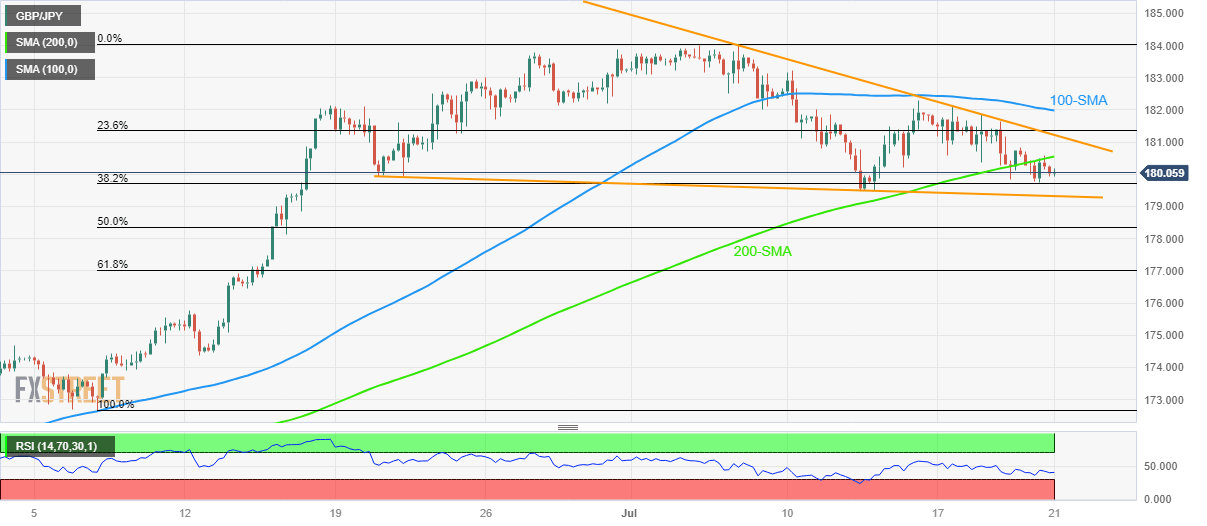

GBP/JPY Price Analysis: 200-SMA, falling wedge prod recovery above 180.00 ahead of UK Retail Sales

- GBP/JPY bounces off intraday low during five-day downtrend.

- Downbeat RSI challenges pair buyers below 200-SMA within one-month-old falling wedge bullish chart pattern.

- Upbeat Japan inflation fails to impress GBP/JPY bears amid positioning for UK Retail Sales.

- Bears need validation from 179.30 and downbeat UK data to retake control.

GBP/JPY licks its wounds at the weekly low, mildly offered near 180.20 amid early Friday in Asia, as it prints the five-day losing streak. In doing so, the cross-currency pair fails to justify the downside RSI conditions while staying within a one-month-old falling wedge bullish chart formation.

That said, the 200-SMA level of around 180.55 and the 181.00 round figure restrict the immediate upside of the quote as the market awaits the UK Retail Sales for June, expected 0.2% MoM versus 0.3% prior.

Also read: GBP/USD: Cable bears need acceptance from 1.2850 and UK Retail Sales

Following that, the stated wedge’s top line, close to 181.25 at the latest, will be crucial to watch for the GBP/JPY buyers to retake control.

Even so, the 100-SMA and the monthly high, respectively near 182.00 and 184.00, may test the pair’s upside past 181.25.

In a case where the GBP/JPY remains firmer beyond 184.00, the theoretical target of the wedge breakout, near 185.75, will be in the spotlight.

Meanwhile, the monthly low of around 179.50 restricts the immediate downside of the GBP/JPY pair ahead of the stated wedge’s bottom line, near 179.30 by the press time, especially amid the below-50.0 RSI level.

Should the GBP/JPY price drops below 179.30 and gains support from downbeat UK Retail Sales, the bears may aim for the 61.8% Fibonacci retracement of June-July upside, close to 177.00.

GBP/JPY: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.