GBP/USD plunges and prints a new YTD low at 1.3027

- The British pound falls vs. the US Dollar on broad US dollar strength amid a risk-off market sentiment.

- UK’s upbeat economic data and BoE rate hike bets expectations faltered to support the GBP.

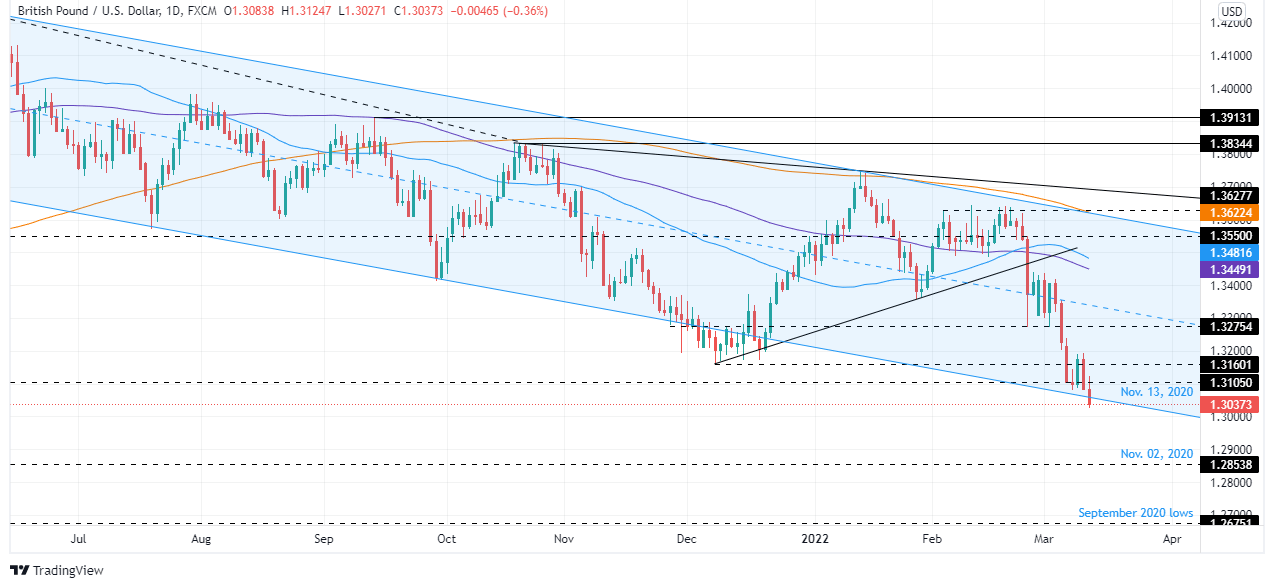

- GBP/USD Technical Outlook: Downward biased, as bears eye 1.2850.

The British pound heads into the weekend, set to record losses as Wall Street’s bell signals the end of a hectic week, mainly driven by market sentiment, leaving macroeconomics or, also sometimes, central banks aside. In tone with the week, Friday’s trading day fluctuated between risk-on/off, on reports from Russia saying that its President Putin seen “certain positive shifts” in talks with Ukraine, while Ukraine Foreign Minister, saying the opposite. That said, the GBP/USD is trading at 1.3035, down 0.39%.

US equities closed the week in the red, with the S&P 500, Dow Jones, and Nasdaq down 1.30%, 0.69%, and 2.18%, respectively. As measured by the US Dollar Index, the greenback is set to finish the week eyeing the 100 mark, up 0.61%, sitting at 99.116, a headwind for the GBP/USD.

Overnight, the GBP/USD braced to the November 2020 lows around 1.31050, and in fact reacted to some UK economic releases, reaching a daily high around 1.3139, to then follow the path of least resistance, falling under the 1.3100 handle, printing a new YTD low at 1.3027.

In the European session, the UK economic docker featured some data. UK’s GDP for January rose 0.8% higher than the 0.2% contraction in December. Furthermore, Industrial Production for January rose 0.7% m/m, influenced by the spike of 0.8% growth in manufacturing. The services sector increased by 0.8% higher than the -0.5% fall of December.

Across the pond, the US economic docket featured the University of Michigan Consumer Sentiment for March, which declined from 62.8 in February to 59.7, while Inflation expectations rose to 5.4% from 4.9% in the previous reading. It is the lowest reading since November of 2011, as inflation expectations rose sharply due to a surge in fuel prices exuberated by the Russian invasion of Ukraine.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is downward biased and further cemented by the break of the last swing low at 1.3160, December 8, 2021 low, which was unsuccessfully tested in the previous two trading days, pushing the GBP/USD under the 1.3100 mark. Additionally, the GBP/USD broke below the bottom-trendline of a descending channel, which can exacerbate a move lower.

That said, the GBP/USD first support would be 1.3000. Breach of the latter would expose the psychological 1.2900 mark, followed by November 2, 2020, low at 1.2853, and September 2020 lows around 1.2675.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.