GBP/JPY Price Analysis: Aims for year-to-date high as bulls take control

- GBP/JPY sees a bullish continuation, testing the year-to-date high amid a weaker JPY and BoE tightening expectations.

- A move past the YTD high could propel the pair toward the 175.00 supply zone and possibly a seven-year high.

- Potential correction below the Tenkan-Sen line could hit support at 172.66 and drop towards the Kijun-Sen line at 171.26.

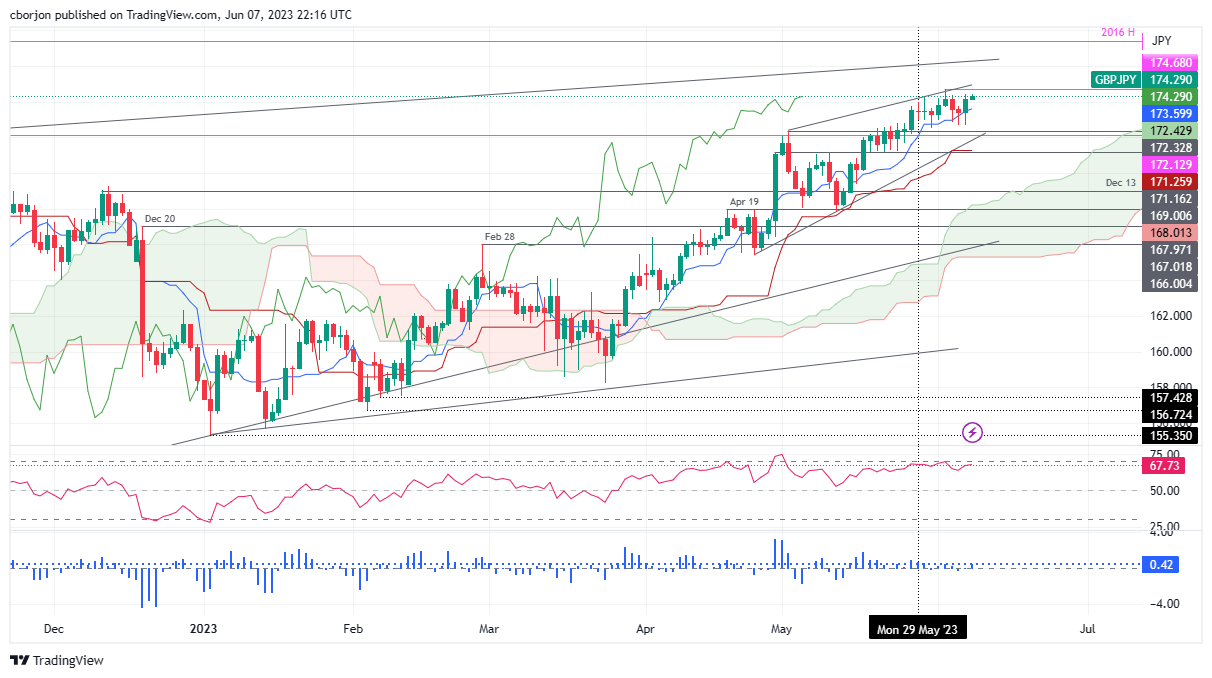

GBP/JPY prints minuscule gains, with buyers eyeing a test of the year-to-date (YTD) high at 174.68 as the Asian session begins. On Wednesday, the GBP/JPY pair finished with gains of 0.42%, bolstered by a weaker Japanese Yen (JPY). Meanwhile, expectations for further tightening by the Bank of England (BoE) underpinned the Pound Sterling (GBP). Hence, the GBP/JPY exchanges hand at 174.28.

GBP/JPY Price Analysis: Technical outlook

GBP/JPY is set for a bullish continuation, as shown by the daily time frame. As the pair closes into the YTD high, price action turns choppy, which could open the door for a reversal, as the Tenkan-Sen line, at 173.59, is the closest to the current price action.

If GBP/JPY extends its gains past the YTD high, the next supply zone would be 175.00. A rally above that level could pave the way for the GBP/JPY to hit seven-year new highs and test the 2016 yearly high at 177.37.

Conversely, a fall below the Tenkan-Sen line and the GBP/JPY might correct lower. First, support would be found at the weekly low of 172.66. A breach of the latter will expose 2022 yearly high shifted support at 172.13, ahead of falling toward the 172.00 figure. Downside risks lie beneath that level, with the Kijun-Sen line at 171.26.

GBP/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.