- The GBP/JPY caught a bounce on Monday as investors go risk-on.

- Tuesday sees UK labor and PMI data.

- Japan has a Tokyo CPI advance inflation reading to close out the week.

The GBP/JPY has reclaimed the 183.00 handle in Monday trading as broad-market risk flows turn risk-on, taking safe havens like the Japanese Yen (JPY) down and bolstering the relatively riskier Pound Sterling (GBP) into fresh highs.

The Guppy is trading into its highest bids in over a week, landing just north of the 183.00 handle at 183.28 before a relief pullback drags the pair back down.

The GBP will need all the help it can get this week: with a sedate Monday on the cards, Tuesday is set to kick things off with a bang.

On the docket this week: UK labor, UK PMIs, Tokyo CPI

Early Tuesday at 06:00 GMT sees UK Claimant Count Change and Employment Change numbers; markets expect the UK to see an uptick in people seeking jobless benefits to increase from 0.9K to 2.3K, while the number of employed people is expected to decline 198K, an improvement over the previous reading of -207K, but still in negative territory.

UK Purchasing Manager Index (PMI) figures are also on the docket for Tuesday at 08:30 GMT; both services and manufacturing components are expected to improve slightly, with the composite PMI for October expected to rise from 48.5 to 48.8.

On the Yen side, Japan's next round of inflation figures are due late Thursday at 23:30 GMT. The Core Tokyo Consumer Price Index (CPI) last showed an annualized 2.5% increase, and markets are forecasting that the CPI (minus volatile fresh food prices) will hold steady at that number, printing 2.5% for the year into October.

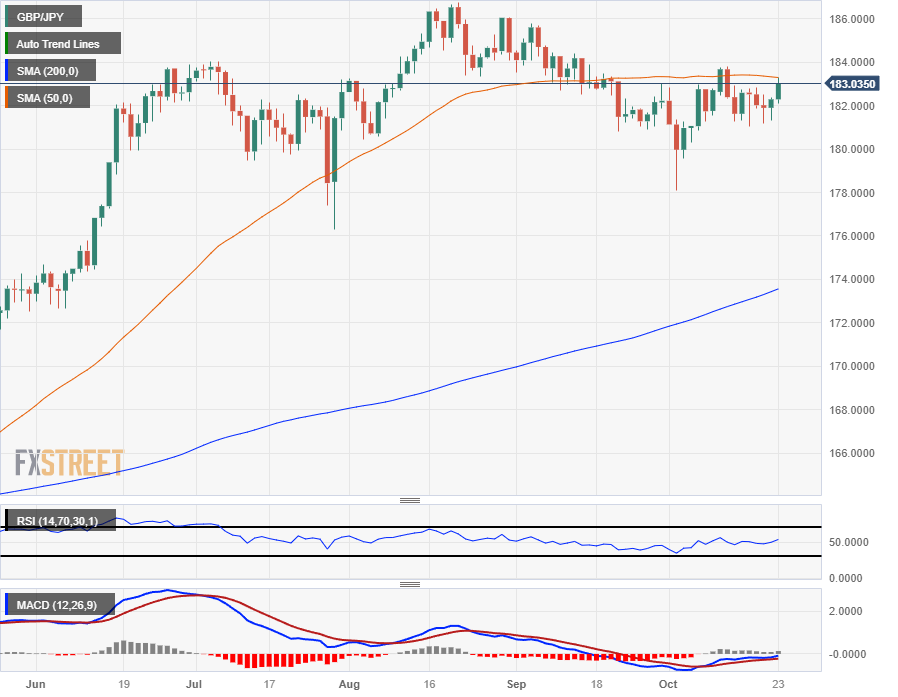

GBP/JPY Technical Outlook

The GBP/JPY is getting dragged back into the 50-day Simple Moving Average (SMA) on daily candlesticks as Monday's six-day high pins the Guppy into medium-term averages.

The next topside level to beat will be the last swing high 183.82 before bidders can re-challenge multi-year highs set back in August beyond the 186.00 handle.

The floor is priced in at the very low end of early October's unexpected plunge into 178.00, and the long-term outlook has the GBP/JPY firmly buried in the high end with the 200-day SMA leaning bullish, but far below current price action just beneath 174.00.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD off highs, back to the 1.1050 area ahead of Fed Minutes

EUR/USD keeps its bullish stance well in place, adding to Tuesday's uptick and retesting the vicinity of the 1.1100 neighbourhood on the back of the intense sell-off in the Greenback, all amid steady concerns over the impact of the China-US trade war.

GBP/USD eases to daily lows near 1.2750, USD picks up pace

The recovery attempt in the US Dollar is now prompting GBP/USD to give away part of the earlier advance past 1.2800 the figure and recedes to the mid-1.2700s in a context still widely favourable to the risk complex.

Gold climbs further, retargets $3,100

Gold preserves its bullish momentum and approaches the $3,100 level per troy ounce on Wednesday, underpinned by the steady safe-haven demand in response to trade tensions between the US and China.

Fed Minutes to offer clues on rate cut outlook amid tariff uncertainty

The eagerly awaited minutes from the US Fed’s March 18-19 monetary policy meeting are set for release on Wednesday at 18:00 GMT. During the gathering, policymakers agreed to keep the Fed Funds Target Range (FFTR) unchanged at 4.25%-4.50%.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.