- Cable falls below 1.3700 as risk sentiment dives following hawkish Fed chatter and robust US data.

- DXY moves in on the 93 area while the pound suffers risk-off ahead of Fed's Powell keynote speech.

GBP/USD is testing below the 1.37 figure and has printed a recent low of 1.3695 as the US dollar shows the intent of a recovery above the 93 psychological levels as per the DXY.

The DXY, an index whereby the US dollar is measured against a handful of major rivals, including the euro and the pound, has been on a collision course with 92.80 for this week so far.

92.80 is a critical level that has been tested over and over due to improved risk sentiment following last week's weaker US data and Federal Reserve hawk, Dallas Fed's Robert Kaplan's comments on Friday.

Kaplan expressed his concerns for the spread of the delta coronavirus variant and said he would reconsider his stance on tapering the Fed's QE programme so early if matters deteriorated.

This led to a bout of risk-on with US stock printing fresh all-time highs. It also lifted commodity-linked currencies and sterling for its correlation to risk sentiment that saw it reclaim the $1.37 level.

Fed hawks circle above Powell's keynote speech

However, the pound is now consolidating gains made on the back of a risk-led recovery this week and risk took a hit from Kaplan's new remarks made on CNBC on Thursday.

Kaplan said it is still his view that the September FOMC Meeting would be a time to announce a plan for tapering, to start in October or shortly thereafter.

With respect to the delta variant, he now argues, "by and large what we are hearing..is they are weathering this resurgence at least as well as previous surges, and many are telling us the impact on their business is more muted."

St. Louis Fed's Bullard spoke earlier on CNBC and said that the Fed is "coalescing" around a plan to begin reducing its $120 billion in monthly bond purchases.

"We probably don't need the asset purchases at this point," he said.

The focus now is with the Jackson Hole and a highly anticipated keynote speech from the Fed's chairman, Jerome Powell.

Traders are looking for clues about the timings of a taper and expect the chairman of the Fed to deliver clarity to the Fed's outlook on the economic recovery, both global and domestic, and monetary policy.

Data is also of utmost importance and is already having an impact on the greenback.

Economic numbers released on Thursday furthered the Fed's narrative that risks to the recovery in the labour market persist, although the outlook has improved.

On the negative side, the number of US workers filing first-time applications for unemployment benefits edged up by 4,000 last week to 353,000, according to the Labor Department.

Analysts expected a smaller uptick to an even 350,000.

However, the 4-week moving average of initial claims, which irons out week-to-week volatility, moved lower last week, so the overall trend remains on a downslope.

Separately, the Commerce Department released its second stab at second-quarter Gross Domestic Product number, adding 0.1 percentage point to show the economy grew at a 6.6% quarterly annualized rate in the April to June period. However, the data fell just short of the 6.7% consensus.

Nevertheless, US 10-year treasury yields are higher again, reaching a 10-day high to 1.3750% and have moved into a positively bullish territory on the daily chart crossing above the 200-day SSMA.

Additionally, the US Treasury's 7-year auction hit a high yield of 1.155% on Thursday, up from the 1.050% high in the previous auction.

The bid to cover ratio for the auction was 2.34, up from the 2.23 ratio in the previous auction.

US stocks are also pressured. The Dow Jones Industrial Average declined 0.2% to 35,350.65, with S&P 500 lower by 0.2% and Nasdaq down by 0.2%.

GBP/USD technical analysis

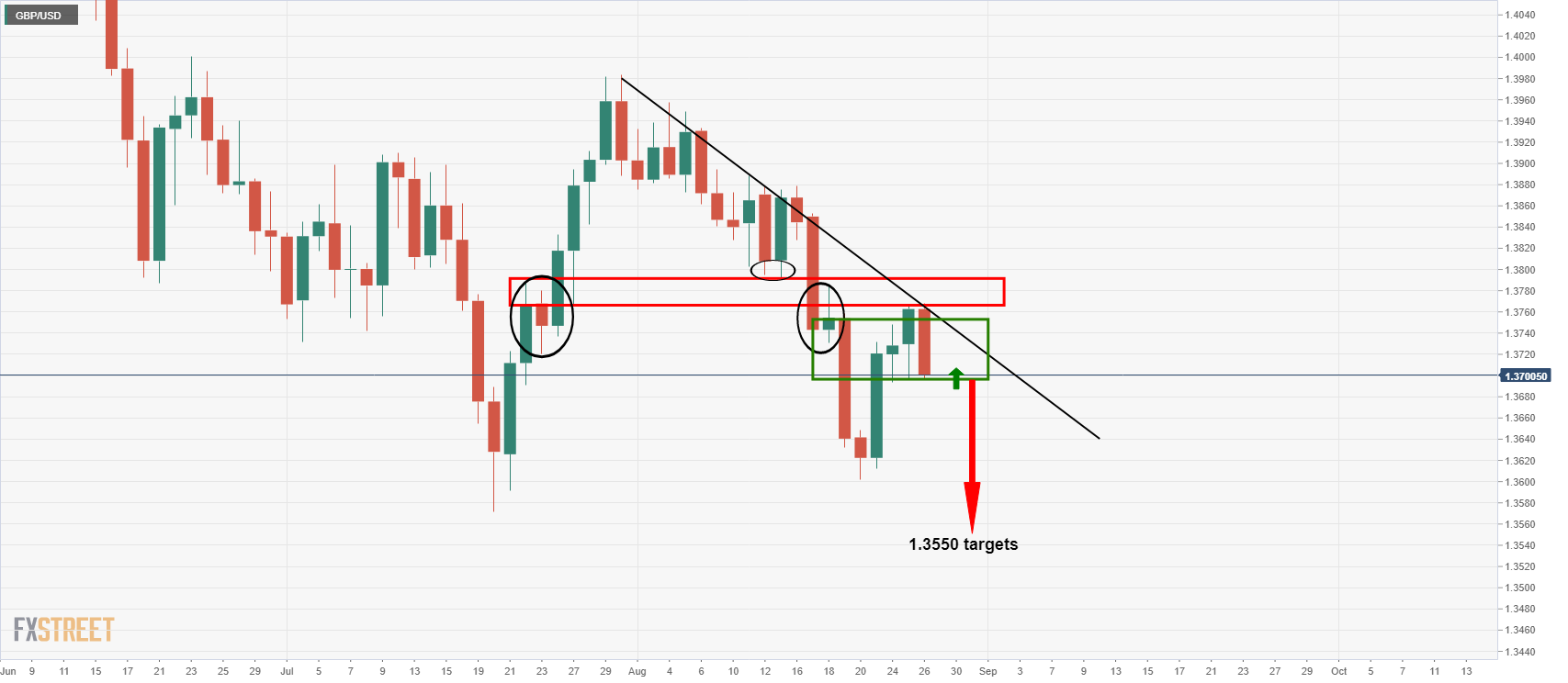

As pe the prior analysis, GBP/USD Price Analysis: Bears waiting to pounce to target the 1.3550s, the market is starting to line up.

Prior analysis:

GBP/USD downside prospects

''This resistance would be expected to hold and lead to a downside continuation as illustrated above.

The downside target area is a -272% Fibonacci retracement of the current correction's range.''

GBP/USD 4-hour chart

''The 4-hour chart offers an entry point at the recent lows near 1.3695 that would be expected to be retested as a resistance level if the price does manage to break lower.''

Live market update, daily and 4-hour chart

The price is yet to break the support structure, but bears will be on guard for an optimal entry-point opportunity over the coming sessions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD recovers toward 1.0500 after mixed US PMI data

EUR/USD rebounds toward 1.0500 in the American session on Friday after the data from the US showed that the business activity in the private sector expanded at a softer pace than anticipated in early February. The pair remains on track to end the week with little changed.

GBP/USD rises above 1.2650, looks to post weekly gains

GBP/USD regains its traction and trades above 1.2650 in the second half of the day on Friday. The data from the US showed that the S&P Global Services PMI dropped into the contraction territory below 50 in February, causing the US Dollar to lose strength and helping the pair edge higher.

Gold holds above $2,930 as US yields edge lower

Gold holds above $2,930 after correcting from the record-high it set above $2,950 on Thursday. Following the mixed PMI data from the US, the benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and allows XAU/USD to hold its ground.

Crypto exchange Bybit hacked for $1.4 billion worth of ETH

Following a security breach first spotted by crypto investigator ZachXBT, crypto exchange Bybit announced that it suffered a hack where an attacker compromised one of its ETH wallets.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.