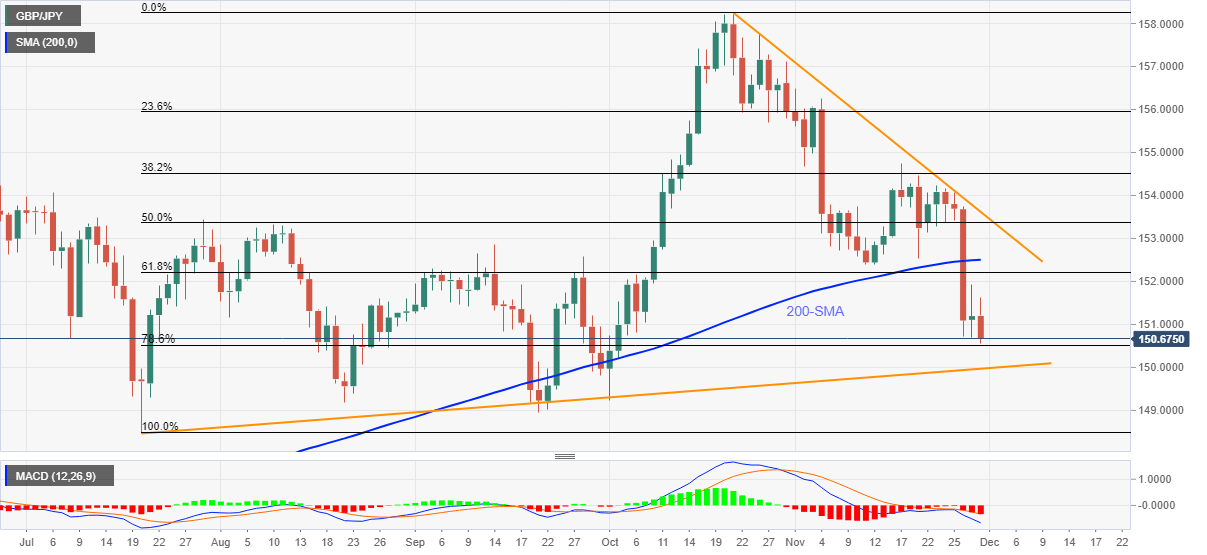

GBP/JPY Price Analysis: Bearish impulse eyes 150.00

- GBP/JPY sellers attack two-month low, nears 78.6% Fibonacci retracement support.

- Bearish MACD, failures to hold 200-DMA highlight ascending trend line from July.

- Monthly resistance line, 50% Fibo. add to the upside filters.

GBP/JPY takes offers around 150.55, the lowest levels since October 04, during early Tuesday morning in Europe. In doing so, the cross-currency pair not only reverses the previous day’s corrective pullback but also braces for the biggest monthly fall since September 2020.

That said, the sellers cheer downside break of 200-DMA and 61.8% Fibonacci retracement (Fibo.) of July-October advances amid bearish MACD signals.

Hence, the latest declines are likely to last longer with the 78.6% Fibo. level near 150.50 acting as the immediate support.

Adding to the downside filters is a four-month-long support line near the 150.00 round figure, a break of which will make the quote vulnerable to test September’s low of 148.95.

Alternatively, 61.8% Fibonacci retracement level and 200-DMA, respectively near 152.50 and 153.65, restrict the short-term upside of the pair.

However, GBP/JPY bulls may not take risk of entries until witnessing a clear upside break of a descending resistance line from October 21, around 153.80 by the press time.

GBP/JPY: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.