GBP/USD drops below 1.2400 after US CPI data

- GBP/USD hits a daily low of 1.2374 as US inflation jumps above 3%.

- The US Dollar strengthens as investors expect the Fed's first rate cut until September 2025.

- If GBP/USD prints a daily close below 1.2400, sellers would target 1.2300.

The Pound Sterling (GBP) slipped during the North American session after the latest United States (US) inflation report showed that prices continued to rise, pushing back expectations of a Federal Reserve (Fed) rate cut in the first half of 2025. The GBP/USD pair trades at 1.2387, down 0.47%.

Pound dips as US inflation surges

Inflation reaccelerates in the US, as the US Bureau of Labor Statistics (BLS) reveals. The Consumer Price Index (CPI) rose in January above 3% YoY for the first time since June 2024. Month-over-month (MoM) figures jumped 0.5%, up from December’s 0.4%. In the meantime, excluding volatile items, CPI increased by 3.3% YoY from 3.2%, and MoM expanded by 0.4%, up from 0.2%, exceeding estimates of 0.3%.

After the data, investors expect the first rate cut until September, according to data from Prime Market Terminal. The swaps market had priced in 20 basis points of easing toward the September 17 meeting, down from last week’s 45 bps.

Source: Prime Market Terminal

In the UK, the National Institute of Economic and Social Research (NIESR) predicts the Bank of England (BoE) has little room to cut rates further and predicts the BoE will cut rates once in 2025 and again in 2026.

This week, traders are watching Fed Chair Jerome Powell's testimony at the US House of Representatives. Besides him, Atlanta’s Fed Raphael Bostic and Governor Christopher Waller will cross the wires.

In the UK, the docket will feature Gross Domestic Product (GDP) figures for Q4 2024. Economists expect the economy to contract by -0.1% QoQ, yet on an annual basis, they estimate growth of 1.1%, up from Q3's 0.9%.

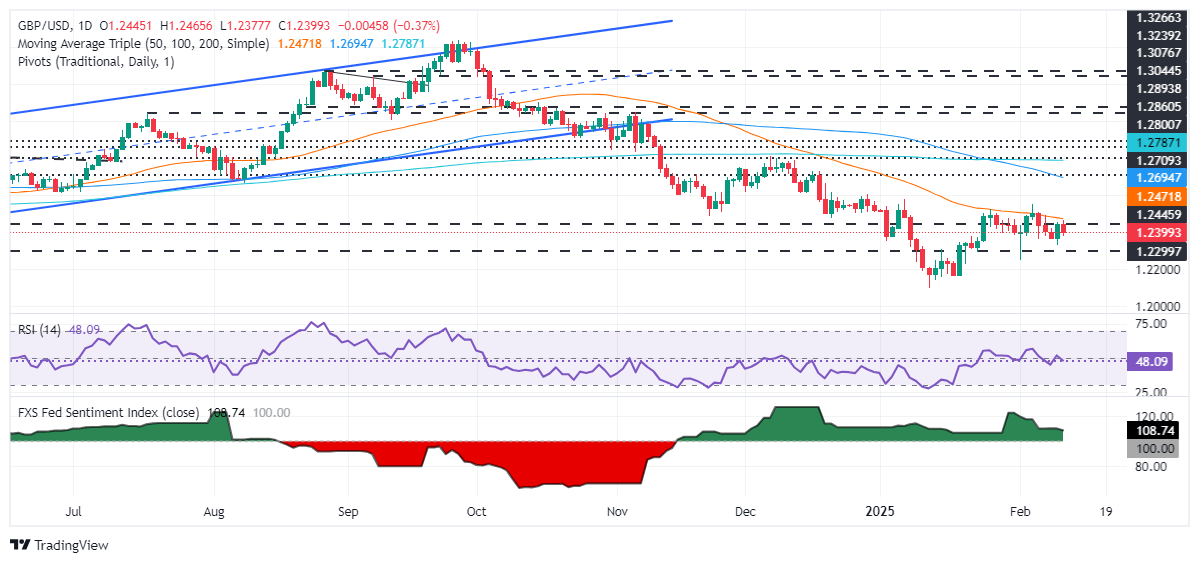

GBP/USD Price Forecast: Technical outlook

GBP/USD price action indicates the pair remains tilted to the downside but is set to consolidate within the 1.2330 - 1.2450 area. The Relative Strength Index (RSI) suggests that momentum remains bearish, opening the door for further selling pressure in the pair.

A daily close below 1.2400 could sponsor a leg toward the February 11 low of 1.2332, followed by the February 3 low of 1.2248. On further weakness, 1.22000 is up next. Conversely, if GBP/USD rises past 1.2400 and challenges the 50-day Simple Moving Average (SMA) at 1.2475, the exchange rate could aim towards 1.2500.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.40% | 1.24% | 0.25% | 0.68% | 0.69% | 0.14% | |

| EUR | -0.16% | 0.24% | 1.07% | 0.09% | 0.52% | 0.52% | -0.02% | |

| GBP | -0.40% | -0.24% | 0.80% | -0.14% | 0.28% | 0.29% | -0.26% | |

| JPY | -1.24% | -1.07% | -0.80% | -0.97% | -0.54% | -0.54% | -1.07% | |

| CAD | -0.25% | -0.09% | 0.14% | 0.97% | 0.43% | 0.43% | -0.11% | |

| AUD | -0.68% | -0.52% | -0.28% | 0.54% | -0.43% | 0.00% | -0.54% | |

| NZD | -0.69% | -0.52% | -0.29% | 0.54% | -0.43% | -0.00% | -0.54% | |

| CHF | -0.14% | 0.02% | 0.26% | 1.07% | 0.11% | 0.54% | 0.54% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.