GBP/USD climbs above 1.2050 post US data, UK-EU Northern Ireland deal

- GBP/USD got bolstered by a soft US Dollar and a risk-on impulse.

- Durable Good Orders collapsed, with US companies feeling the pain of tighter monetary policy.

- The EU and the UK had agreed to a deal in Northern Ireland, which could boost the GBP.

GBP/USD is recovering some ground after hitting a daily low of 1.1921 as speculations for the Brexit deal struck in Northern Ireland grow, which could bolster the Pound Sterling (GBP) in the near term. In addition, worse-than-expected US economic data are a headwind for the greenback. At the time of typing, the GBP/USD is trading at 1.2052, above its opening price by 0.65%.

The US Dollar (USD) is weakening across the board on a dismal Durable Goods Orders report. Durable Good Orders for January plunged below expectations, -4.5%, below the last month’s revised 5.1% figures, the lowest reading since April 2020. The so-called core orders excluding transport rose by 0.7%, above December’s -.0.4% drop.

The US Dollar Index (DXY), a measure of the buck’s value against a basket of rivals, edged down 0.62%, at 104.594, retracing last Friday’s gains sponsored by a jump in the preferred’s gauge for inflation by the US Federal Reserve (FED), the Core PCE. Following goods orders data, the DXY dropped from around 105.100 toward current quotes.

In the meantime, the latest headlines that the United Kingdom (UK) and the Eurozone (EU) agreed to a deal in Northern Ireland sponsored a leg-up in the GBP/USD, as witnessed by the 1-Hour chart. After seesawing around the daily pivot at 1.1970, the GBP/USD jumped around 80 pips, though hit a daily high of 1.2054.

Sources on both sides told the BBC that the UK and EU had reached a post-Brexit trade agreement for Northern Ireland. Later, the EU’s President Ursula von der Leyen and the UK Prime Minister Rishi Sunak are expected to host a press conference at around 15:30 GMT. Details on the agreement will be released later.

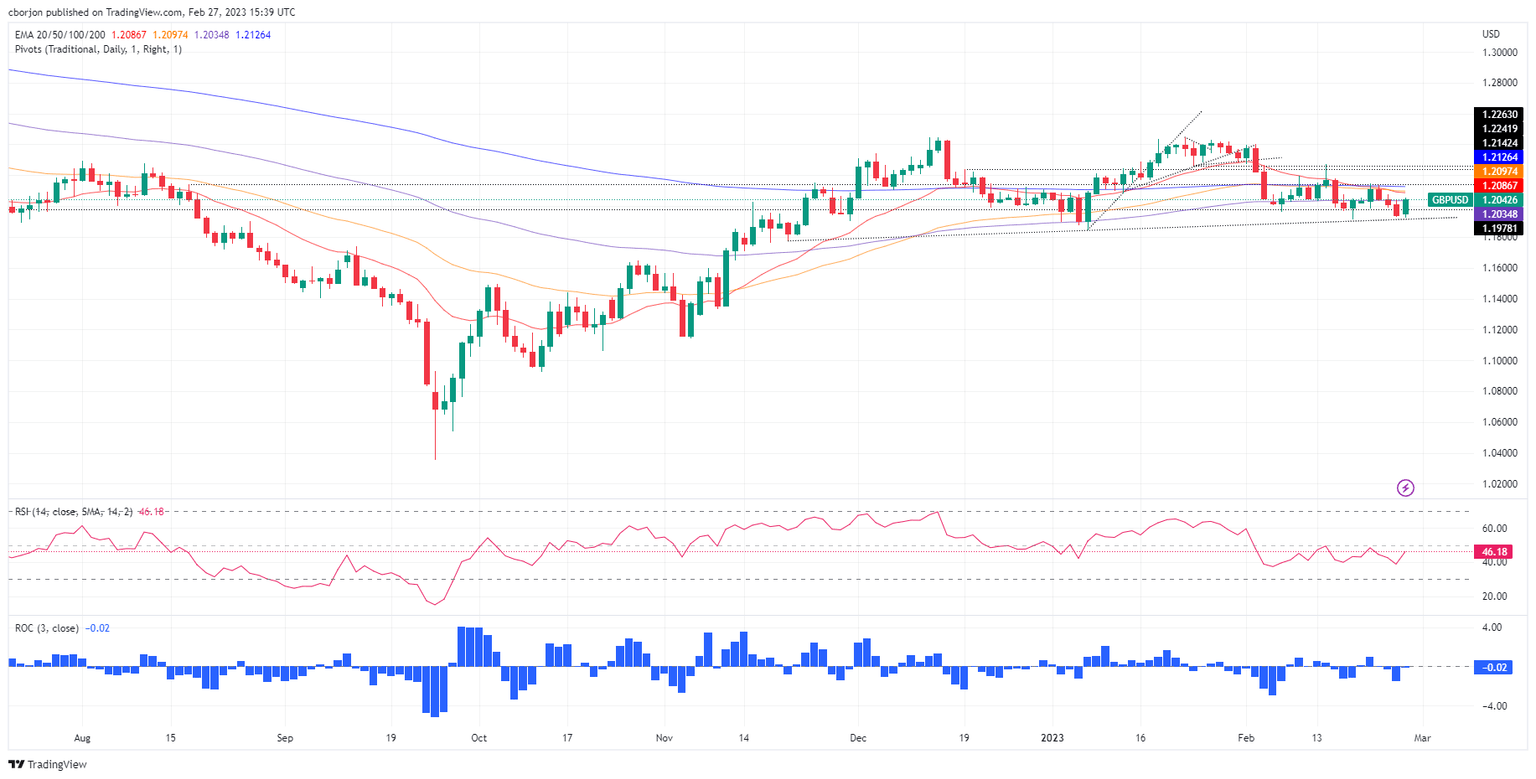

GBP/USD technical analysis

From a daily chart perspective, the GBP/USD formed a bullish engulfing candle, which could send the pair rallying toward the 20-day EMA at 1.2088 before testing the 50-day EMA at 1.2097, shy of the 1.2100 mark. A breach of the latter would expose the important 200-day EMA at 12126. As an alternate scenario, the GBP/USD could fall toward the last week’s low at 1.1927 before testing 1.1900.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.