GBP/JPY Price Analysis: GBP in command, investors may start taking profits

- The daily RSI on the GBP/JPY reveals a strong bullish posture, while the MACD shows a shift towards a more balanced market.

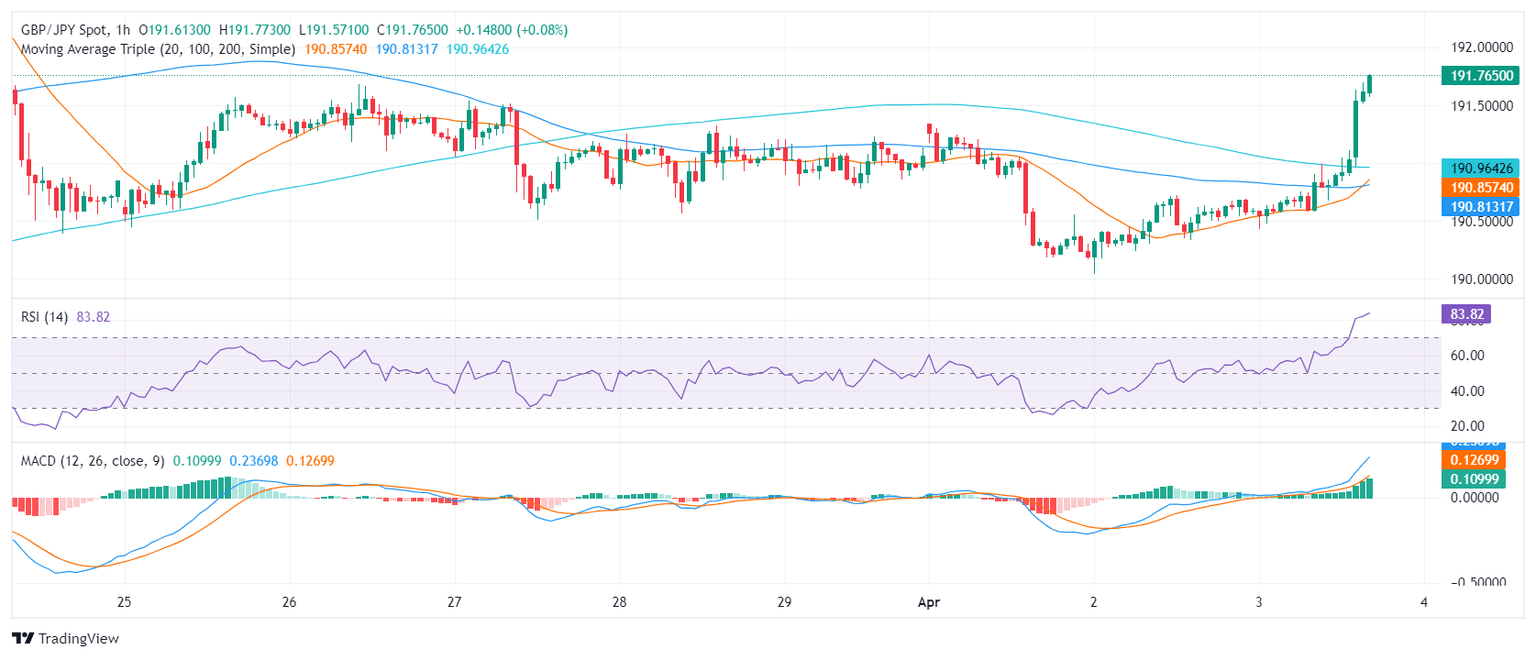

- The hourly chart discloses the RSI regularly exceeding overbought thresholds.

In Wednesday's session, the GBP/JPY is trading at the 191.65 level, showing a 0.57% uptick. The market sentiment for GBP/JPY is majorly bullish, but there is a high likelihood that investors may start taking profits as the cross reached overbought conditions on the hourly chart.

On the daily chart, the Relative Strength Index (RSI) pointing north above 50 indicates that buyers currently have a slight advantage in the market. While there are no extreme levels, suggesting overbought conditions, the RSI reveals a generally strong bullish posture. On the contrary, the Moving Average Convergence Divergence (MACD) is generating decreasing red bars, hinting at the presence of negative momentum and pointing toward more balanced market conditions.

GBP/JPY daily Chart

The hourly chart presents a contrasting perspective with the RSI logging higher values, lying deep in overbought terrain. This tends to predict a downward correction as the upward momentum may be overextended. In addition, the green rising bars of the MACD histogram also demonstrate positive momentum, reinforcing the strong presence of buyers in the market.

GBP/JPY hourly Chart

In terms of the overall trend, the GBP/JPY is positioned above its 20-day, 100-day, and 200-day SMAs. This pattern signals an enduring bullish trend in both short-term and long-term periods. In summary, while both the daily and hourly charts appear mostly bullish, the indicators reveal a stronger upward momentum in the hourly market with the possibility of a downward correction in the short term. However, as the pair holds above the main SMAs, the downward movements could be considered a mere correction.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.