GBP/JPY Price Analysis: Rallies for five-straight days climb above 195.00

- GBP/JPY up 0.26% on Friday, totaling a 1.74% weekly gain, now at 195.10.

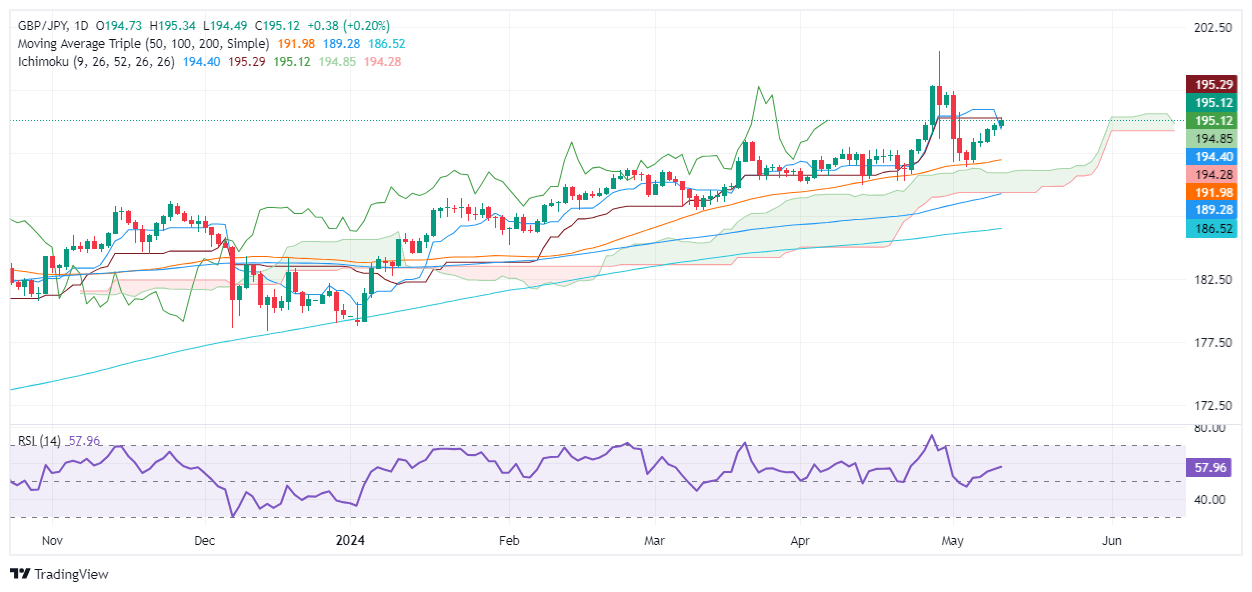

- Technicals show upward trend, rebounding from 50-day MA at 193.50.

- Resistance at Kijun-Sen (195.26); breaking this could push towards 196.00 and April 26 high of 197.92.

The Pound Sterling (GBP) will finish the week on a higher note against the Japanese Yen (JPY), posting gains of more than 0.26% on Friday and 1.74% weekly. At the time of writing, the GBP/JPY exchanges hands at 195.10, testing key resistance levels.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is upward biased after recovering from the Bank of Japan intervention during the last week. Since then, the pair bottomed out at around the 50-day moving average (DMA) at around 193.50 and recovered some ground.

Even though the uptrend remains intact, the GBP/JPY faces key resistance at the Kijun-Sen at 195.26. A breach of the latter will expose the 196.00 psychological level, followed by the April 26 high at 197.92.

On the other hand, if the cross-pair falls below the Senkou Span A of 194.82, that could open the door to challenge the Senkou Span B at 194.24. Further losses are seen at 194.00.

GBP/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.