- GBP/USD breaks dynamic resistance as the US dollar continues to fall.

- Traders are getting set for the next key jobs report from the US.

GBP/USD is trading at 1.3830 and is firmly through a critical dynamic resistance on Thursday's price action so far.

The pound, in the absence of UK-specific data releases or Bank of England speakers this week, has been moved by flows in the greenback.

Cable rallied from a low of 1.3767 and reached a high of 1.3837, higher by almost 0.50% at the time of writing, as the US dollar sinks into bearish territory on the forex board.

According to the Currency Strength Index, the US dollar has fallen well behind as investors move into risk following Friday's dovish tilt in the Fed's narrative and US data disappointments earlier this week.

On Friday in a speech made at the Jackson Hole, the Federal Reserve's Chair, Jerome Powell, said that while the central bank has probably got to the point where “substantial further progress” has been made on inflation “we have much ground to cover to reach maximum employment”.

Powell said, “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”. In an environment of “substantial” labour market slack, this could be “particularly harmful”.

Meanwhile, yesterday's ADP report, which missed expectations by a long way, has been taken as a potential prelude to Nonfarm Payrolls in Friday's data.

ADP private-sector jobs came in soft at 374k vs. 625k expected.

As for NFP, the consensus currently sees 725k jobs added vs. 943k in July, while the Unemployment Rate is expected to fall two ticks to 5.2%.

Meanwhile, investors are also watching the UK's COVID-19 infection data.

In the last week of August, Britain reported the highest number of new COVID-19 cases in just over a month which could be a headwind for the pound going forward.

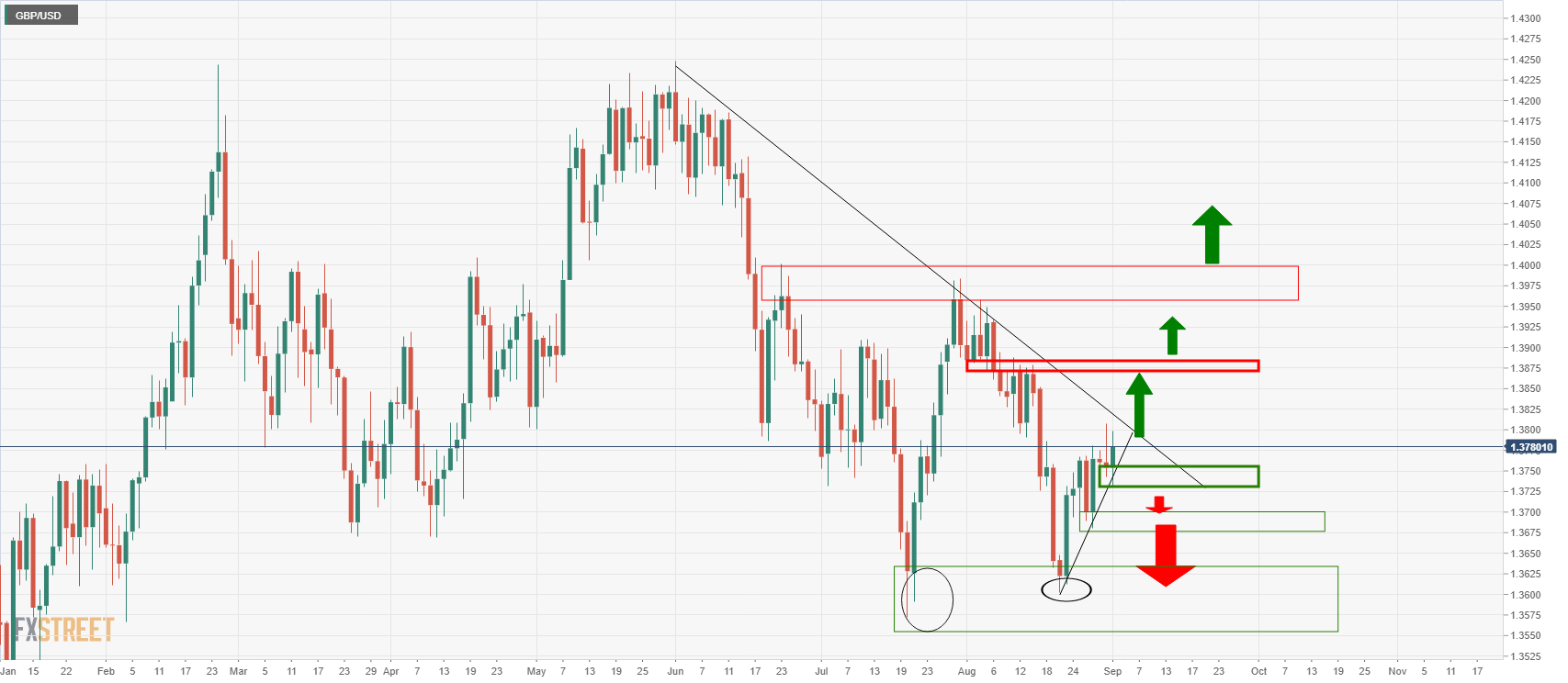

GBP/USD technical analysis

As per the prior day's analysis, illustrated above, cable has taken out the resistance as follows:

The 1.3880s are next resistance.

On the downside, a break of the support structure and then the recent lows near 1.3680 opens prospects of a test to the August swing lows of 1.3602.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains toward 1.1400 after German sentiment data

EUR/USD stretches higher toward 1.1400 in the European session after upbeat German business sentiment data. The pair's solid uptick could also be linked to the latest leg down in the US Dollar as concerns re-emerge over Trump's tariff plans with China and Japan.

GBP/USD holds firm near 1.3300 on intense US Dollar weakness

GBP/USD rises further to test 1.3400 in European trading on Thursday, snapping a two-day losing streak. Uncertainty over US President Donald Trump's tariff plans returns and sends the US Dollar sharply lower across the board, suporting the pair. Mid-tier US data awaited.

Gold price trims part of intraday gains, still well bid above $3,300 mark

Gold price regains positive traction as fading US-China trade optimism revives safe-haven demand. The US economic worries and Fed rate cut bets undermine the USD, also benefiting the commodity. A positive risk tone might hold back the XAU/USD bulls from placing aggressive bets and cap gains.

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's Crypto Task Force met with El Salvador's National Commission on Digital Assets representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.