GBP/USD drops to 1.3300 again amid thin FX market conditions

- GBP/USD has dropped to 1.3300 in recent trade, around which it is currently consolidating.

- No new news appears to have driven the move, though there has been an overarching pessimistic feeling regarding Brexit talks this week.

No new news is driving the move, but GBP/USD is back to fresh lows of the day and briefly fell below 1.3300, for the first time since Monday. Though price action is now consolidating back above the psychological level, the pair does seem to be testing this area with more aggression than before, something which is likely to be making the bears feel uncomfortable that a downside break could be coming up next.

As a reminder, market conditions are thin given the absence of most of the US participants due to a second day of Thanksgiving holiday celebrations. Although that normally is a precursor to rangebound trade, a lack of market depth can leave assets vulnerable to big moves.

Brexit pessimism (there has been no indication today that the EU and UK have moved any closer to a deal this week) is likely to be behind today’s downside. Indeed, GBP is far and away today’s worst-performing G10 currency, down 0.4% against the US dollar on the day versus AUD, NZD and EUR, which are all trading with gains of 0.45 against the US dollar.

In thin liquidity conditions, it only takes a few big bearish orders to drive the pair lower, and that looks likely to have been the case today, with month-end flows also likely to be a factor working against sterling.

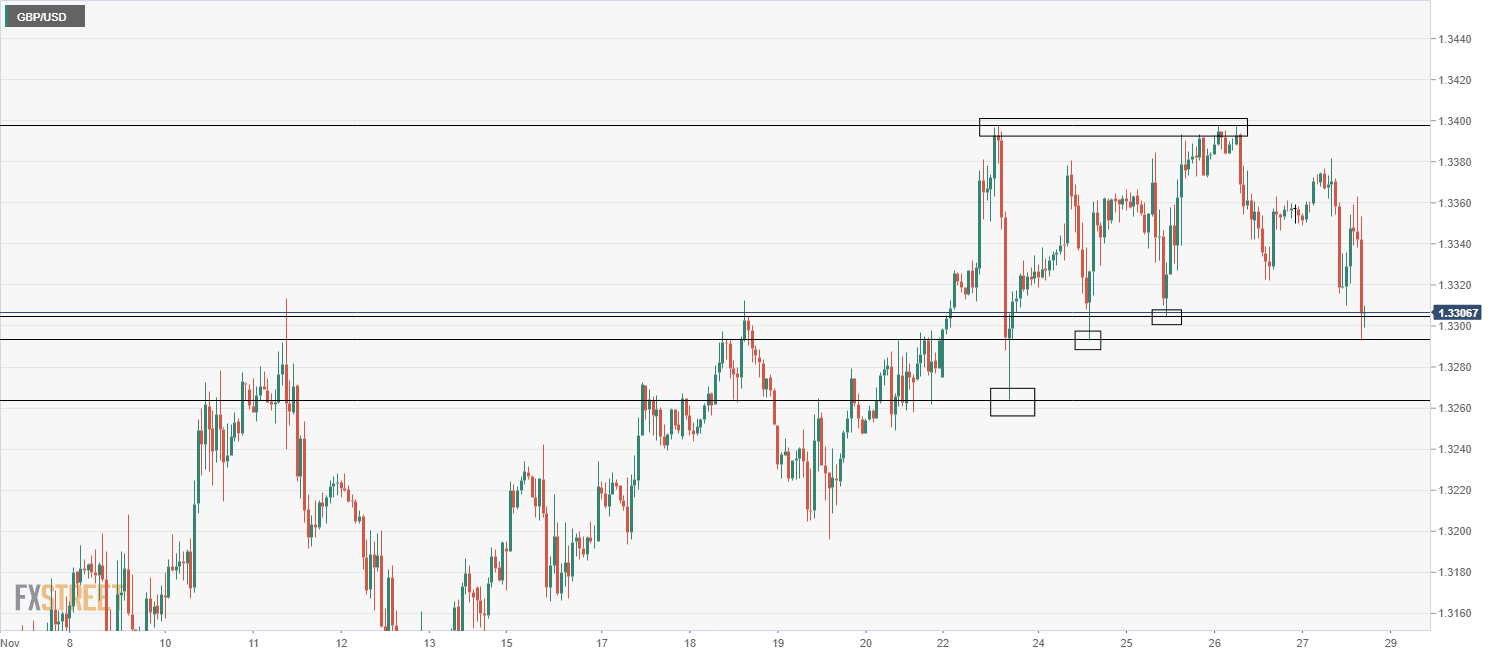

GBP/USD testing the bottom of this week’s range and looking heavy

GBP/USD’s move lower to 1.3300 has taken the pair back to the bottom of recent day’s ranges. For now, cable is holding up at support in this area, but if the bottom of this week’s range were to go, that would open the door to a move lower towards Monday’s low just above 1.3260 and then onto last Thursday’s low around the psychological 1.3200 mark.

However, some may see this recent move lower as another opportunity to buy the dip, in which case GBP/USD could march higher again. In this scenario, the main levels to watch would be Friday’s 1.3380ish highs and this week’s highs around 1.3400.

GBP/USD one hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset