GBP/USD holds steady as US PMI slows, UK data sparks recessionary talks

- GBP/USD remains stable around 1.2690 despite the US manufacturing activity slowdown.

- UK data shows slight improvement but remains in recessionary territory, raising economic concerns.

- Speculations of the Fed’s interest rate increases impact GBP/USD, while the US Dollar strengthens against a basket of currencies.

GBP/USD stayed firm at the beginning of the year’s second half, at around the 1.2690s area; post-data release in the United States (US) showed manufacturing activity slowed down. Meanwhile, UK data portrayed a slight improvement but remained in recessionary territory. At the time of writing, the GBP/USD is trading at 1.2690, almost unchanged.

US manufacturing slowdown and UK recessionary concerns influence GBP/USD stability

The Institute for Supply Management (ISM) revealed its June Manufacturing PMI poll, which showed that business activity is deteriorating further, as data stood at contractionary territory at 46.0, below May’s 46.9 and estimates of 47.0. The data highlighted that input prices continued to slow down, signaling inflation edges down amidst 500 basis points of rate increases by the US Federal Reserve (Fed).

The GBP/USD reacted upwards to the data, trimming speculations of the Fed’s two interest rate increases. Chances for July’s 25 bps lift remained at 89.3%, above last Friday’s peak, as reported by the CME FedWatch Tool, while for November, odds slumped from 37% to 34%.

Last week’s data pushed aside recession fears in the United States (US), after Q1’s Gross Domestic Product (GDP) crushed the advance and preliminary readings, opening the door for further tightening. Nonetheless, US inflation data was softer than estimated; hence traders braced for a less aggressive Federal Reserve.

The US Dollar Index, a gauge of the buck’s value against a basket of six currencies, climbs 0.08% and is back above 103.002, a headwind for the GBP/USD pair.

On the UK front, the S&P Global/CIPS Manufacturing PMI for June came at 46.5, above estimates of 46.2, but trailed May’s 47.1, flashing signs of an economic slowdown. Recession fears had increased in the UK, with the Bank of England (BoE) expected to continue to tighten monetary conditions. Money market futures estimate the BoE would raise rates by at least 6%, representing the most aggressive tightening cycle among the majors. Even though the Sterling (GBP) could appreciate in the short term, the recession risks increased, suggesting that despite higher rates, the GBP/USD could depreciate, as traders seeking safety would likely buy the US Dollar.

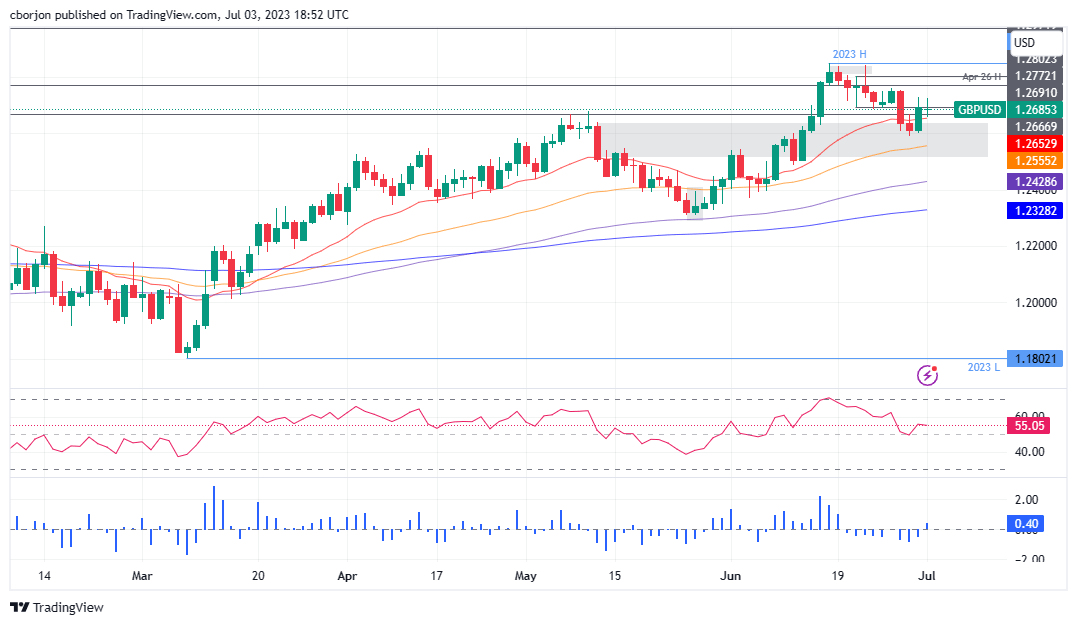

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains upward biased, although it’s forming a doji after failing to break above the 1.2700 figure, suggesting that in the near term, a dip toward the 20-day Exponential Moving Average (EMA) at 1.2683 or below could pave the way for buyers to post new bets, as the GBP/USD could re-test the year-to-date (YTD) highs at 1.2848. On its way north, GBP/USD buyers must surpass 1.2700 and the June 21 daily high at 1.2802. Conversely, if GBP/USD bears drag prices below the June 29 swing low, seen as intermediate support at 1.2590, that will pave the way for a test of 1.2500 and probably the 100-day EMA at 1.2428.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.