- The GBP/JPY is catching a late-week lift as investors jump back into risk assets.

- Market sentiment has flipped positive to close out the trading week.

- The US NFP printing has sent the entire market broadly risk-on and most pairs are recovering the week's downside action.

The GBP/JPY is tapping into the week's highs near 182.80 after catching a firm lift on rebounding investor market sentiment, climbing a full 1% from the day's lows just past the 181.00 handle and is now testing 182.75 after a 180-pip climb.

Broader markets went firmly risk-on following the US Non-Farm Payrolls (NFP) data beat, with the NFP showing 336K jobs added to the US economy, well above the forecast 170K. Market sentiment has turned firmly bullish on the bumper reading, sending risk assets back into weekly highs, sending markets broadly into the green for the Friday trading session.

The GBP/JPY tapped into 182.80 on the post-NFP market run-up, and is currently trading into 182.70 as the trading week wraps up another Friday session.

Japanese Labor Cash Earnings missed expectations in the early Friday trading session, holding flat at the previous printing of 1.1% and flubbing market expectations of a rise to 1.5%, and Guppy traders will be looking ahead to Monday's UK BRC Like-For-Like Retail Sales on Monday, which last showed similar retail sales rising 4.3% for the annualized period into August.

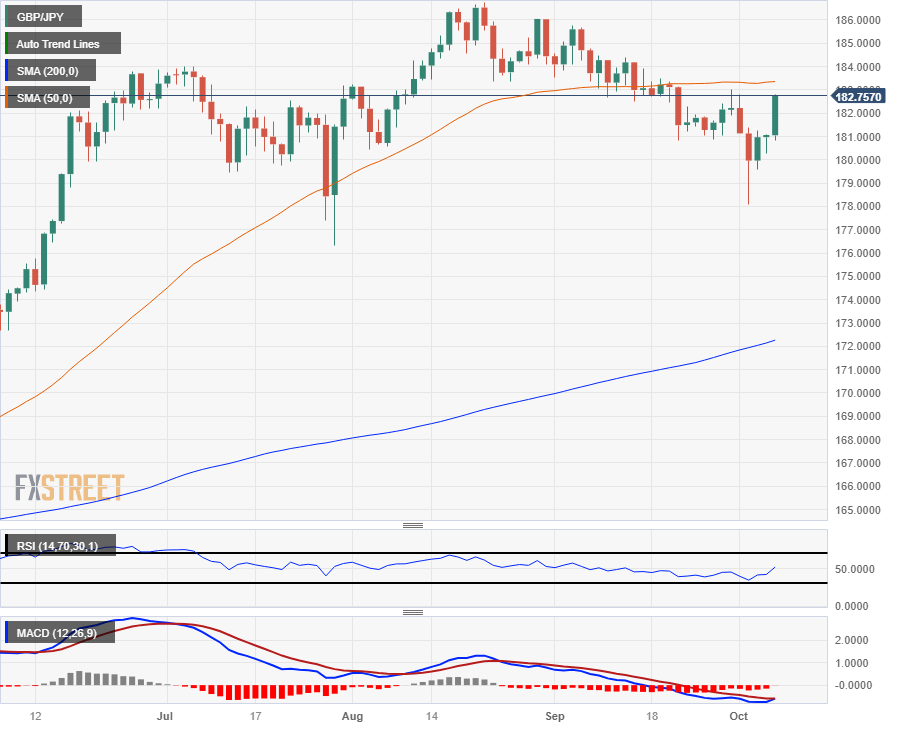

GBP/JPY technical outlook

The GBP/JPY is set to close out Friday's trading session firmly bid, testing the week's highs near 182.80 after rising from Friday's early lows near the 181.00 psychological level.

The GBP/JPY is catching a near-term bullish bounce on the daily candles, climbing from Tuesday's low near 178.00 and lifting into the 50-day Simple Moving Average (SMA) just north of current price action at 183.36.

The Guppy has been treading water in firmly bullish territory in the long-term, with candlesticks still trading well above the 200-day SMA at 172.00, and the tricky challenge for GBP/JPY bidders will be pushing the pair back above August's highs past the 186.00 handle.

GBP/JPY daily chart

GBP/JPY technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold jumps to new record-high above $3,220 as China ramps up tariffs on US goods

Gold extends its relentless rally and trades at a new all-time high above $3,220 in the European session on Friday. The precious metal benefits from safe-haven flows following China's decision to raise additional tariffs on US imports to 125% from 84%.

EUR/USD climbs to fresh multi-year high above 1.1400 on intense USD weakness

EUR/USD continues to push higher and trades at its strongest level since February 2022 above 1.1400 in the European session on Friday. The US Dollar (USD) stays under heavy pressure after China raised tariffs on US imports in retaliation, fuelling the pair's upsurge.

GBP/USD extends the advance to near 1.3100 as USD selloff picks up steam

GBP/USD preserves its bullish momentum and advances to near 1.3100 in the European session. The persistent USD weakness remains the main market theme as fears over the deepening China-US trade conflict triggering a recession in the US continue to grow.

Bitcoin, Ethereum and Ripple show weakness while XRP stabilizes

Bitcoin and Ethereum prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple broke and found support around its critical level; maintenance suggests a recovery on the cards.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.