GBP/JPY Price Analysis: Retreats from daily high as bearish-engulfing pattern emerge

- Following the US inflation data release, GBP/JPY sinks more than 100 pips to the 169.00 area.

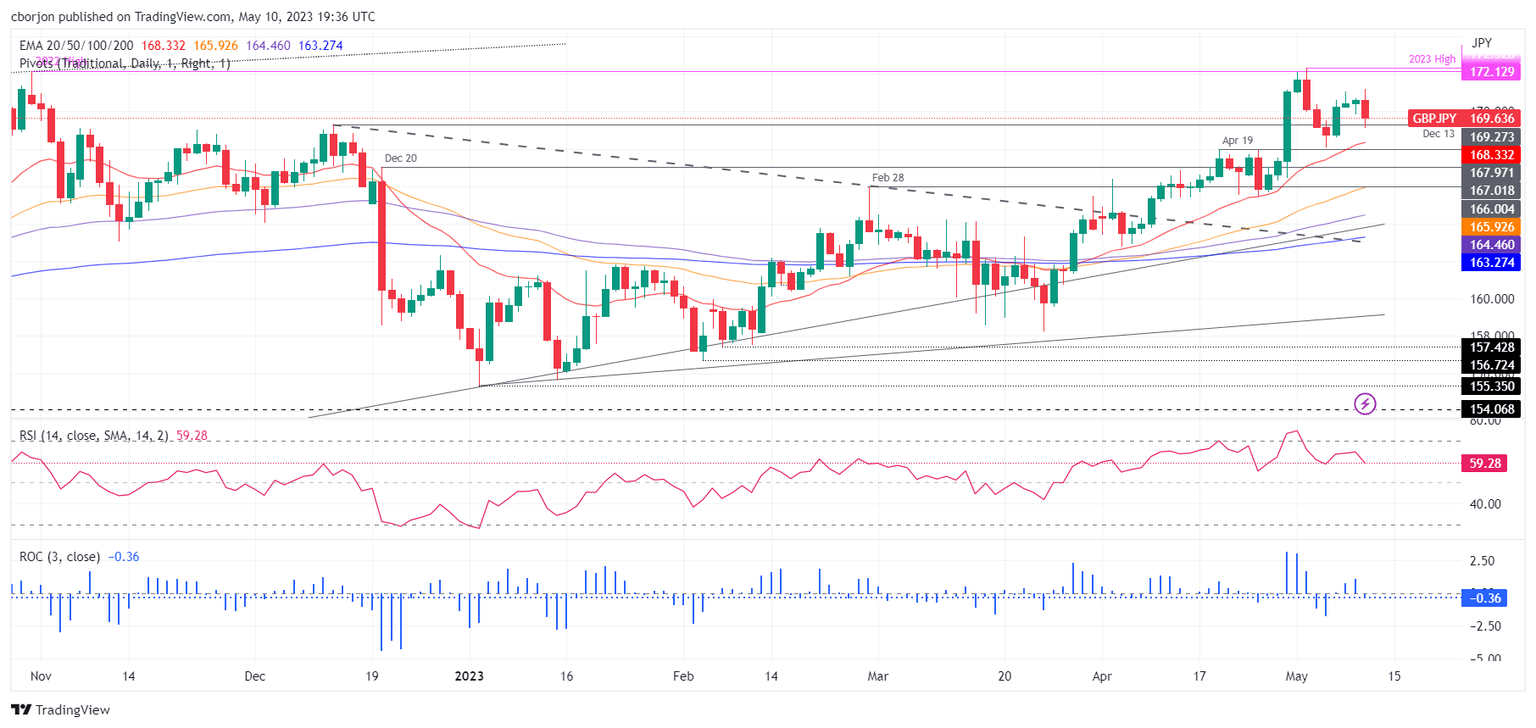

- A bearish technical outlook emerges as RSI aims lower and the 3-day RoC turns negative.

The GBP/JPY slips after hitting a daily high of 171.17 after safe-haven peers advanced following the release of US inflation data. The GBP/JPY slumped more than 100 pips toward the 169.00 handle as traders anticipate another interest rate hike from the Bank of England (BoE) as it scrambles to curb inflation from around 10%.

GBP/JPY Price Analysis: Technical outlook

After snapping three days of gains, the GBP/JPY dropped toward the 169.50 region as the cross-currency pair formed a bearish-engulfing candle pattern. Although the Relative Strength Index (RSI) indicator remains in bullish territory, it continues to aim lower, suggesting buyers are losing steam ahead of the BoE’s decision. The 3-day Rate of Change (RoC) turned negative, allowing sellers to enter new positions.

If GBP/JPY drops below the 169.00 figure, the next support would be the 20-day Exponential Moving Average (EMA) at 168.33, followed by the April 19 high at 167.97. Once cleared, the GBP/JPY next demand area would be the December 20 high turned support at 167.01.

On the flip side, if GBP/JPY reclaimed the 170.00 figure, the next resistance would be May 9 daily high at 170.71. A breach of the latter will expose the May 10 daily high of 171.17, which once cleared, could pave the way to test the YTD high at 172.13.

GBP/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.