- GBP/JPY remains lackluster near 180.50 despite the UK’s economic turmoil.

- BoE Bailey sees inflation likely at or below 5% by the year-end.

- Japan Kishida vowed to make a surge of wage rises sustainable to keep inflation above 2%.

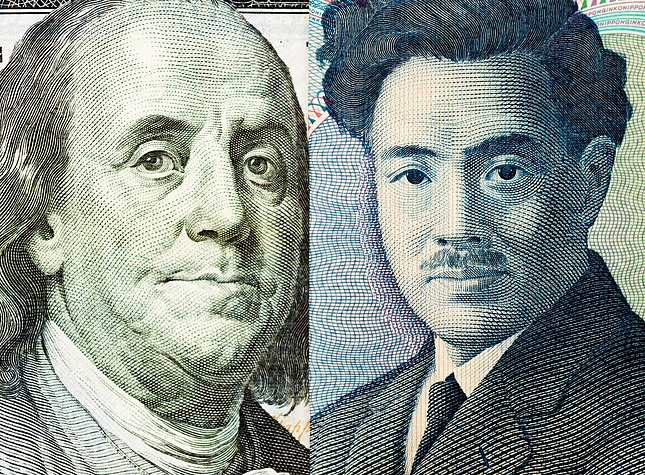

The GBP/JPY pair struggles for a direction as the impact of the Bank of Japan’s (BoJ) intervening expectations starts fading. The cross fails to find a decisive move despite a significant decline in the UK’s Constructing PMI data for September.

S&P Global reported the Construction spending at 45.0, much lower than expectations of 49.9 and the former release of 50.8. A figure below the 50.0 threshold is considered as contraction in the construction activities. Households’ spending on construction was expected to remain weak as higher mortgage rates have forced them to postpone their demand for new houses.

The UK’s housing sector is expected to remain vulnerable as mortgage rates are expected to remain high for a longer period. Also, Bank of England (BoE) Governor Andrew Bailey warned about possible inflation shocks ahead. The BoE is expected to keep interest rates in a restrictive territory for a sufficiently longer period as Andrew Bailey opposed changing the UK’s 2% inflation target. On the inflation outlook, Bailey sees inflation likely at or below 5% by the year-end.

On Wednesday, the Pound Sterling remained volatile after the release of the S&P Global Services PMI data. The economic data improved significantly to 49.3 from expectations and the former release of 47.2. The S&P Global reported that the improvement came in the economic data due to sustained easing of inflationary pressures and a few businesses were optimistic as the BoE paused the policy-tightening spell.

On the Japanese Yen front, Japanese Prime Minister Fumio Kishida vowed to make a surge of wage rises sustainable, which is highly required to keep inflation comfortably above the 2% target as current inflationary pressures are broadly contributed by external factors.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0350 ahead of German inflation data

EUR/USD gathers recovery momentum and trades above 1.0350 in the European session after the data from Germany and the Eurozone showed that Services PMI figures for December were revised higher. Investors await German inflation report.

GBP/USD extends rebound toward 1.2500 on broad USD weakness

GBP/USD extends its recovery from the multi-month low it set in the previous week and closes in on 1.2500. The improving risk mood makes it difficult for the US Dollar (USD) to find demand on Monday and helps the pair push higher ahead of mid-tier US data releases.

Gold price keeps the red near 100-day SMA despite modest USD weakness

Gold price (XAU/USD) turns lower for the second straight day following an intraday uptick to the $2,647-2,648 area on Monday and moves further away from a nearly three-week high touched on Friday.

Sandbox Price Forecast: SAND bulls eyes for $1 mark

Sandbox (SAND) price extends its gains by 7% and trades around $0.68 at the time of writing on Monday after rallying more than 16% the previous week. On-chain data paints a bullish picture, as SAND’s open interest and whale transactions are rising.

The week ahead: Three things to watch

Analysts believe that American exceptionalism will persist in 2025, and the first trading week of the year would suggest that investors are also betting on another strong year for the US.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.