GBP/USD catches a bid from bad NFP print

- GBP/USD found a foothold on Friday after wide miss in US data.

- US NFP showed the lowest initial print in years as job market cools.

- Coming up next week: US ISM Services PMI, UK BRC Retail Sales.

GBP/USD wrapped up the trading week with a last-minute win after a misfire in US Nonfarm Payrolls (NFP) kicked the Greenback lower across the board. This gave the Pound Sterling a foothold, but still ended the week lower against the USD.

Forecasting the Coming Week: Focus remains on data and rate cut bets

The Pound Sterling deflated this week after the Bank of England (BoE) delivered a widely-expected quarter-point rate cut early Thursday, while US jobs data flashed further warning signs that the US economy may be turning south quicker than investors initially expected.

The latest US NFP labor data revealed that the US added 114K net new jobs in July, falling short of the expected 175K. Additionally, the previous month's figure was revised down to 179K from the initial 206K. The US Unemployment Rate also increased to 4.3%, the highest level since November 2021, while the U6 Underemployment Rate rose to 7.8% from 7.4% as employed individuals faced challenges in securing jobs with sufficient hours.

Average Hourly Earnings growth slowed to 0.2% month-over-month, below the anticipated 0.3%, and the year-over-year wages growth decreased to 3.6% from the previous 3.8%.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Actual: 114K

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

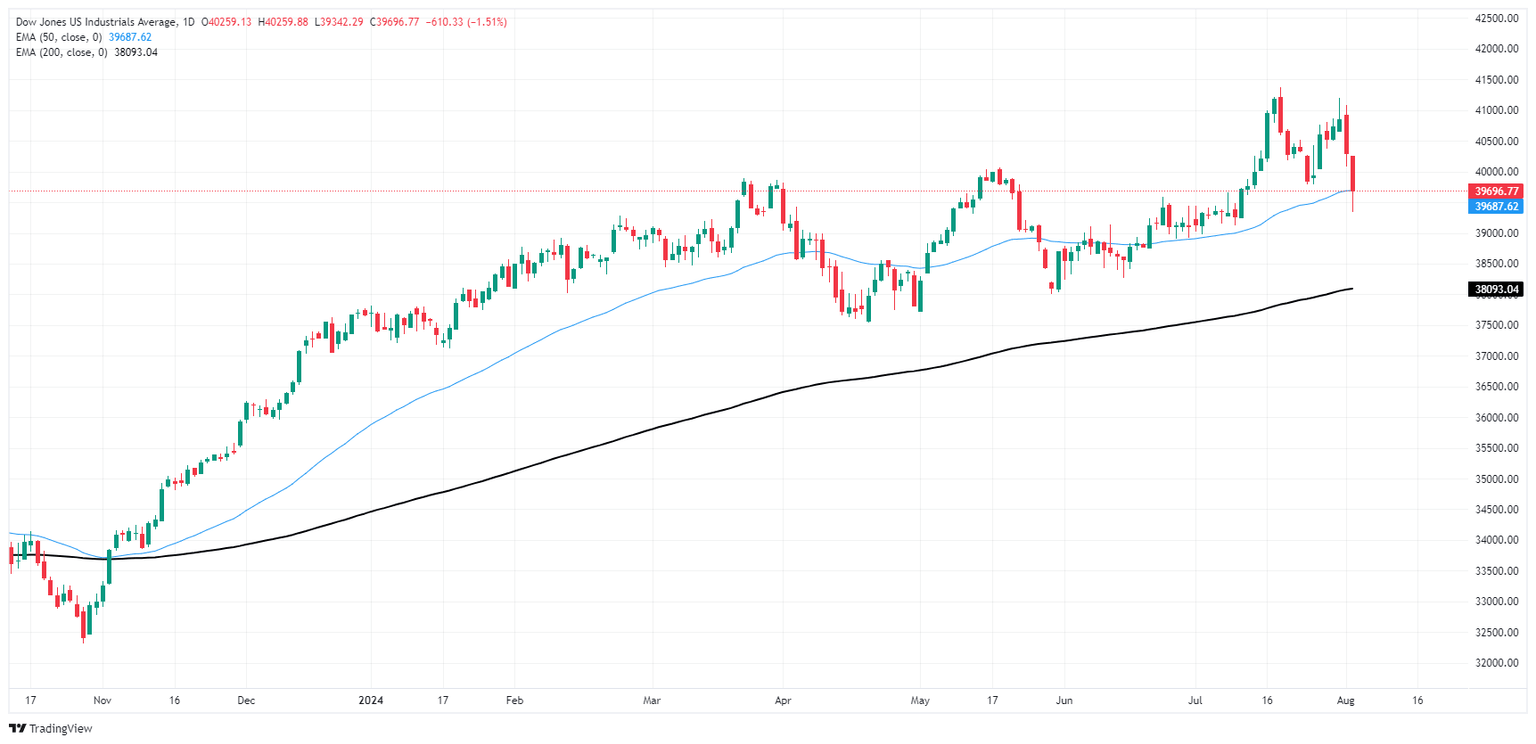

Given the generally disappointing US economic data, investors reacted by extending a two-day decline amidst increasing concerns about a potential widespread recession in the domestic US economy. This prompted a move away from risky assets and led to broad declines in equity indexes. As per the CME's FedWatch Tool, rate traders have completely priced in a rate cut in September, with a 70% chance of a double-cut amounting to 50 basis points, when the Fed announces its rate decision on September 18.

Coming up next week, the US will see July’s ISM Manufacturing Purchasing Managers Index (PMI) Figures on Monday, which is forecast to increase to 51.0 MoM and cross back over into expansion territory compared to June’s contractionary 48.8. On the UK side, BRC Like-For-Like Retail Sales for the year ended in July is expected to recover to 0.3% after the previous period’s -0.5% contraction.

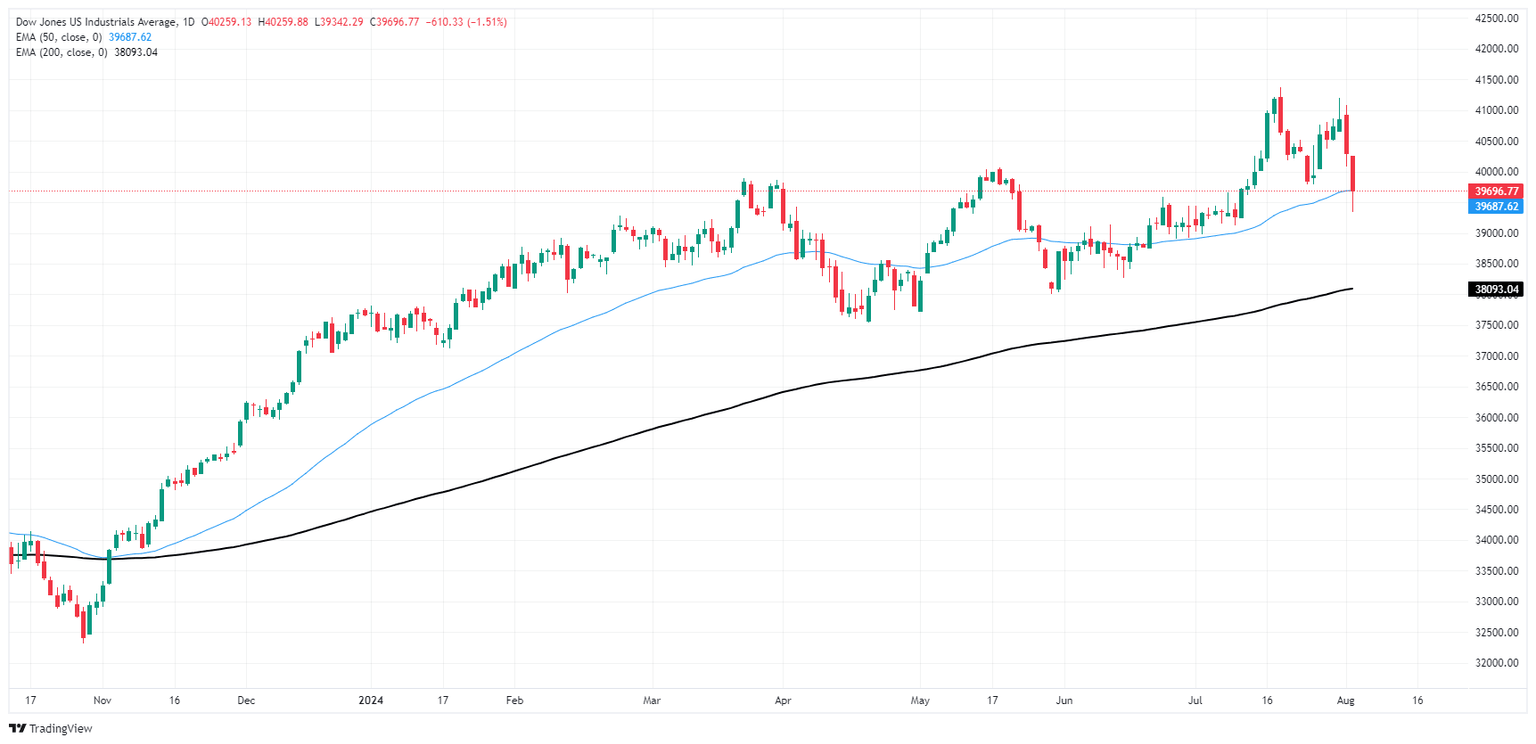

GBP/USD technical outlook

The Cable chalked in a third straight down week, falling -2.58% peak-to-trough after setting a 12-month peak of 1.3045 in mid-July. Bidders are coming out of the woodwork to keep GBP buoyed into the 1.2800 handle, but downside momentum remains strong.

Price action continues to hold on the high side of the 200-day Exponential Moving Average (EMA) at 1.2645, but intraday bids are struggling to vault back over the 50-day EMA at 1.2790.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.