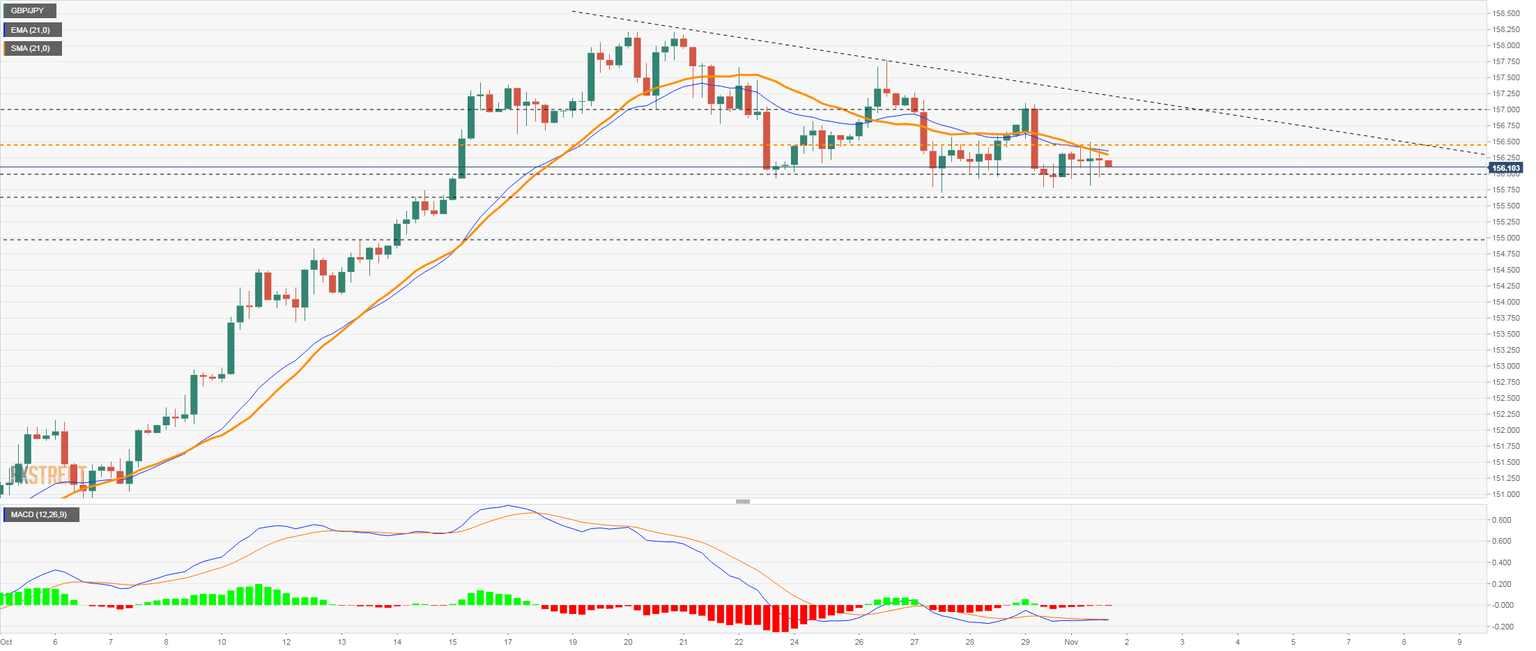

GBP/JPY Price Analysis: Bearish bias while below 156.50, key support around 155.50

- GBP/JPY moving sideways around 156.00 with a modest bearish bias.

- The negative momentum is easing; consolidation under 156.00 to trigger more losses.

The GBP/JPY continues to make lower highs but it failed to print fresh lows. It keeps getting rejection from under 156.00. A consolidation clearly under 156.00 should open the doors to more losses, targeting 155.65 first and then 155.35. The next support stands at 154.95.

On the upside, a firm recovery above 156.50, would put the price above the 21-SMA, improving the outlook for the pound. The next level to watch is the 157.00 zone followed by a downtrend line at 157.20. A break higher would negate the bearish bias, strengthening further the positive outlook.

Technical indicators are tilted to the downside but showing not much force. During the week, key economic reports in the US are due and also the Federal Reserve and Bank of England decisions, so volatility could rise sharply.

On a wider perspective, the correction in GBP/JPY from multi-year highs reached the 155.50/70 support area. A slide below should point to more losses. While if it holds above it could resume the upside move.

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.