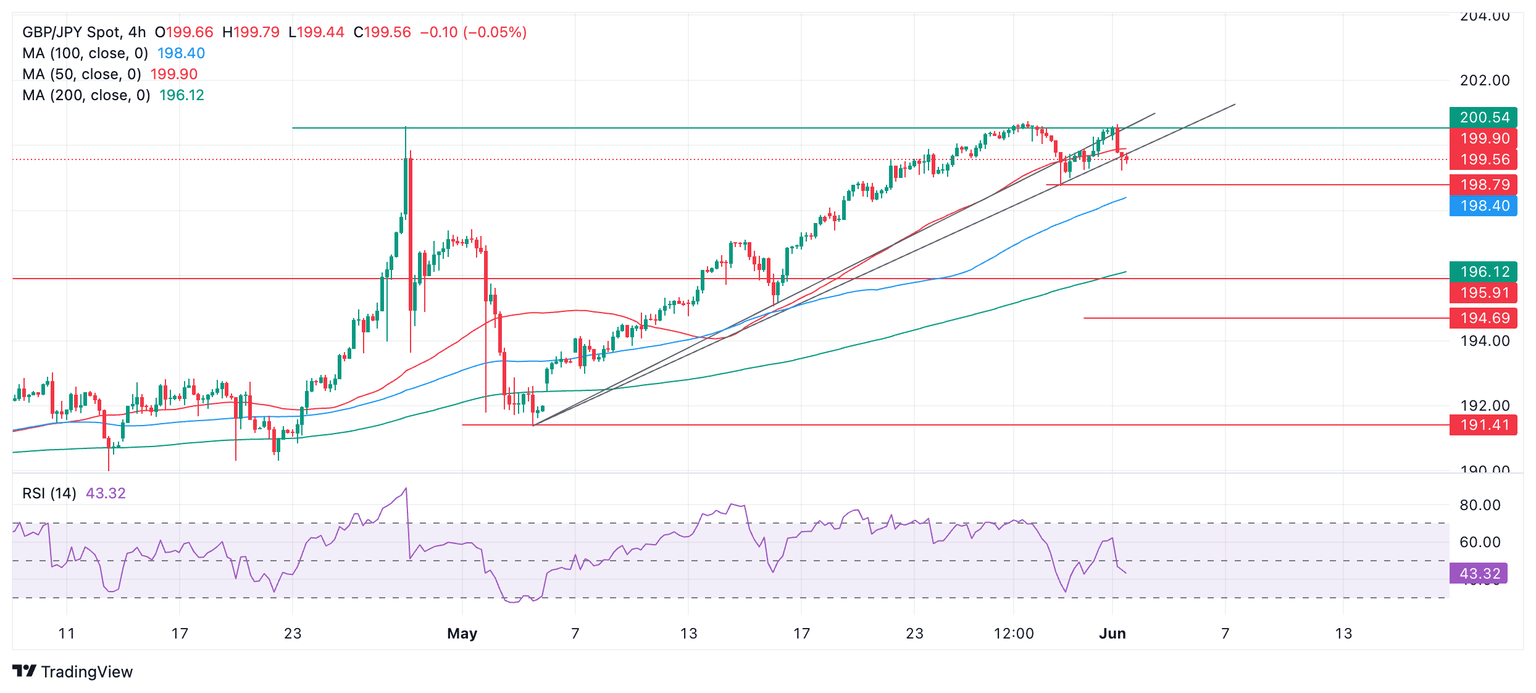

GBP/JPY Price Analysis: Rolls over after touching multi-year highs above 200

- GBP/JPY pulls back after retouching multi-year highs.

- The trend is bullish so the pull back is not expected to last before the uptrend resumes.

- Intervention by the Japanese authorities is a risk factor that could push GBP/JPY lower.

GBP/JPY rallies up to 200.65 on Monday just short of multi-year highs (May 29) and then pulls back. Despite correcting back down to the 199.50s the pair remains in an uptrend over a short, intermediate and long-term time horizon, and since “the trend is your friend” more upside it expected.

4-hour Chart

The pair has broken through one – perhaps even two – trendlines underpinning the rally during May. If the correction continues it will probably find support at 198.79 (May 30 swing lows). A break below would suggest further weakness to perhaps the 100 Simple Moving Average (SMA) at 198.40.

Given the dominant uptrend, however, bulls are expected to turn things around once the correction runs out of steam and pushes the pair higher again.

The only sign the pull back may be ending is the formation of a bullish Japanese Hammer candlestick reversal candlestick on the last bar. This occurs when price makes a new low but then recovers to close near the open. If the current period ends as a bullish green candle it will confirm the hammer and could indicate a short-term reversal and resumption of the uptrend.

A break above the 200.75 high will establish a higher high and extend the uptrend. The next targets will probably be at the round numbers – 201.00, 202.00 etc.

Risk of intervention from the Japanese authorities to strengthen the Yen (resulting in a decline of GBP/JPY) could distort the technical picture.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.