- GBP is under pressure on Thursday and has run through stops to test a 50% mean reversion of prior bullish impulse.

- US dollar firm on stabilising US yields, traders hitting the bid on Wall Street and positive growth outlook and job creation prospects.

At the time of writing, GBP/USD is down 0.64% to 1.3835. Cable fell on Thursday from a high of 1.3949 to a low of 1.3826 printed at the start of the North American session.

The move, however, started in Europe when the pound fell across the board. The move was a bit of a head-scratcher as there was little in the way of domestic fundamental news to move the price.

However, the technical landscape has been bearish for the price considering the market's structure and how far the pound has come from over the course of the week.

The UK has merged from out of a tight COVID-19 lockdown and the data is starting to reflect the economic recovery.

On a key data week, cable hit a six-week high in prior sessions after Britain's unemployment rate unexpectedly fell for the second month in a row in the December to February period.

Additionally, the pound has enjoyed a slump in US Treasury yields coming down from their recent highs and prompting the dollar to weaken.

However, 1.50% in the US 10-year Treasury yield was being eyed in the market but it has yet to be tested and we have seen a rebound from a low of 1.5310% to a high of 1.5870 on the day so far.

This has fuelled a bid in the US dollar and the recent reaction to US President Joe Biden's proposal to almost doubling the capital gains tax rate for wealthy individuals to 39.6% has sent stocks sharply lower assisting the greenback higher as illustrated in the following price comparison chart between the S&P 500 and DXY:

Looking ahead

Meanwhile, the pound should find solace in forthcoming sessions on positive UK data outcomes.

For instance, UK Retail Sales data is due on Friday, along with flash PMIs which are expected to be strong, especially in Sevices.

''Non-essential shops in England and Wales re-opened on April 12, as part of a plan to ease the COVID-19 restrictions. The number of people going to shops in Britain jumped 87.8% last week, data on Monday showed,'' Reuters reported.

Moreover, Reuters also reported that ''British manufacturers' expectations of an economic rebound rose to their highest since 1973 this month as the country began to recover from the slump caused by the COVID-19 pandemic, the Confederation of British Industry said.''

As for the greenback, it will continue to fid demand on recovering yields and the negative correlation to the stock market should also be noted, as illustrated above.

Next week's US Federal Reserve will be important and possible comments about how it views future changes in its easy monetary policy, especially in light of the recent hawkishness at the Bank of Canada and a subtle change in tone from the European Central Bank today.

However, the report from the government that US weekly jobless claims declined further is welcome news, strengthening expectations for blockbuster US job growth in April.

Over the longer term, the outlook remains positive for the greenback due to a strong US economy and more coronavirus vaccinations.

GBP/USD technical analysis

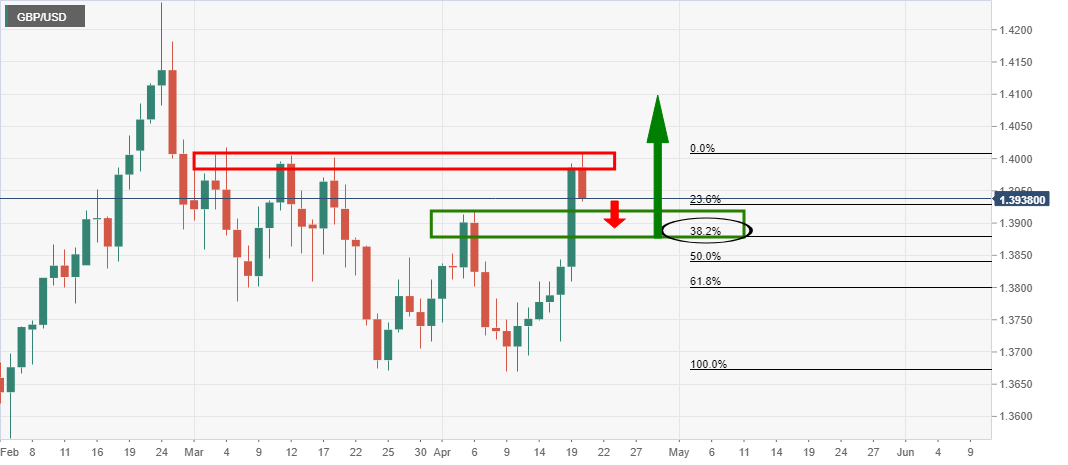

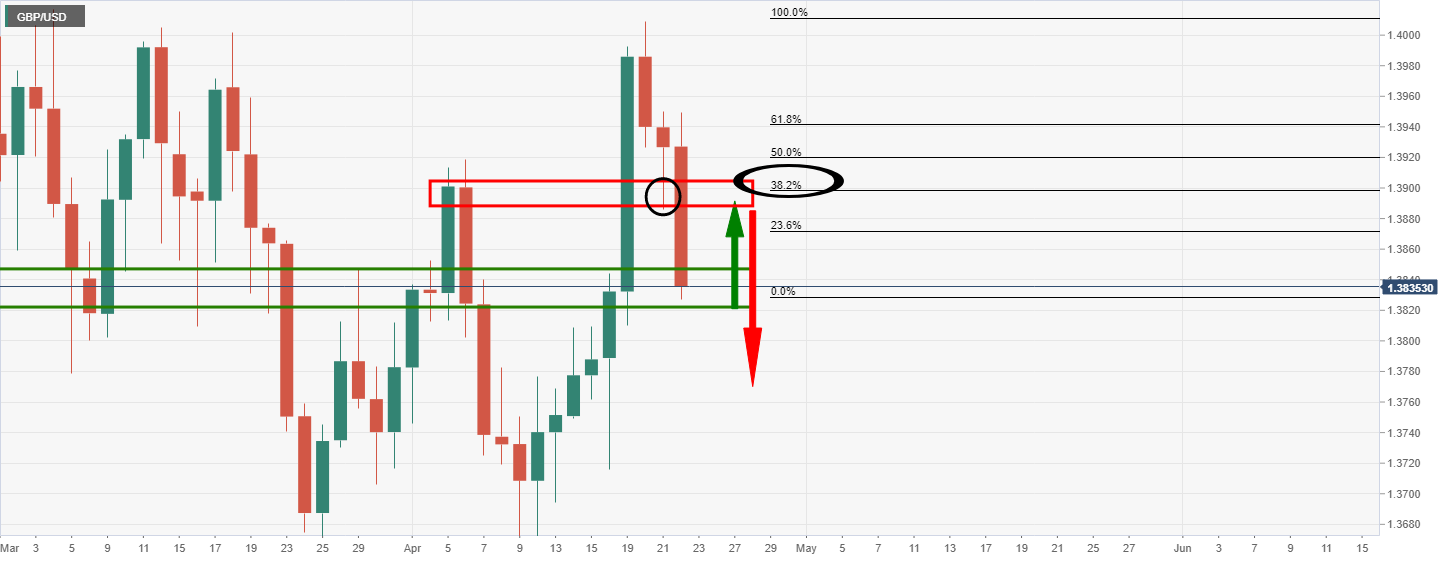

As per the prior analysis, GBP/USD bears set on a 38.2% Fibo 1.3880 target, the price to only achieved the target but it has gone on to test the next area of market structure in a 50% mean reversion of the prior bullish impulse.

Prior analysis

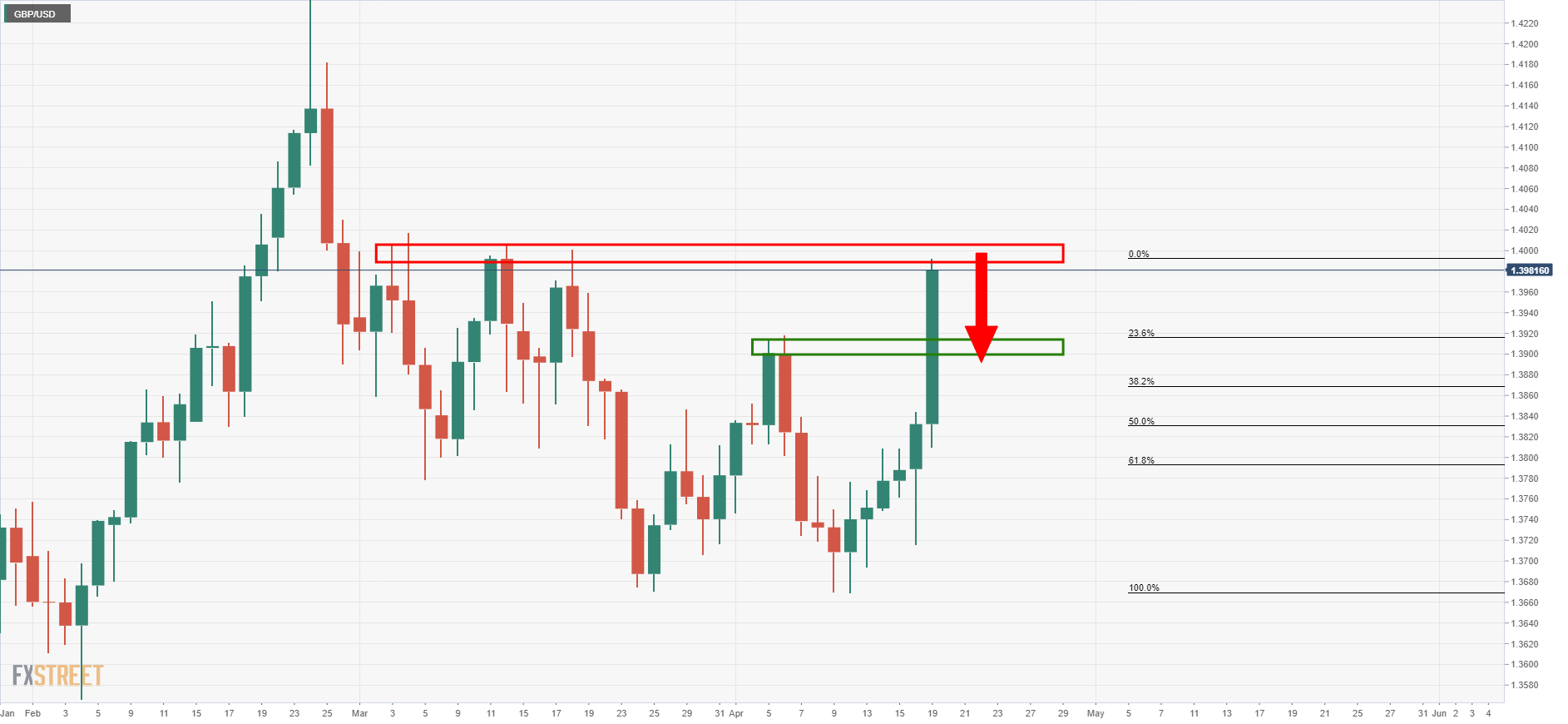

As per prior analysis, as illustrated in the chart below, the area of resistance was cited as follows:

Old live market analysis

There are now expectations of a significant correction to test the prior resistance which has a semi-confluence with a 38.2% Fibonacci retracement level near to 1.3880.

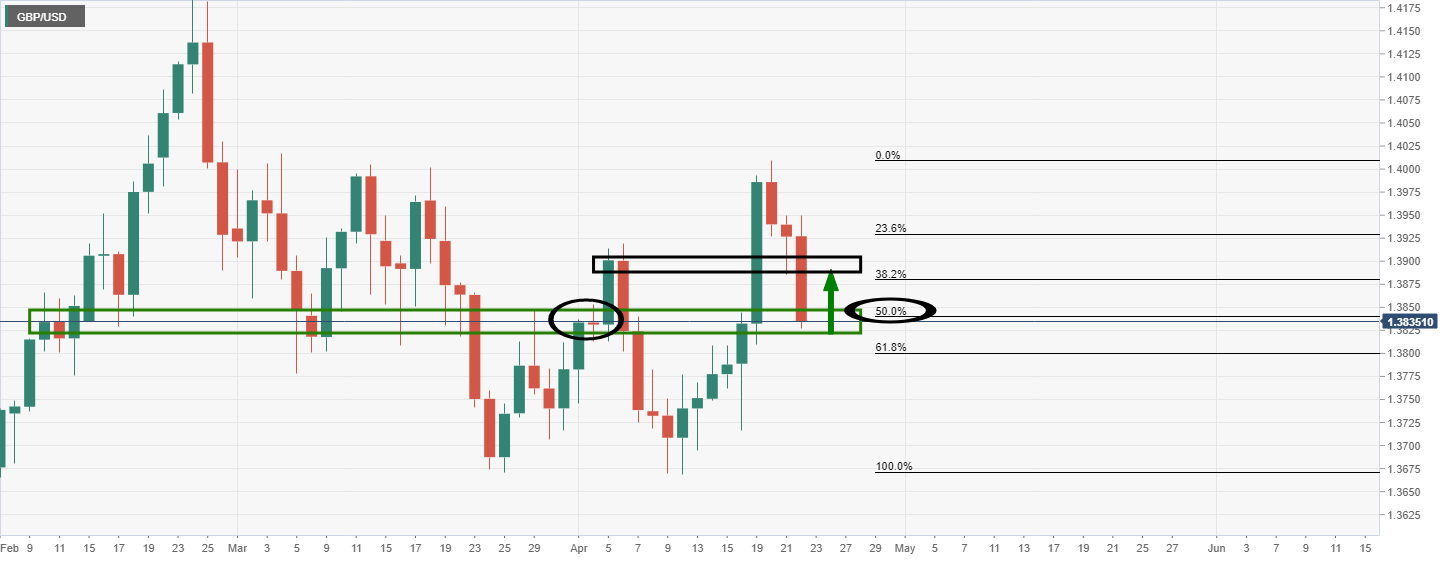

Current live market analysis, daily chart

As illustrated, the price has made a 50% mean reversion and is testing old daily support.

Significantly, the price is meeting an interruptive old resistance candle in from 2 April business. Habitually, such candles act as a firm support or resistance.

At this juncture, an upside correction would be expected prior to the next leg to the downside.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold refreshes all-time highs above $3,000 on escalating geopolitical tensions

Gold price is reneweing record highs beyond $3,000 early Tuesday on intensifying geopolitical Middle East tensions. Israel resumes military operations against Hamas in Gaza after the group rejected US proposals for extending ceasefire. Further US-Iran tensions add to the latest leg up in the safe-haven Gold.

AUD/USD trades with caution below 0.6400 amid MiIddle East tensions

AUD/USD has paused its upsurge, trading with caution in Tuesday's Asian trading. Traders prefer to stay on the sidelines amid intensifying geopolitical risks in the Middle East, reducing the appeal of the higher-yielding Aussie. Meanwhile, the US Dollar finds its feet due to risk aversion.

USD/JPY sits at two-week high near 149.50 as US Dollar finds demand

USD/JPY sits at two-week high near 149.50 in the Asian session on Tuesday as renewed Middle East geopolitical jitters revive the safe-haven demand for the US Dollar. However, further upside appears elusive amid divergent BoJ-Fed expectations and rising trade tensions.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Fed.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637547115431294610.png)