GBP/USD climbs on upbeat sentiment, ahead of crucial US/UK data

- GBP/USD rises driven by optimistic sentiment and before key economic announcements.

- Upcoming US inflation figures to impact Fed rate cut discussions; Fed officials urge policy caution.

- Lower US Treasury yields contribute to GBP/USD's gain as the Dollar softens.

- UK job data and BoE Governor Bailey's upcoming remarks eyed, with no explicit policy hints expected.

The GBP/USD edges higher in the North American session as market participants await a busy economic calendar across both sides of the Atlantic. At the time of writing, the pair exchanges hands at 1.2637, up 0.09%.

Pound rises on risk-on impulse as traders await US inflation, UK labor data

An upbeat market mood is sponsoring a leg-up on the major, though it remains within familiar levels. Market participants are eyeing an inflation report in the United States (US) which is expected to fuel speculations for rate cuts by the US Federal Reserve (Fed). Words from Fed Governor Michelle Bowman pushed back against easing policy too soon, adding that the current monetary stance is appropriate. In the meantime, Richmond Fed President Thomas Barkin added inflation is closing on the target, but it’s not there yet.

As of writing, the futures market sees the Fed will hold rates unchanged at 5.25%-5.50% at the March meeting, while odds for a May 25 basis point rate cut are at 52%. US Treasury bond yields are edging lower, a headwind for the Greenback (USD).

Across the pond, the UK economic calendar will feature employment data, with estimates suggesting that a mixed report will be released. The Bank of England (BoE) Governor Andrew Bailey is crossing the wires, though he’s not commenting on monetary policy.

Regarding monetary policy, the BoE is expected to slash rates by 80 basis points through 2024, less than the 110 bps at the beginning of the last week. Consequently, short-term UK Gilts jumped, pushing Sterling higher against the US Dollar.

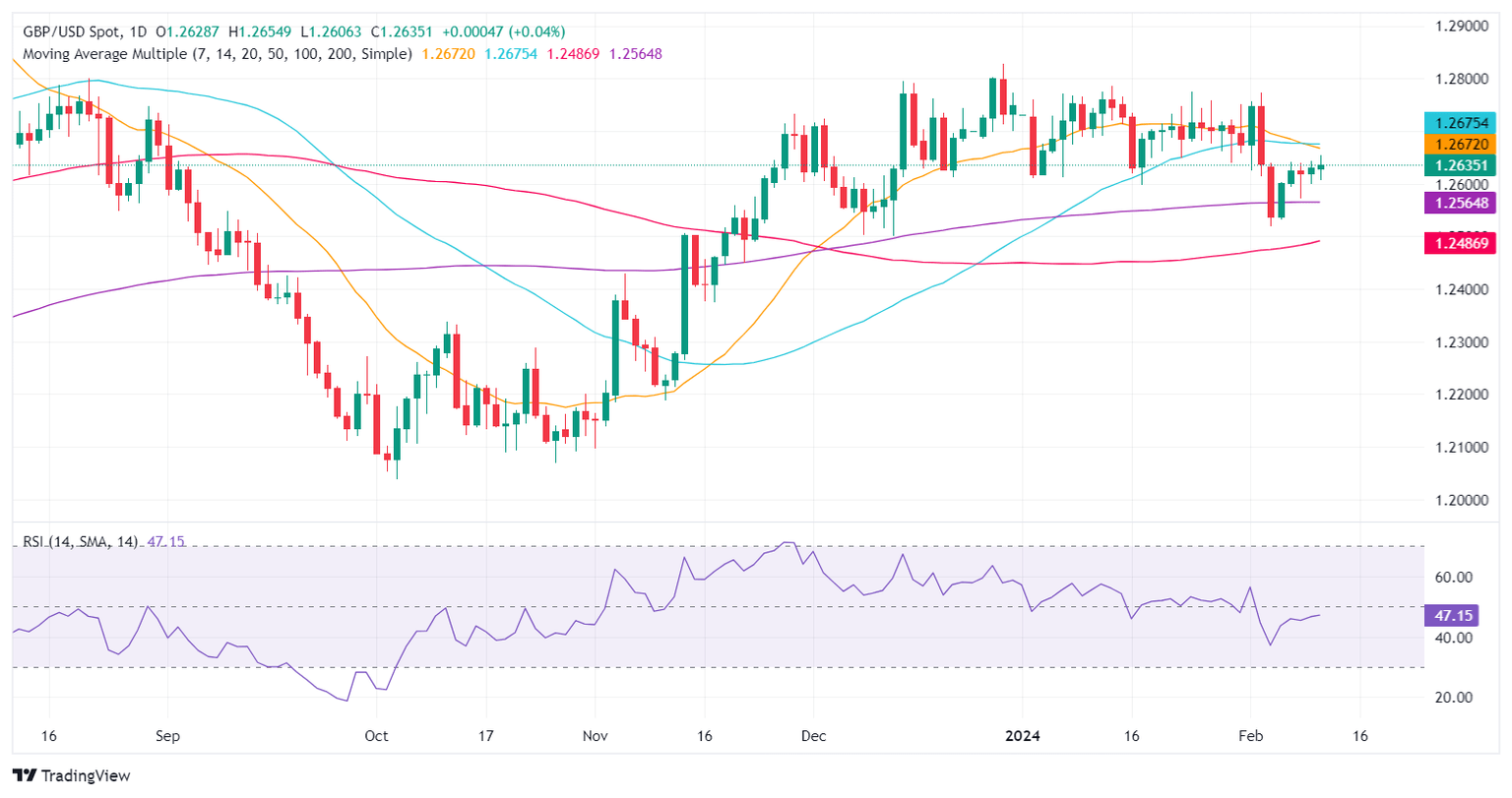

GBP/USD Price Analysis: Technical outlook

The GBP/USD is neutrally biased after it bounced from below the 200-day moving average (DMA). Nevertheless, the path of least resistance is downward biased as the RSI remains bearish, while price action depicts a series of lower highs/lower lows, which could open the door to re-testing the 200-DMA at 1.2562. A breach of 1.2600 would expose the latter, followed by 1.2500. On the other hand, if buyers reclaim the 50-DMA at 1.2672, that will clear the path to 1.2700.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.