GBP/USD edges lower though almost flat post-US inflation data

- GBP/USD's decline influenced by higher-than-expected US CPI, suggesting potential delay in Fed rate cuts.

- Mixed inflation readings in the US trigger market uncertainty, with core CPI showing a slight easing.

- BoE Governor Bailey's remarks on mortgage rates and potential rate adjustments add to market focus ahead of UK GDP data.

The Pound Sterling remains on the back foot in the mid-North American session on Thursday, as inflation in the United States (US) picked up more than estimated in December, which might deter the US Federal Reserve (Fed) from easing monetary policy as investors estimate. The GBP/USD trades at 1.2734, printing losses of 0.02%.

GBP/USD trips down but buyers hold the forth above 1.2700

The US economy remains solid, as can be witnessed after the US Bureau of Labor Statistics (BLS) revealed the latest Consumer Price Index (CPI) figures for December. CPI climbed 3.4% above forecasts of 3.2%, and core CPI advanced 3.9% YoY higher than estimated. Nevertheless, the data was mixed compared to November’s readings, with core easing below 4%.

Although inflation continues to cool down, it should be said that we’re witnessing an uptick after diving to 3% in June. Since then, the CPI has remained unable to crack below the 3% threshold, signaling that prices are becoming stickier than foreseen.

Meanwhile, Cleveland’s Fed President Loretta Mester crossed the wires. She commented that a March rate cut is “probably” too early, adding that she needs “to see more evidence” that prices are headed lower. She added the latest inflation data suggests no progress on reducing inflation, and that it is stalling.

Across the pond, the United Kingdom (UK) economic docket was scarce, though traders leaned into the Bank of England’s (BoE) Governor Andrew Bailey’s speech. He added that he wouldn’t like to discuss the economic outlook but addressed that the decline in mortgage rate has shifted that the BoE could lower its bank rate this year.

On Friday, the UK calendar would feature the release of Gross Domestic Product (GDP), with November’s month-over-month figure expected to grow 0.2%. The GDP 3-month average is foreseen to dive to -0.1%, lower than the previous reading. On the US, the docket will feature the release of the Producer Price Index (PPI).

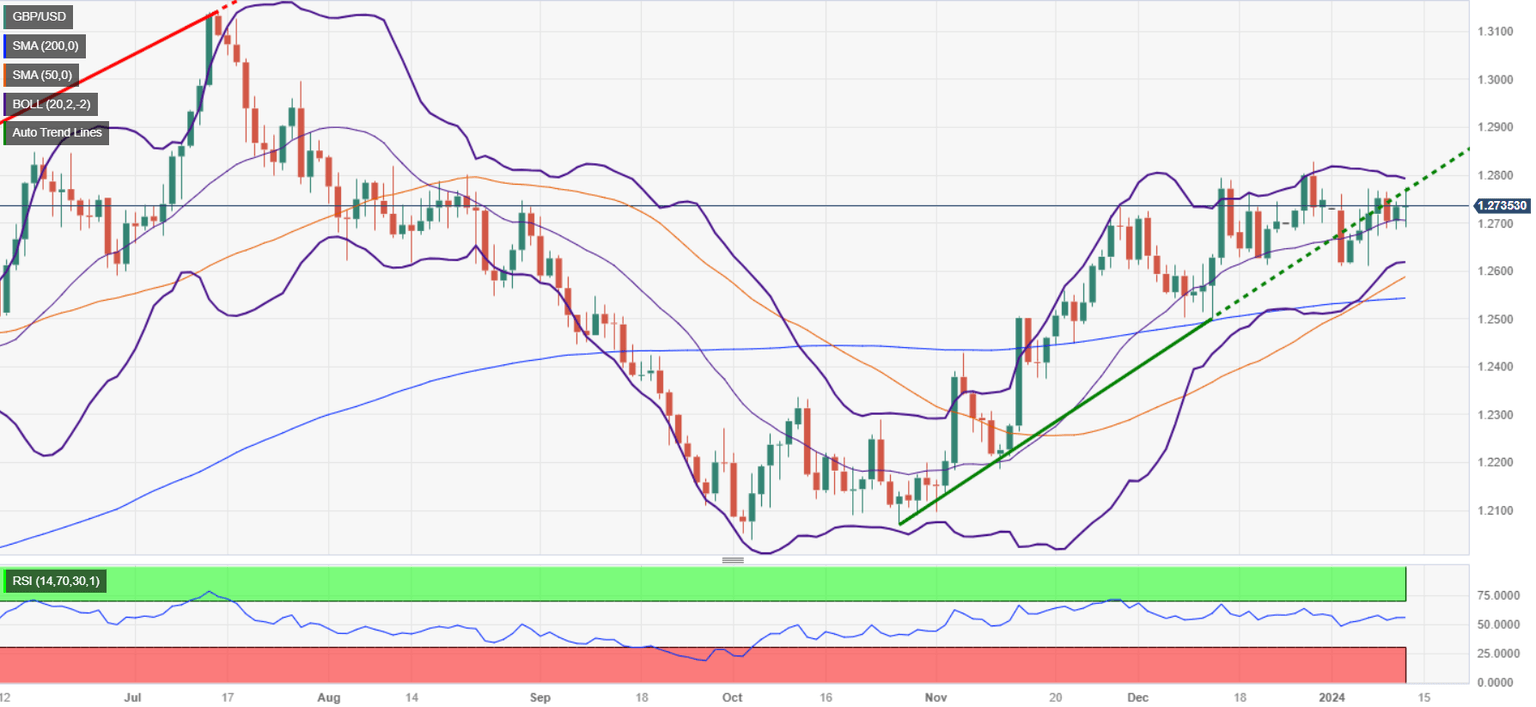

GBP/USD Price Analysis: Technical outlook

On Thursday, the GBP/USD hit an eight-day high at around 1.2774, but it was quickly rejected around those levels as data underpinned the US Dollar. Although the pair is neutral to upward biased, a daily close below the 1.2700 figure could open the door to challenge the January 5 swing low at 1.2611 before breaking toward 1.2600. On the other hand if buyers keep the spot price above 1.2700, that could pave the way for further upside. Key resistance levels lie at 1.2774, followed by 1.2800, ahead of reaching December’s high at 1.2827.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.16% | 0.08% | 0.30% | 0.57% | 0.10% | 0.17% | 0.51% | |

| EUR | -0.16% | -0.09% | 0.13% | 0.42% | -0.06% | -0.01% | 0.37% | |

| GBP | -0.09% | 0.08% | 0.21% | 0.50% | 0.02% | 0.07% | 0.45% | |

| CAD | -0.30% | -0.13% | -0.22% | 0.28% | -0.19% | -0.13% | 0.24% | |

| AUD | -0.57% | -0.40% | -0.49% | -0.27% | -0.46% | -0.42% | -0.05% | |

| JPY | -0.10% | 0.05% | -0.04% | 0.18% | 0.46% | 0.04% | 0.42% | |

| NZD | -0.17% | 0.03% | -0.07% | 0.13% | 0.42% | -0.06% | 0.39% | |

| CHF | -0.53% | -0.37% | -0.45% | -0.23% | 0.05% | -0.43% | -0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.