GBP/USD: Better bid around 1.2150 as US Dollar stalls rebound

- GBP/USD pauses downside momentum amid a steady US Dollar, cautious mood.

- Fed-BoE policy divergence continues to keep any upside in GBP/USD temporary.

- Pound Sterling bears fight back control below 21DMA, eyes 200DMA support.

GBP/USD is attempting a tepid bounce near mid-1.2100s, having paused its three-day bearish momentum. The US Dollar is holding steady amid a mixed market mood and the persistent uptrend in the US Treasury bond yields across the curve.

The hawkish Fed outlook and downbeat US economic data-induced recession fears continue to keep investors on the edge. Meanwhile, the continued widening policy divergence between the US Federal Reserve (Fed) and the Bank of England (BoE) adds to the vulnerability in the GBP/USD pair.

Attention now turns towards a set of US Housing data, which will be closely watched for the state of the US economy, as we head toward the Christmas holiday thin trading in the second half of this week.

Broad-based US Dollar weakness is underpinning the uptick in the Pound Sterling, despite the continued widening policy divergence between the US Federal Reserve (Fed) and the Bank of England (BoE). The slide in the USD/JPY pair is exerting bearish pressure on the US Dollar, as investors pay little heed to the higher Treasury bond yields.

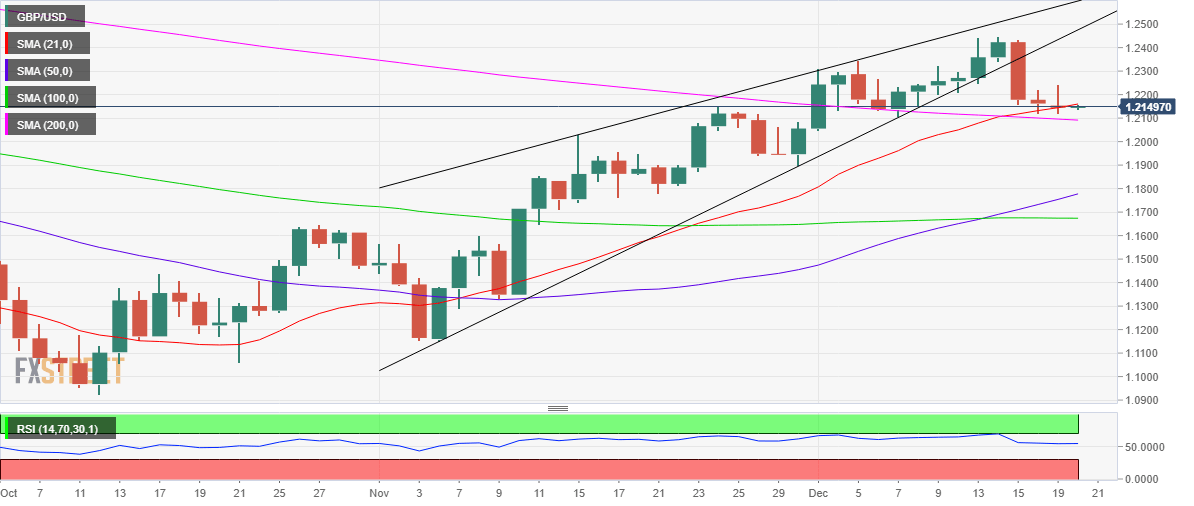

Despite the bullish 14-day Relative Strength Index (RSI) and double Bull Cross confirmation, the rising wedge pattern overpowers and keeps GBP bears pushing for more.

After defending the mildly bullish 21-Daily Moving Average (DMA) at 1.2160 on Monday, the pair opened Tuesday below the latter, exposing the descending 200DMA at 1.2091.

Daily closing below the critical 200DMA will initiate a fresh downswing toward the bullish 50DMA at 1.1777.

On the upside, Cable will need to recapture the 21DMA on a daily closing basis in order to challenge the 1.2200 hurdle once again. Further up, bulls will aim for Monday’s high at 1.2223.

The next relevant upside target is envisioned at the 1.2250 psychological level.

GBP/USD: Daily chart

GBP/USD: Additional technical levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.