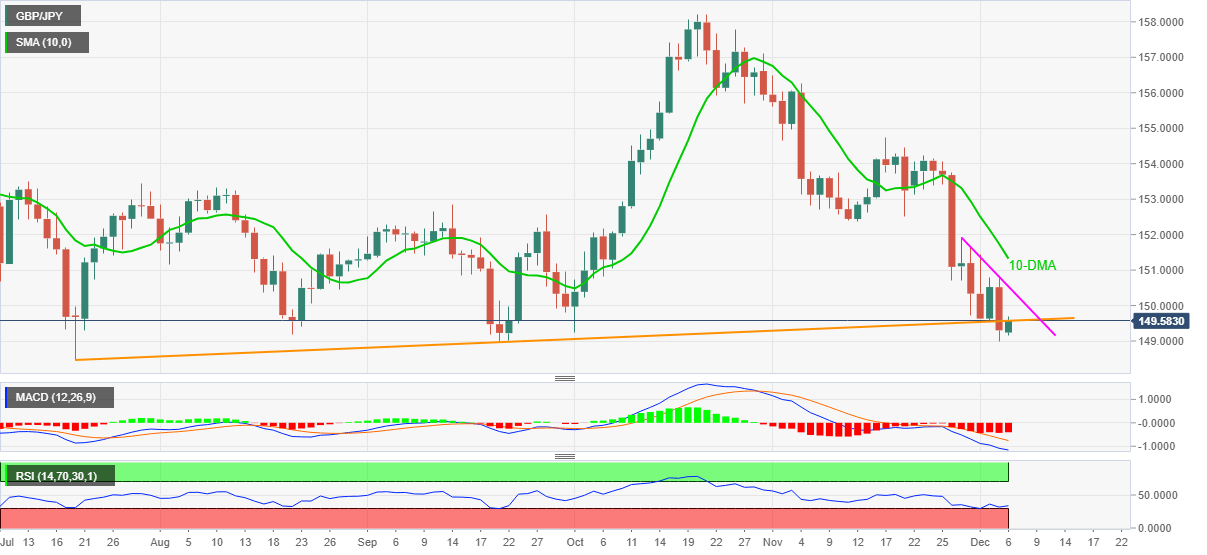

GBP/JPY Price Analysis: Support-turned-resistance tests bulls around 149.50

- GBP/JPY struggles to keep corrective pullback from 11-week lows.

- Bearish MACD signals, sustained trading below previous support keeps sellers hopeful.

- Weekly resistance, 10-DMA add to the upside filters.

GBP/JPY buyers battle short-term key resistance, previous support, while taking rounds to 149.50-60 ahead of Monday’s London open.

In doing so, the cross-currency pair keeps the bounce off September’s low amid nearly oversold RSI conditions.

Considering the bearish MACD signals and the pair’s failures to cross the previous support line, near 149.60 at the latest, GBP/JPY sellers are likely to keep the reins.

That said, September’s low of 148.95 and July’s trough close to 148.45 act as nearby supports to watch during the quote’s fresh downside.

Should the quote remain bearish past 148.45, the December 2019 peak of 147.95 will be important to watch.

Alternatively, a one-week-old descending trend line around 150.55 and the 10-DMA level of 151.35, add to the upside filters even if GBP/JPY manages to cross the immediate support-turned-resistance line surrounding 149.60.

In a case where the pair remains firmer past 151.35, early November’s low of 152.38 will be in focus.

GBP/JPY: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.