- GBP/USD been capped on the dollar's correction following the FOMC minutes that were a slight disappointment to markets.

- The U.S. stock markets have been unable to spike on the event, signalling a pause in the risk-on central bank hysteria.

- GBP/USD is currently trading at 1.3063, up from a low of 1.3011 and now below session highs of 1.3110 due to a bid in the greenback.

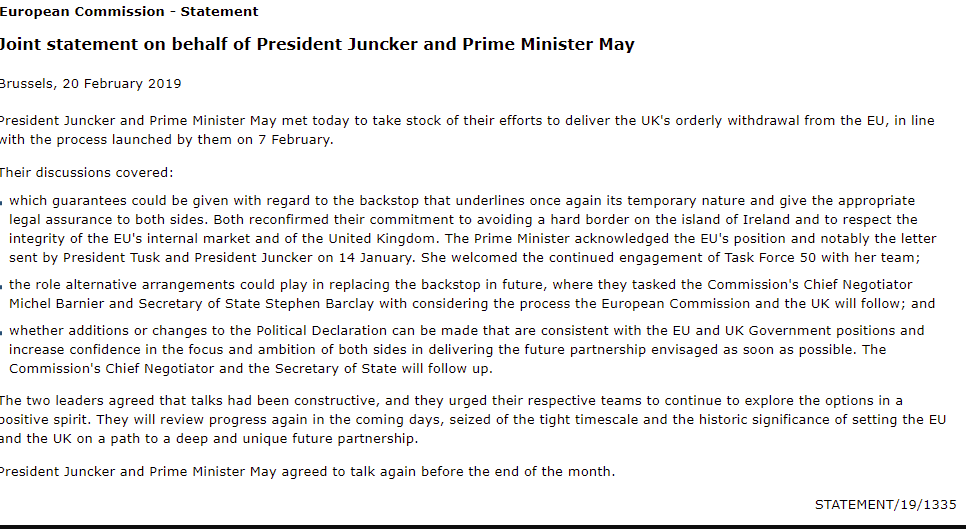

- Brexit headlines filtering through with a joint statement on behalf of EU's Juncker And UK PM May.

GBP/USD has been a solid performer this week, relishing in the prospects of a soft Brexit where it is quite frankly inconceivable that the UK will leave next month with a deal, according to the majority of the markets. However, PM May warns that a no-deal is still on the table and preparations are being made for such a scenario.

However, the core to the pound's strength is related to the BoE and risk-FX overdrive of late. Recent UK data has been solid and a BoE rate hike will likely be on the cards, regardless of whatever type of Brexit. Inflation will need to be tamed in the case of a weaker pound on a hard Brexit or even in the case of a stronger economy if all goes well with the EU following the outcome of Brexit. Meanwhile, Juncker has said timing is of the essence and they have made progress today in a meeting that took place regarding the backstop where PM May has said that she had underlined the need for legally binding changes to the backstop at the meeting with Juncker. Additionally, FX markets have favoured the central bank meetings as an excuse to be long of risk, leading to a sell-off in the dollar.

As far as the FOMC minutes event, it was not much of one and failed to inspire the bulls to keep buying the US indices. Instead, short-covering the greenback lifted the DXY from the session lows down at 96.29 to a post-event high 96.56. Additional work from the bulls will be required if the DXY is to break back above the menacing bearish H&S on the hourly charts, however - That level is located around 96.70. The FOMC minutes essentially echoed the neutral rhetoric we heard earlier in the week from Mester (hawk turned neutral) and Williams. The key takeaway is the Fed is considering the balance sheet policy for the latter part of 2019 and unsure what to make of the current climate with respect to their interest rate cycle - Thus, the Fed is neutral and seen holding for the foreseeable future.

Key statements form FOCM minutes, (Source LiveSquawk):

- Participants noted maintaining current target range for fed funds rate ‘for a time’ posed few risks at this point.

- Staff gave options for ending balance sheet runoff in h2 this year.

- Almost all officials wanted to halt b/sheet runoff in 2019.

- Many officials unsure which rate moves could be needed in 2019.

- Policymakers agree it is ‘important’ to be flexible in balance sheet normalization.

- Policymakers agree it would be appropriate to adjust if necessary.

- Several participants saw further hikes appropriate in 2019 if economy evolved as expected.

- Patient posture allows time for ‘clearer picture’.

- - ‘few officials’ not concern over uncertainty not captured in dot plot;

- - seen strong household data recently;

- - officials note concerns over slowing growth, China;

- - concerns over trade, shutdown, fiscal policy;

- - seen some downside risks increase;

- - officials note volatility, tighter fin. Conditions.

GBP/USD levels

GBP/USD continues to show signs of near term recovery following its recent reversal ahead of the 61.8% retracement at 1.2740, as noted by analysts at Commerzbank who explained cable has overcome the 200-day ma at 1.3002 to alleviate downside pressure. "Our attention has reverted to the 1.3217 recent high. The intraday Elliott wave counts are conflicting."

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady below 0.6550 after PBOC's status quo

AUD/USD is trading in a tight range below 0.6550 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions keep the Aussie on the edge ahead of Fedspeak.

USD/JPY pares gains below 155.00 amid risk-off mood

USD/JPY is paring back gains below 155.00 in Wednesday's Asian session. A broadly softer US Dollar, a risk-off market mood and looming Japanese intervention risks limit the pair's upside. Mounting Russia-Ukraine tensions weigh on risk appetite, lending support to the safe-haven Japanese Yen.

Gold stays firm amid geopolitical concerns, nears $2,650

Gold price holds comfortably above $2,600, nearing $2,650 early Wednesday. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help Gold price hold its ground.

XRP on the verge of a rally to $1.96 as investors maintain bullish sentiment

Ripple's XRP trades at $1.11 on Wednesday, maintaining its position as the best-performing cryptocurrency in the top 20 cryptos by market capitalization, with over a 50% rise in the past week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.