GBP/USD consolidates below yearly highs, focus is on 1.3980

- Cable has rallied over 4% in 2020 due to a combination of USD weakness, BoE dialling back on rates and the vaccine roll-out.

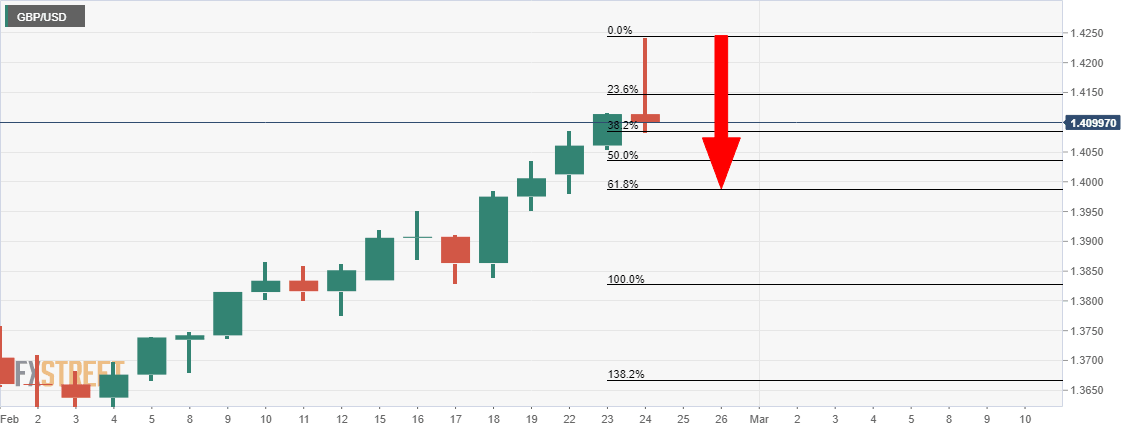

- GBP/USD bears target the 50% mean reversion mark at 1.4036 ahead of the 1.3980s.

As per the prior analysis, GBP/USD Price Analysis: Bulls coming up for their last breath?, cable rallied in a fresh daily impulse from the support structure.

However, the price extended in five consecutive days of higher highs and lows, coming within touching distance of 1.43 today and sailed through anticipated resistance in the psychological 1.40/41 areas.

The pound has been the best-performing G10 currency this year. Cable was up some 4% for the year so far while the pound was 3.2% higher vs the euro.

A combination of the Bank of England pushing back on the need for negative rates, USD weakness and a faster and more effective COVID-19 vaccine rollout has spurred on investment back into sterling.

Equally, the relief of avoiding a no-deal Brexit and fewer immediate complications at the start of the year pertaining to the new regulations has been positive for the British currency.

''There is speculation in the market that some of the interest in the pound this year has been drawn from pent-up demand,'' analysts at Rabobank explained.

''There is evidence that investment levels in the UK were lower than they would have been otherwise in recent years due to political uncertainty related to Brexit.''

Moreover, the analysts remind that ''any relief on the Brexit trade agreement announcement should be tempered by the fact that the deal agreed was not comprehensive or an improvement on market expectations.''

Overall, the analysts forewarn that there could still be stumbling blocks on the road ahead related to Uk politics and Brexit, concerning, In particular, the Northern Ireland issue as well as the Scottish elections in May.

Additionally, considering the PM's Boris Johnson's cautious relaxation of the lockdown, some restrictions may remain in place into the summer months and given how fluid the crisis is, covid could still give the UK bulls the run-around.

All things weighed, the UK economy was one of the worst affected by the virus, and while that leaves plenty of room for an economic bounce back, under the bonnet of any economic growth is a very damaged engine.

Therefore, in the absence of any new economic data that would prove otherwise, following such longevity in the recent rally, the focus, if only technically, should be on the downside.

GBP/USD technical analysis

The path of least resistance, having cleared whatever liquidity had accumulated around the 1.40/41 area, opens the way to a 61.1% Fibonacci retracement, 1.3987, of the length of the latest daily bullish impulse.

Daily chart

The first hurdle, however, is the 50% mean reversion mark at 1.4036, which has a confluence with the 19th Feb highs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.