GBP/USD drifting higher in thin Monday action as investors await key data

- The GBP/USD is seeing some minor lift ahead of Tuesday's bumper data reading.

- An easy Monday to give way to a bumper economic calendar data docket.

- UK wages & labor, US CPI in the barrel.

The GBP/USD climbed to a Monday high near 1.2280 as markets jockey for position ahead of Tuesday's bumper data prints, with UK wages and labor data hitting markets in the early London session before US Consumer Price Index (CPI) inflation figures drop on investors in the mid-day.

UK Average Earnings (excluding bonuses) for the 3rd quarter is expected to moderate, with the forecast expected to tick down from 7.8% to 7.7%; meanwhile, earnings with bonuses factored in is expected to accelerate towards the low end, forecast to drop from 8.1% to 7.4%.

Investors will be hoping for improvement (or at least a lack of downside) in UK Employment and Claimant Count figures. The UK last saw the labor landscape contract in September, showing a 82 thousand job decline in employed persons, while unemployment benefits seekers increased by almost 20.5 thousand.

US CPI Preview: Forecasts from seven major banks, still to the high side of the Fed’s target

US CPI inflation is broadly expected to hold steady at the annualized level with slight declines in the month-on-month figures. Headline US CPI for the year into October is expected to decline from 3.7% to 3.3%.

Monthly CPI inflation is expected to print at a moderate 0.1% in October compared to September's 0.4%.

GBP/USD Technical Outlook

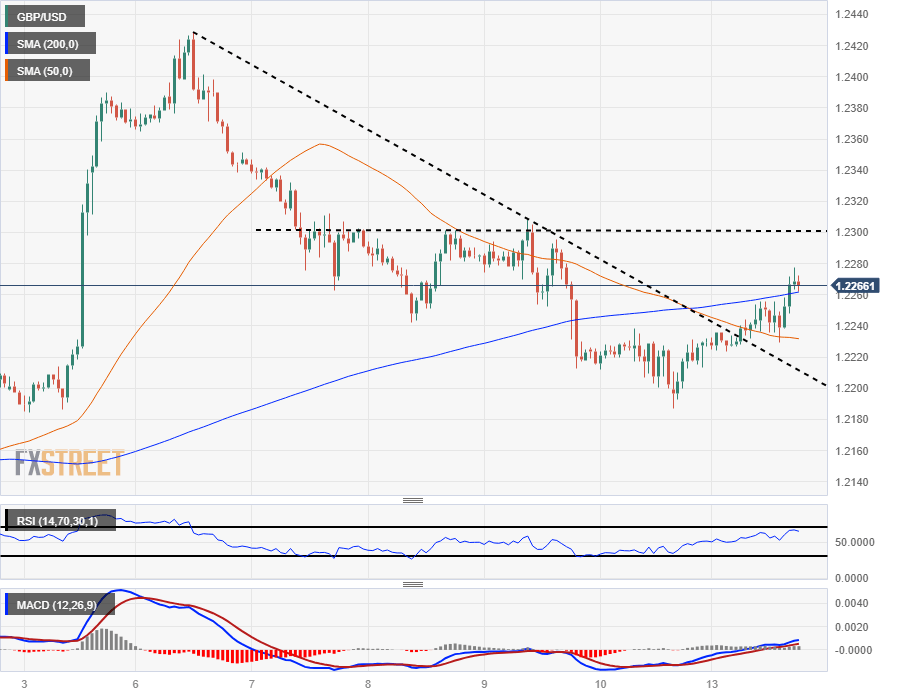

The Pound Sterling's soft bounce on Monday is continuing last Friday's rebound from a weekly low near 1.2190, breaking through a descending intraday trendline from last week's peak near 1.2425.

The pair is drifting back up into the 200-hour Simple Moving Average (SMA), currently grinding upwards through 1.2260.

The pair is currently setting up a near-term technical support zone near 1.2240, and as long as the low side continues to hold, the topside will be free to crash against the technical resistance barrier baked into the 1.2300 handle.

GBP/USD Hourly Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.