GBP/USD aimed at 1.22 as US Dollar eases back

- The GBP/USD is seeing a bounce as the US Dollar eases back ahead of mid-week Fed.

- UK data continues to miss the mark as BoE looms ahead for Thursday.

- Traders to keep an eye out with another NFP Friday over the horizon.

The GBP/USD is finding some bids for Monday, rebounding from the day's early lows just south of the 1.2100 handle, and the Pound Sterling has a target set on 1.2200 ahead of the Federal Reserve's (Fed) Wednesday rate call. The Fed will beat the Bank of England (BoE) to the punch on central bank action this week, with the BoE slated for the day after.

Both central banks are expected to keep rates steady this week, especially with another round of US Non-Farm Payrolls on the docket for Friday, but investors are approaching both monetary policy institutions with very different attitudes.

Market to punish GBP on impression that BoE is not doing enough – Commerzbank

Concerns continue to mount that the UK's central bank is risking too little movement, exposing the British economy to further inflation despite a lagging economy set to tip even further into the downside if rates go up any higher.

On the US side, investors are all but hoping and pleading for the Fed to get pushed into a rate cut cycle sooner rather than later, but a firm economy and limited downside sees the Fed set to hold rates higher for longer.

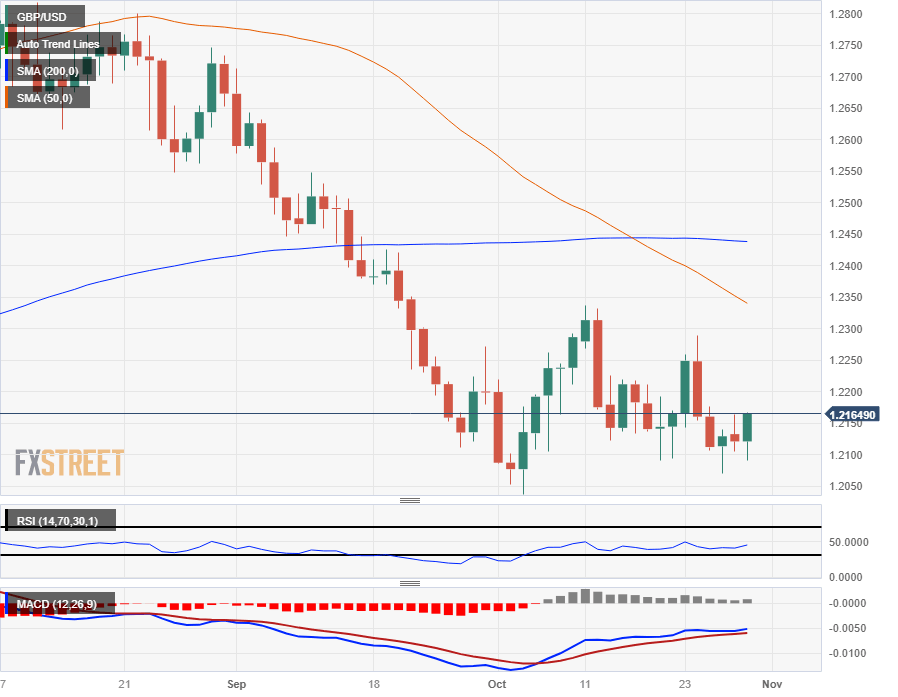

GBP/USD Technical Outlook

The Pound Sterling is bidding up on Monday climbing over 0.6% from the day's early-week lows below 1.2100, and the pair is set for a re-challenge of 1.2200 as long as GBP bidders can hang onto the near-term uptrend.

The Price floor for the GBP/USD sits nearby at eight-month lows near 1.2037, while technical resistance sits at the last swing low near 1.2300.

The 50-day Simple Moving Average (SMA) is dipping into the 1.2350 region, while the 200-day SMA is capping off long-term upside from 1.2450.

GBP/USD Daily Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.