GBP/USD loses the 1.22 handle to close out Friday trading

- The GBP/USD initially rose on Friday, but got knocked lower as the market broadly swept back into the US Dollar.

- The US Dollar index caught a late bid to push back into the middle to close out the trading week.

- Recession risk is still quite high in the UK, capping Pound Sterling bids.

The GBP/USD sank just south of the 1.2200 handle heading into the Friday market close, and the pair finds itself still struggling under the weight of a heavy bearish trend.

Inflation continues to be a hot topic for the Bank of England (BoE), and the UK may have no choice but to continue facing down high interest rates. With prices continuing to grow above the BoE's target, interest rate cuts remain a far-off dream for market investors hoping to get their borrowing and funding costs eased.

UK labor conditions continue to deteriorate, and the manufacturing outlook remains pessimistic looking forward.

Next week the UK will see Manufacturing Purchasing Manager Index (PMI) figures for September; the PMI data is broadly expected to show continued deterioration in economic expectations.

The US Dollar (USD) is set to remain well-bid through next week's trading window. An impending US government shutdown is seeing the Greenback bolstered across the broader market, and a government shutdown could see next week's Non-Farm Payrolls delayed.

Read More:

Forex Today: Another positive week for the Dollar

Pound Sterling fails to hold recovery as US Dollar recovers

GBP/USD technical outlook

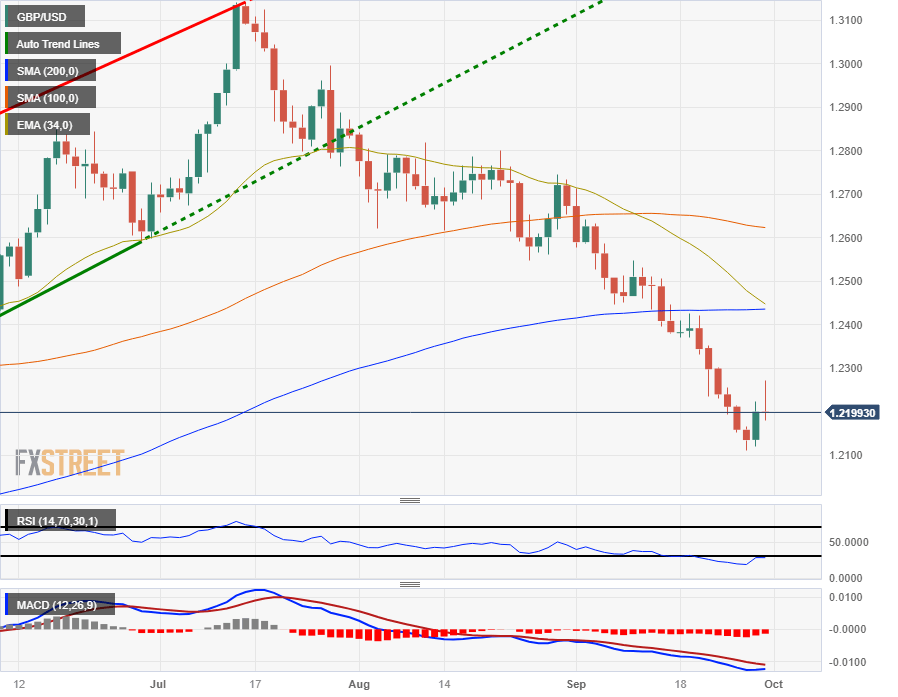

The Sterling got rejected from the 200-hour Simple Moving Average after peaking at an intraday high of 1.2270 on Friday, sending the pair into a fresh low of 1.2180 for the day.

The GBP/USD is currently pinned to the midpoint at the 34-hour Exponential Moving Average (EMA) as intraday momentum bleeds out, and the midweek's bounce from a near-term low if 1.2110 looks set to run out of steam.

Daily candlesticks have the GBP/USD deeply off the beaten path, tumbling away from the 200-day SMA currently parked just above 1.2400, and the pair is set to continue charging into fresh six-month lows is selling pressure keeps up.

A descending 34-day EMA is providing dynamic resistance for any potential bullish pullbacks, and is currently priced in at the 200-day SMA, looking for a bearish crossover.

GBP/USD daily chart

GBP/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.