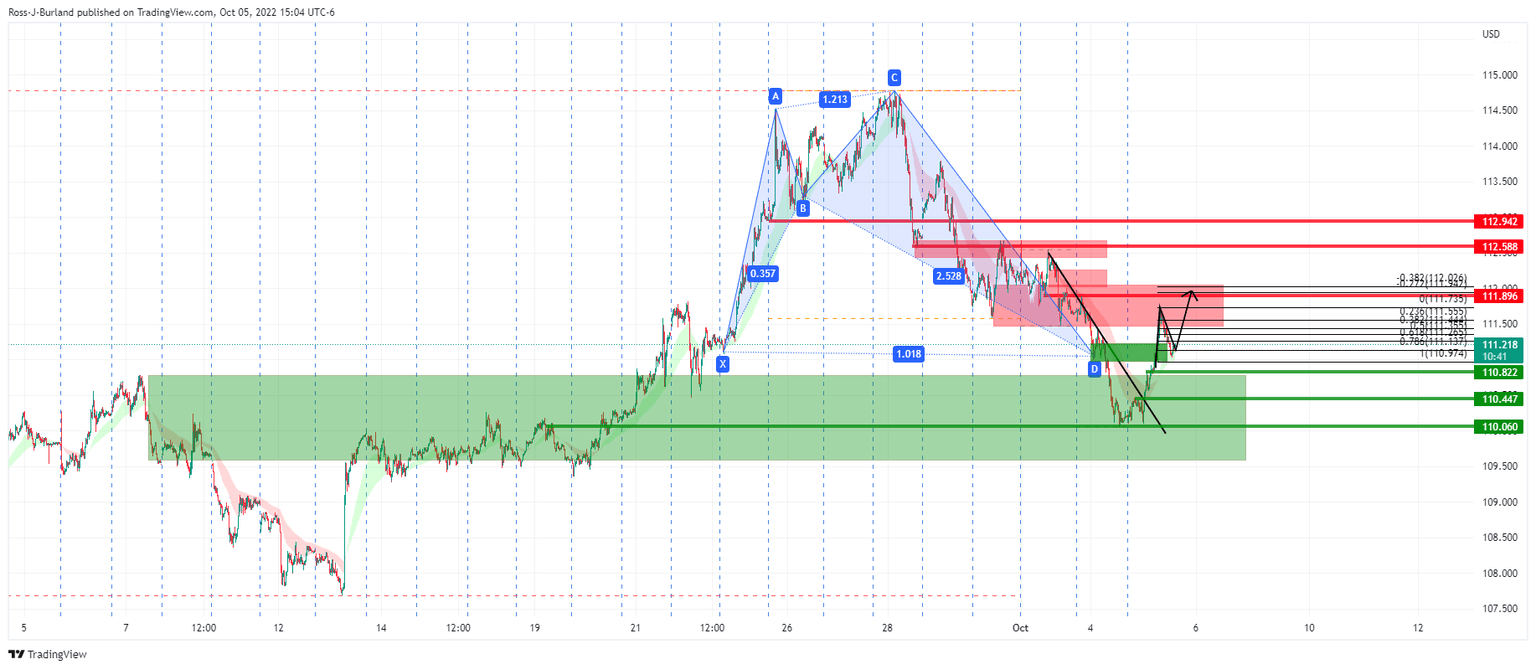

US dollar

The greenback, as measured by the DXY index, has consequently rallied on the day but corrected into a support structure.

This structure would be expected to see the index extend the bullish correction and move in on the 112 area.

GBP/USD H1 chart

GBP/USD will remain bearish while below the 61.8% Fibonacci retracement level near 1.1350 and there are prospects of a downside continuation for the day ahead putting heat on committed bulls near 1.1200.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.