GBP/USD holds within familiar support territory in the 1.32's

- GBP{/USD trapped within the 1.32's, eyes on a significant upside correction.

- The central bank divergences are laying into the hands of the GBP/USD bears.

GBP/USD is under pressure but remains within a 50 pip range with support within the 1.3200 vicinities. At the time of writing, cable is down some 0.25% trading between 1.3208 and 1.3289 on the day.

Risk sentiment rebounded further on Tuesday as markets become more optimistic that Omicron will not impede the global economic recovery. Also, pledges from China to support economic growth also helped alleviate some of the fears. Markets now expect further monetary policy easing in China after the People’s Bank of China said it will reduce bank reserve requirements.

The US dollar is holding up with the DXY index trading just shy of the one-week high of 96.592 printed earlier today. However, the pound is the worst-performing currency on the CSI for Tuesday as central bank divergence plays out.

While the Federal Reserve sent some hawkish signals of late despite the covid variant risks, as it is focused on spiking inflation. However, the Bank of England saw even some of its more hawkish voices such as Michael Saunders taking a more cautious tone. Saunders, one of two members of the nine-strong Monetary Policy Committee who voted to raise Bank Rate to 0.25% in November, said on Dec. 3 there "could be particular advantages in waiting to see more evidence" of Omicron's impact.

BoE expectations

The Bank of England is now expected to hold off again next week on becoming the world's first big central bank to raise interest rates from their pandemic lows. On Tuesday, investors were pricing in a roughly 50% chance of the BoE raising Bank Rate to 0.25% on Dec. 16, down from around 75% last week but higher than just a one-on-three chance immediately after the speech by Saunders on Friday.

This divergence in policy expectations may keep cable pinned to the floor in the 1.32 area in the run-up to the BoE meeting despite the upbeat risk sentiment. Meanwhile, a possible catalyst for volatility i the pair before then could come from the Dec 10 monthly Gross Domestic Product report for October.

''Manufacturing likely pulled down on growth with a relatively sharp fall, driven in part by a decline in motor vehicle production, but we see upside risks elsewhere (including for the Index of Services), as consumers pulled forward demand over fears of end-of-year shortages, '' analysts at TD Securities said. ''This would leave GDP growth roughly on track for the BoE's recent forecast of 1.0% QoQ.

GBP/USD technical analysis

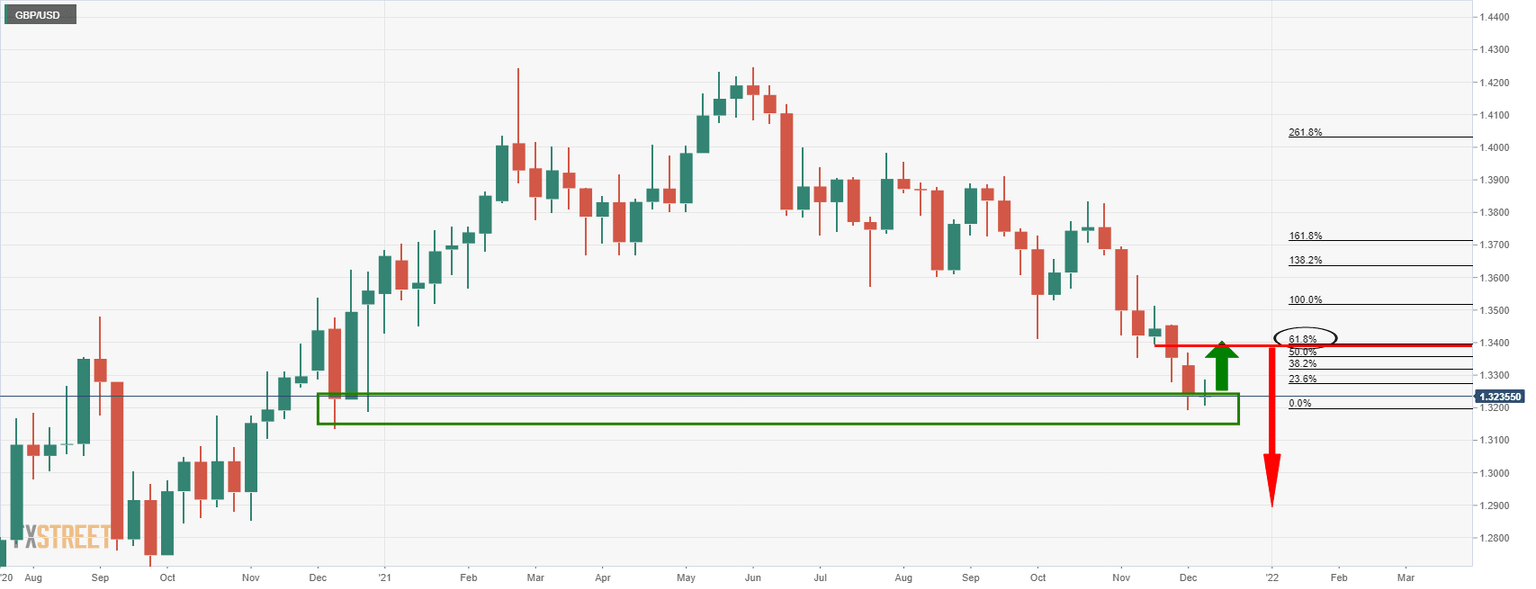

The price appears to be trapped in the 1.32's. From a longer-term perspective, the price could be headed for an upside correction prior to further downside. This opens prospects of a correction back to test the old support near the 61.85 Fibonacci retracement level around 1.34 the figure:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.