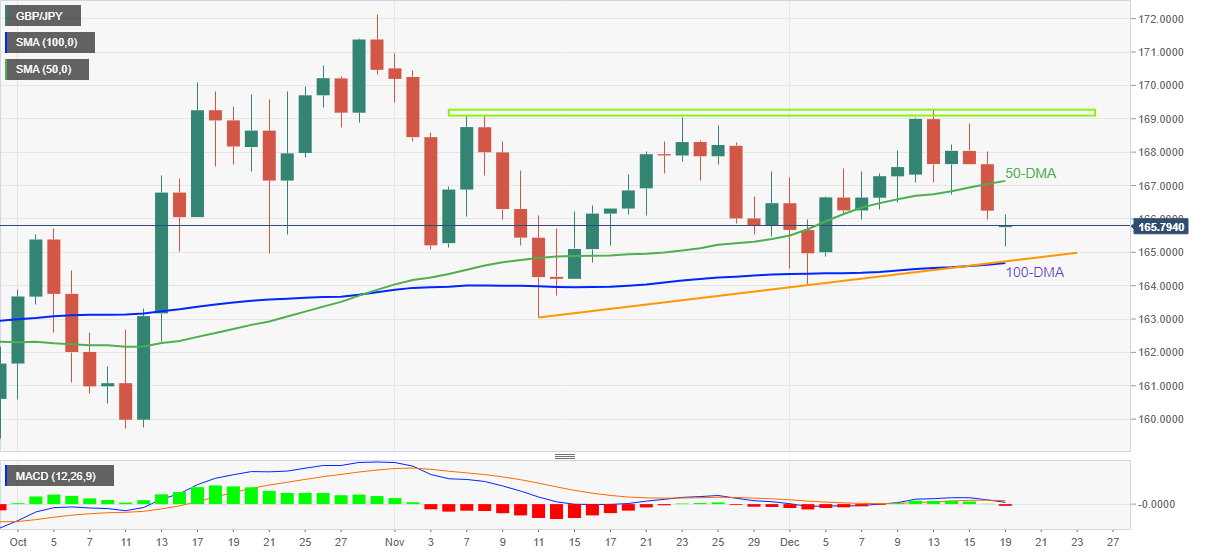

GBP/JPY Price Analysis: On the way to 164.70 support confluence

- GBP/JPY fades bounce off two-week low as it approaches the key support.

- 100-DMA, five-week-old ascending support line restricts short-term downside.

- Bearish MACD signals, clear break of 50-DMA favor sellers.

GBP/JPY bears keep the reins, fading the day-start bounce off 165.20, ahead of Monday’s London open.

That said, the cross-currency pair’s daily closing below the 50-DMA joins the bearish MACD signals to favor GBP/JPY bears. However, a convergence of the 100-DMA and an upward-sloping trend line from November 11, near 164.70, appears a tough nut to crack for the bears.

In a case where the prices drop below 164.70, November’s low near 163.00 could act as an extra filter towards the south before highlighting the 160.00 psychological magnet.

It should be noted, however, that October’s low near 159.75 could challenge the GBP/JPY bears afterward.

Alternatively, recovery moves appear elusive unless the quote provides a daily closing beyond the 50-DMA level of 167.15.

In that case, a five-week-old horizontal resistance area near 169.00-169.20 will act as the key hurdle to the upside. Also acting as an extra filter is the 170.00 round figure.

Overall, GBP/JPY remains on the back foot as it breaks key support and has MACD as a backup to call the bears. However, the downside moves appear to have limited room unless providing a daily closing below 164.70.

GBP/JPY: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.