GBP/JPY Price Analysis: Bears extend control as Pound weakens near 188

- GBP/JPY trades near the lower end of its daily range after slipping below 189

- All key moving averages align with the bearish bias

- RSI and CCI remain neutral but momentum continues to erode

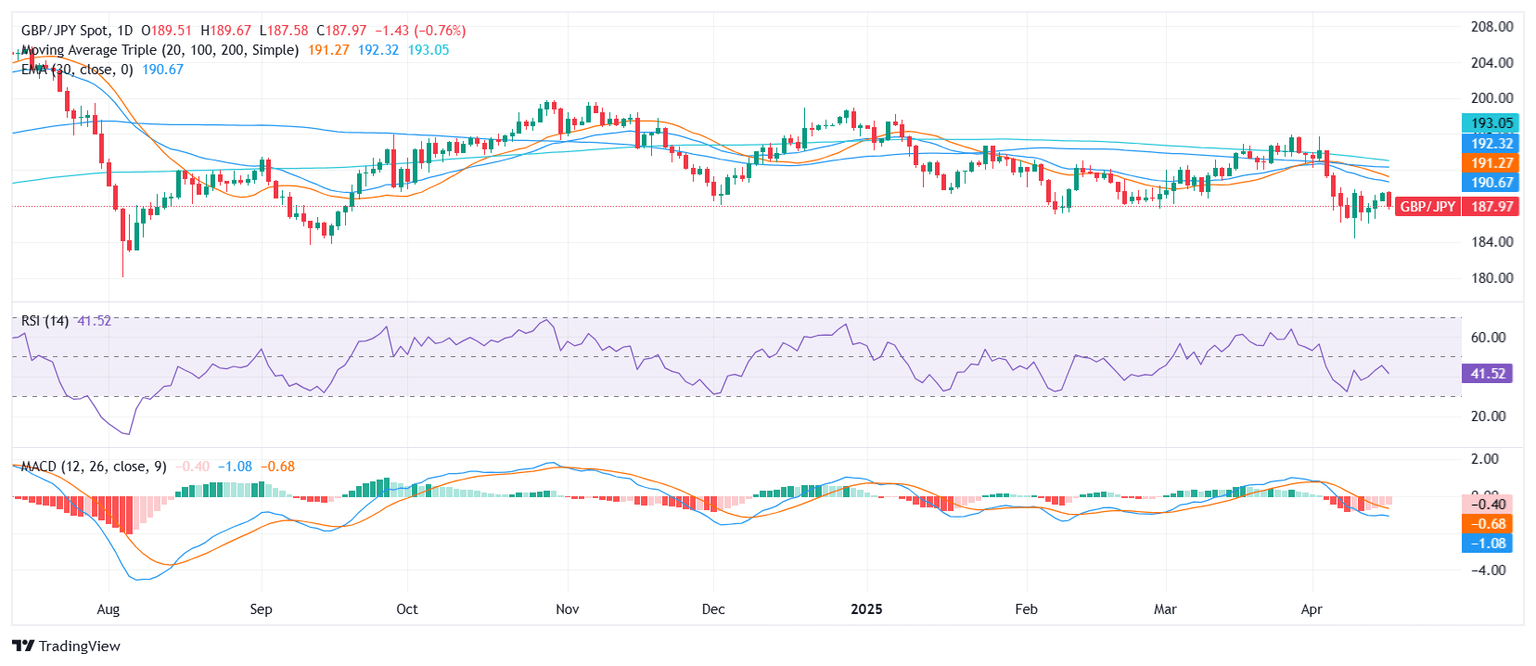

The GBP/JPY pair continued to edge lower on Wednesday, falling toward the 188 zone and marking a daily decline of nearly 0.9%. The cross remains anchored near the bottom of its range between 187.668 and 189.664, reinforcing the weight of recent selling pressure.

The overall technical picture is bearish. The MACD prints a fresh sell signal, confirming ongoing downside momentum. While the RSI at 41.24 remains in neutral territory, it shows a gradual approach toward oversold conditions. Similarly, the Stochastic %K at 37.23 and the Commodity Channel Index (CCI) at -69.48 remain neutral, yet do little to challenge the prevailing negative bias.

The most compelling signal comes from the moving averages. The 20-day SMA at 191.292, the 100-day at 192.269, and the 200-day at 193.184 are all firmly sloping downward. Short-term averages such as the 10-day EMA (189.174) and SMA (188.644) also reinforce the bearish trajectory, with the price continuing to trade below all of them.

Resistance awaits at 188.632, 188.644, and 189.174 — levels that must be overcome to ease the bearish pressure. For now, sellers remain in charge as GBP/JPY struggles to regain upward traction.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.