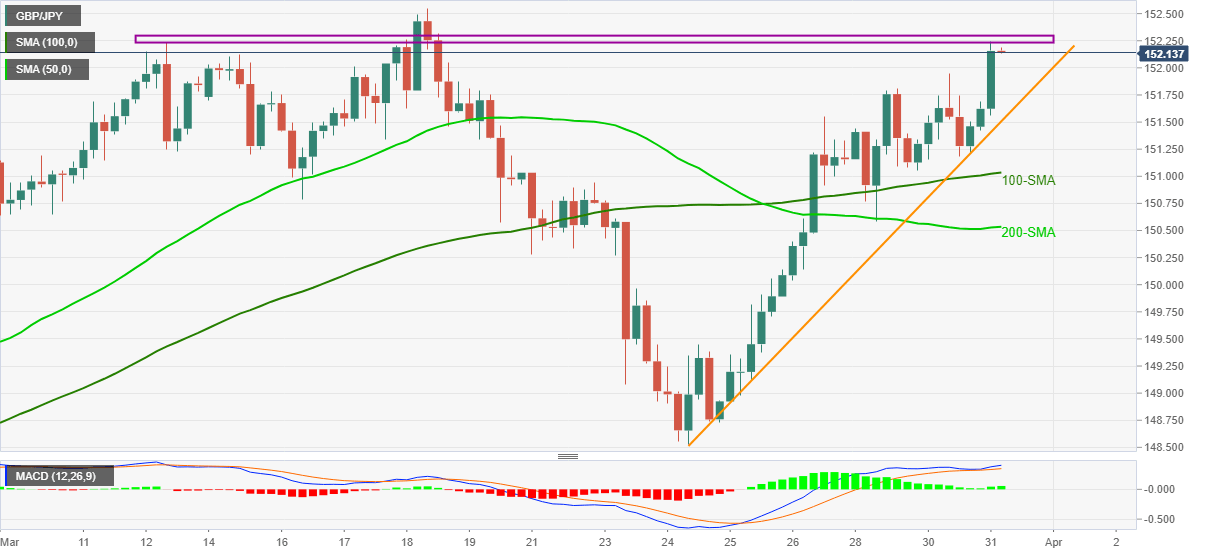

- GBP/JPY stays firmer around two-week top amid bullish MACD.

- 13-day-old horizontal area guards immediate upside ahead of the early month’s multi-day high.

- One-week-long support line, key SMAs restrict short-term downside.

GBP/JPY wavers around 152.15-20, up 0.33% intraday, ahead of Wednesday’s London open. In doing so, the pair attacks the key horizontal resistance that holds the gate for the pair’s further upside towards fresh top since April 2018.

Given the bullish MACD and the pair’s run-up during the last week, as portrayed by an ascending support line, GBP/JPY is likely to overcome the 152.20-30 immediate hurdle. However, a clear run-up beyond the monthly high, also the highest in 35 months, near 152.55, becomes necessary for the bulls.

Should the quote cross 152.55 resistance, the April 2018 peak surrounding 153.85 will be the spotlight. However, the April 26, 2018 high of 152.75 can act as a buffer during the rise.

Meanwhile, pullback moves will have to break the immediate support line, around 151.50, to direct GBP/JPY towards 100 and 50-SMA levels of 151.00 and 150.53.

Though, a clear downside below 150.53 will not hesitate to challenge the monthly low of 148.53 while likely taking a break around 149.45 during the fall.

GBP/JPY four-hour chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction and bounces off daily lows

After bottoming out near 1.0450, EUR/USD managed to regain some balance and revisit the 1.0470 zone on the back of alternating risk appetite trends in the FX world and amid investors' assessment of the German elections.

GBP/USD hovers around 1.2630 amid a vacillating Dollar

GBP/USD alternates gains with losses in the low-1.2600s in response to the lack of a clear direction in the global markets and a lacklustre price action surrounding the Greenback.

Gold extends consolidative phase near record highs

Prices of Gold glimmered higher on Monday, hitting an all-time high around $2,955 per ounce troy on the back of the US Dollar's inconclusive price action as investors are warming up for a key inflation report due toward the end of the week.

Bitcoin Price Forecast: BTC standoff continues

Bitcoin has been consolidating between $94,000 and $100,000 since early February. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $540 million net outflow last week, signaling institutional demand weakness.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.