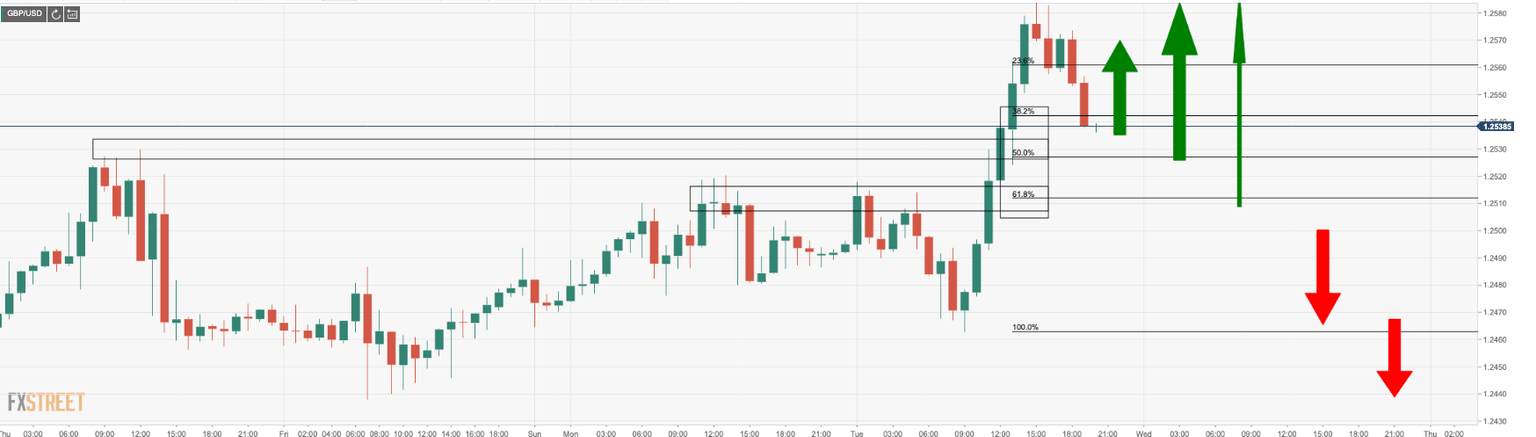

GBP/USD bulls looking for a buy-in at a discount below a 31.8% Fib retracement

- GBP/USD bears taking over, but bulls lurking for buy-in opportunities on a renewed surge to the upside.

- DXY falling away, giving life to the G10s with Brexit talks underway.

GBP/USD is currently trading at 1.2541, consolidating and edging just below a 38.2% Fibonacci reatecment between the day's range of 1.2462 and 1.2592.

The bulls stole the show, taking the pound to a four week high as the US dollar was faded across the board.

The lack of progress in the dollar's recovery is leading speculators to continue selling into rallies.

A late CHFT report pertaining to the US holiday showed, at the start of his week, that the USD net positions remained in negative territory for the third consecutive week.

While during this period market sentiment deteriorated, as reflected in global stocks running out of steam, the USD failed to benefit to a full extent from its status of safe haven due to a resurgence of coronavirus cases in the US where a number of states reported a record increase in infections,

analysts at Rabobank explained.

Brexit talks resume

Meanwhile, traders will await any headlines subsequent of the UK's government’s chief Brexit negotiator, David Frost hosting of his EU counterpart Michel Barnier for a private dinner in Downing Street on Tuesday evening.

There is a concern that Brexit negotiations are stuck in the mud as the two sides go face to face throughout this week's negotiations in a bid to revive flagging talks on a trade and security deal.

The meeting follows the abrupt ending to the first round of “accelerated” face-to-face talks last week.

Barnier had complained about a perceived lack of respect and engagement from the British government.

Asked what would be on the agenda for this week's talks, the UK's PM's official spokesman said:

They’re informal talks, so there is no published agenda, but you are fully aware of the range of issues that we need to reach agreement with the EU on. Discussions will cover everything from what the EU calls the level playing field, through to governance structures.

GBP/USD levels

The price action could be giving the bulls a discount, or a break below the highlted Fibonacci reyracements will nulify such an outlook.

-

GBP/USD Price Analysis: Cable edges toward psychological 1.26 where a key Fib level lies

-

EUR/GBP Price Analysis: Break under 0.9000 leaves euro vulnerable to more losses

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.