GBP/JPY reclaims 184.00 on Tuesday as Yen gets yanked back down by dovish BoJ

- The GBP/JPY has rocketed back to 184.00 after the BoJ flubbed hawkish tone expectations.

- The Pound Sterling is set for its single best trading day against the Yen since July.

- The Guppy is back into its highest bids in over a month.

The GBP/JPY is climbing back over the 184.00 handle for Tuesday, with the Yen (JPY) getting punished after the Bank of Japan (BoJ) struck a far more dovish tone than markets were prepared for, even as Japanese inflation forecasts tick higher.

BoJ: Another disappointment for JPY bulls – TDS

BoJ Governor Kazuo Ueda hit newswires early Tuesday with dovish comments, stating that he doesn't see Japanese inflation reaching BoJ targets "with certainty", and the Japanese central bank will stand pat on interest rates for the foreseeable future, even as the BoJ's own inflation forecasts are revised higher.

The BoJ now expects 2024 inflation to come in at 2.8% (previous 1.9%), with 2025 seen at 1.7% (previous 1.6%).

It is now the Bank of England's (BoE) ballgame to lose with UK's central bank slated to bring another rate call on Thursday. The BoE is broadly expected to also hold steady on rates, and investors will be looking at the BoE's Monetary Policy Report and BoE Governor Andrew Bailey's press conference.

BoE Governor Bailey's press conference is scheduled for thirty minutes after the rate decision announcement is released.

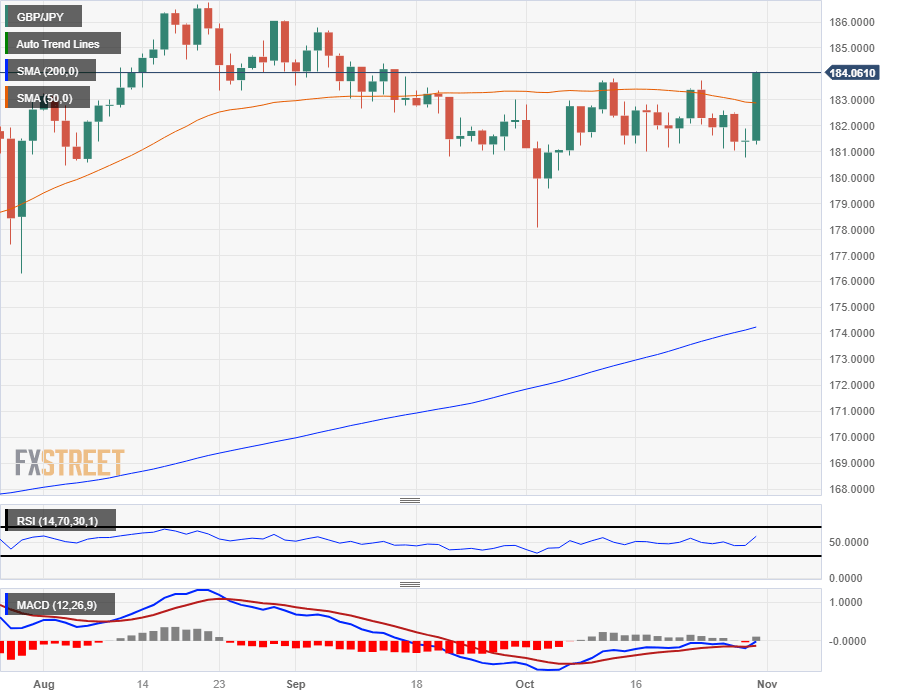

GBP/JPY Technical Outlook

Tuesday's rally in the GBP/JPY sends the pair back over the 184.00 handle, taking the Guppy into its highest bids in six weeks.

The pair continues to cycle the 50-day Simple Moving Average (SMA), with the MA in play near 183.00.

Major top side resistance is baked in from August's swing high into 186.77, and a congestion range from here will see the formation of a head and shoulder pattern from July's peak near 184.00.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.