GBP/JPY Price Analysis: Hovers nearby weekly highs as bulls loose steam

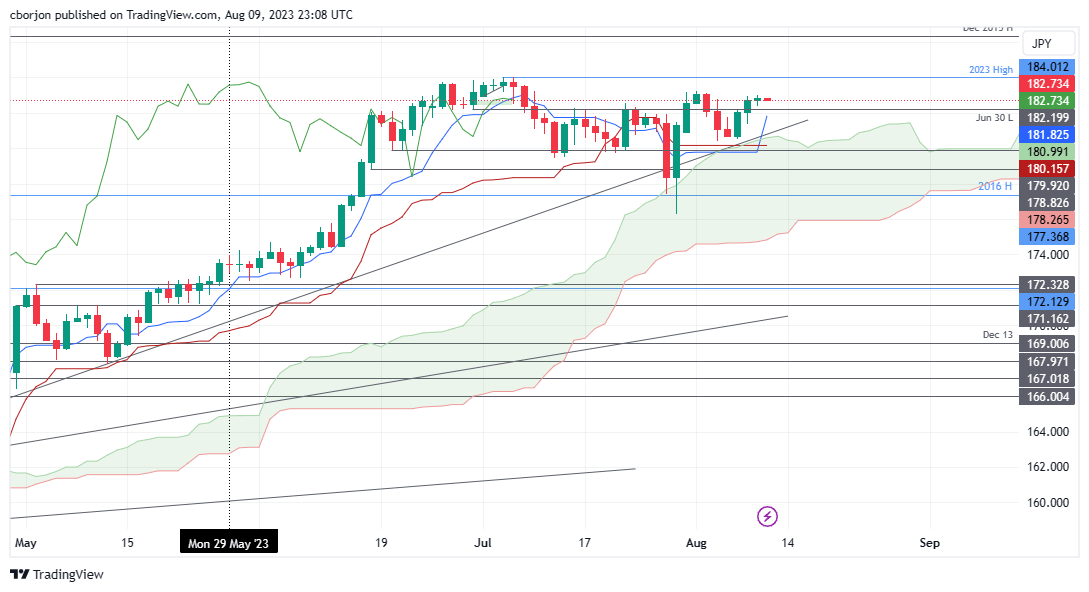

- Despite a brief touch at 183.01, the GBP/JPY remains anchored below the 183.00 psychological resistance.

- Key resistance lies at last week’s high of 183.24, and surpassing this could put YTD high of 184.01 into focus.

- Support levels to watch include the August 9 low at 182.36, Tenkan-Sen at 181.82, and an established support trendline from April's lows around 180.80/95.

GBP/JPY consolidates around the weekly highs of 182.70s and prints a small candlestick, suggesting the uptrend is losing steam, despite reaching a fresh weekly high of 183.01. However, as the Asian session began, the GBP/JPY exchanged hands at 182.69, well below 183.00, after the Tenkan-Sen crossed above the Kijun-Sen level.

GBP/JPY Price Analysis: Technical outlook

From a technical perspective, the GBP/JPY remains neutral to upward bias but must reclaim the last week’s high of 183.24 to threaten the year-to-date (YTD) high of 184.01. Even though the bullish cross of the Tenkan-Sen above the Kijun-Sen portrays the GBP/JPY as bullish, further confirmation is expected.

Otherwise, if GBP/JPY dives below the August 9 low of 182.36, it would exacerbate a pullback towards the top of the Ichimoku Cloud (Kumo). The GBP/JPY’s first support would be the Tenkan-Sen at 181.82, followed by a support trendline drawn from the lows of April, at 180.80/95, before slumping towards the Kijun-Sen at 180.15, inside the Kumo.

GBP/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.