GBP/USD Price Analysis: 1.3570 is the next relevant target for bears

- GBP/USD continued losing ground on Friday and dropped to one-month lows in the last hour.

- Sustained USD buying, disappointing UK macro data bot contributed to the ongoing downfall.

- Weakness below July swing lows will set the stage for an extension of the depreciating move.

The GBP/USD pair added to the previous day's heavy losses and witnessed some follow-through selling on the last day of the week. This marked the fourth day of a negative move in the previous five and dragged the pair to the 1.3600 neighbourhood, or one-month lows during the mid-European session.

The prevalent risk-off environment, along with expectations that the Fed will begin rolling back its pandemic-era stimulus pushed the safe-haven US dollar to a nine-and-half-month high on Friday. Apart from this, the disappointing release of the UK monthly Retail Sales figures weighed on the British pound and contributed to the GBP/USD pair's ongoing decline.

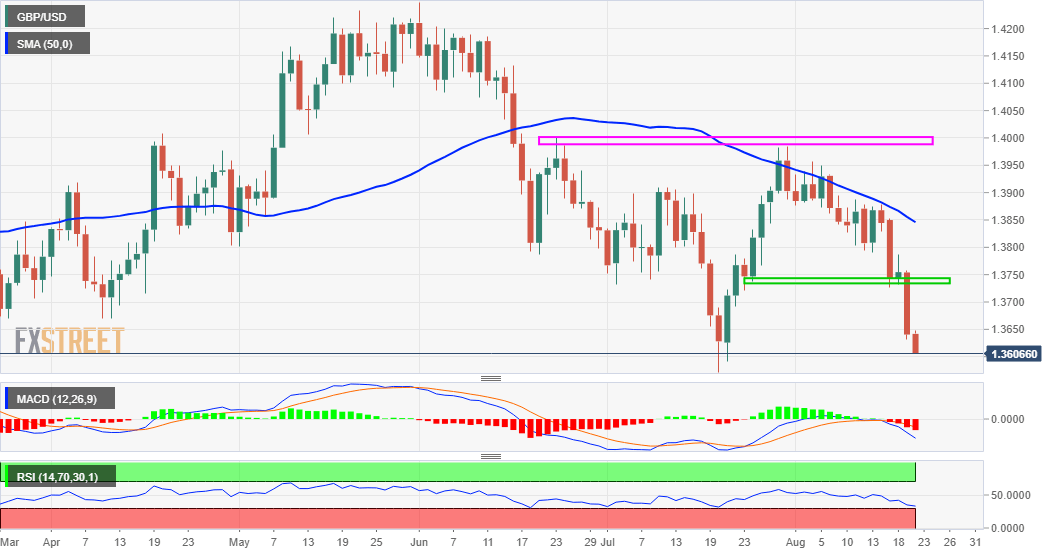

From a technical perspective, the overnight slide confirmed a double-top breakdown through the neckline support near the 1.3725 region. Subsequent weakness below the 1.3700 mark validated the bearish set-up and contributed to the ongoing decline. However, oversold RSI on hourly charts held traders from placing fresh bearish bets, at least for the time being.

Nevertheless, the bias remains tilted firmly in favour of bearish traders and supports prospects for a fall back towards retesting July monthly swing lows, around the 1.3570 region. This is followed by support near mid-1.3500s, below which the downward trajectory could further get extended and drag the GBP/USD pair towards challenging the key 1.3500 psychological mark.

On the flip side, any attempted recovery back above the 1.3640-50 region might now confront stiff resistance ahead of the 1.3700 mark. A sustained strength beyond might prompt some short-covering move towards the 1.3680-90 zone. The momentum might still be seen as a selling opportunity and runs the risk of fizzling out quickly, rather remain capped near the 1.3725 support breakpoint.

GBP/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.