GBP/USD's reversal from 1.1300 finds support at 1.1200

- The pound remains steady above1.1220.

- Weak UK data and political uncertainty are weighing on the GBP.

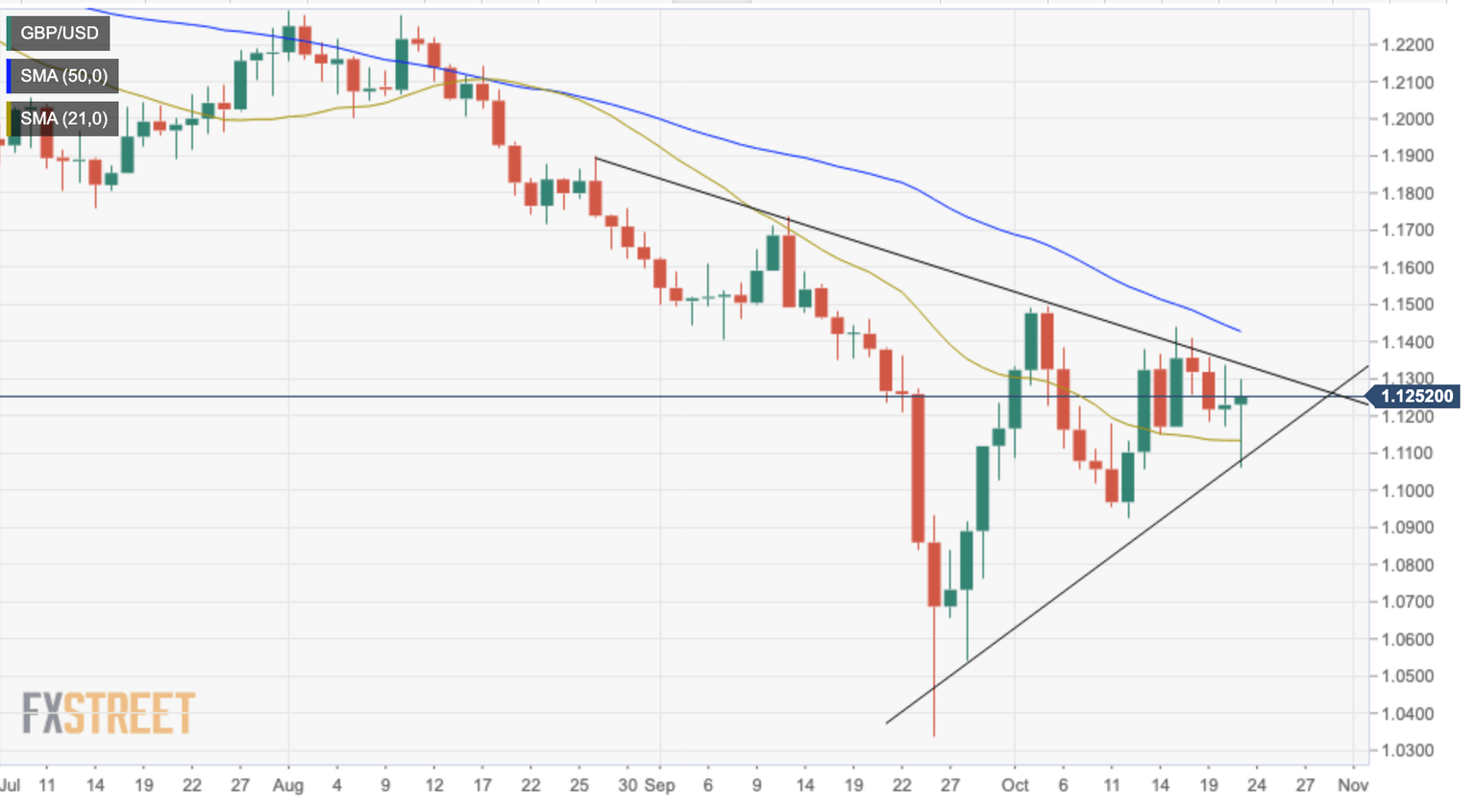

- GBP/USD, approaching the tip of a triangle pattern.

The pound failed on its assault to 1.1300 earlier on Friday, although the ensuing reversal has found support at 1.1220 and the pair picked up again to the 1.1250 area. The GBP/USD remains moderately positive on the day in track to regain the previous two day’s losses.

UK's weak economic prospects are hurting the pound

Retail consumption contracted by 1.4% in September, well above market expectations of a 0.5% decline, and was 6.9% lower from the same month last year, according to data reported by National Statistics released earlier on Friday.

The impact of these figures, which have confirmed fears of an upcoming recession in the UK and have been coupled with political uncertainty, as the Tory party hustles to find a replacement for Liz Truss, which has increased negative pressure on the pair.

GBP/USD approaching the tip of a triangle formation

From a technical point of view, the daily chart shows the pair approaching the tip of a symmetrical triangle pattern with trendline resistance at 1.1325, and the next potential resistance levels at 1.1430 (50-day SMA) ahead of October 4 and 5 highs at 1.1510.

On the downside, the base of the triangle lies now at 1.1080. Below here, bears might increase confidence and send the pair to 1.0920 (October 12 low) and then probably to 1.0540 (September 28 low)

GBP/USD daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.