GBP/JPY Price Analysis: Dives to near two-week lows, around mid-154.00s

- GBP/JPY came under some heavy selling pressure in reaction to the incoming Brexit headlines.

- The formation of a bullish flag pattern supports prospects for the emergence of some dip-buying.

- A convincing break below mid-154.00s is needed to negate the constructive set-up.

The GBP/JPY cross witnessed a dramatic turnaround on Wednesday and tumbled nearly 85 pips from the intraday swing highs, around the 155.30 region. The downward momentum dragged the cross to two-week lows, around mid-154.00s in the last hour.

The sharp intraday fall was sponsored by some heavy selling around the British pound in reaction to the latest Brexit headlines. The European Commission Vice President of Interinstitutional Relations and Foresight, Maroš Šefčovič reiterated that the EU will react swiftly if the UK takes any unilateral action on border controls.

Apart from this, speculations that the UK may delay plans to end restrictions fully on June 21 – amid the spread of the so-called Delta variant – further acted as a headwind for the sterling. This, along with a strong pickup in demand for the safe-haven Japanese yen, exerted some additional downward pressure on the GBP/JPY cross.

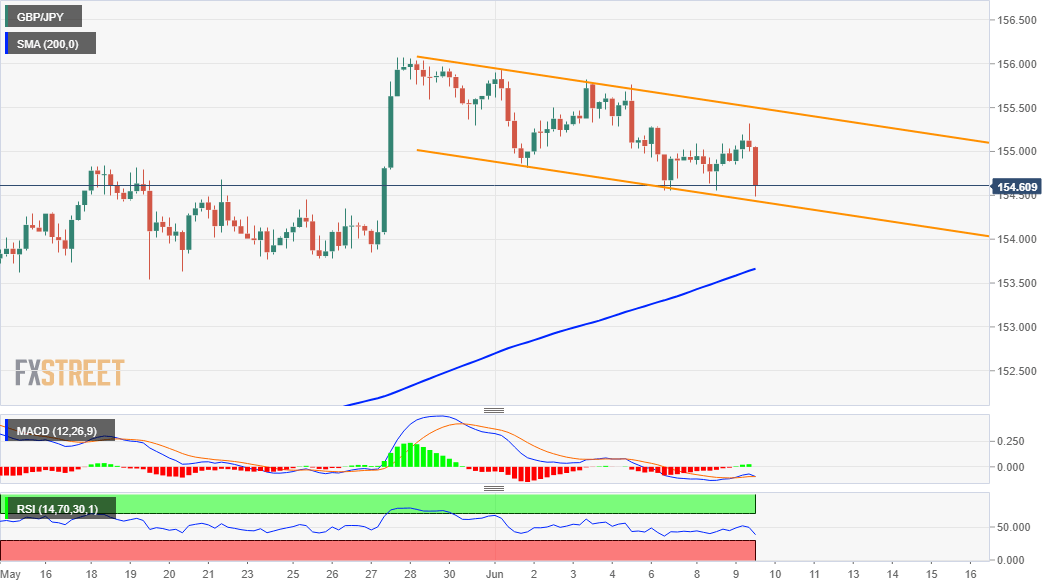

From a technical perspective, the GBP/JPY cross was last seen hovering near support marked by the lower boundary of a short-term descending channel. Given the recent strong positive move, the mentioned trend-channel seemed to constitute the formation of a bullish continuation pattern on short-term charts.

The constructive set-up is reinforced by the fact that technical indicators on the daily chart – though have been losing positive traction – are still holding in the bullish territory. That said, a convincing break below the trend channel will negate the positive outlook and prompt some aggressive technical selling.

The GBP/JPY cross might then extend its corrective pullback from multi-year tops and accelerate the slide to test the 154.00 round figure. Some follow-through selling has the potential to drag the cross further towards the next relevant support near the 153.25-20 horizontal zone en-route the 153.00 mark.

On the flip side, the key 155.00 psychological mark now seems to act as an immediate hurdle. A sustained move beyond will reaffirm the bullish flag pattern and push the GBP/JPY cross towards the trend-channel resistance, currently around mid-155.00s.

GBP/JPY 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.