GBP/JPY finds thin lift in early week trading as BoE rate call looms

- GBP/JPY claws back recent declines, but early week remains thin.

- UK holiday Monday will see flow return on Tuesday.

- BoE set to give another rate call on Thursday, broadly expected to hold.

GBP/JPY found some room up top on Monday as markets kick off the new trading week on a quiet note. UK markets were shuttered for a holiday, and UK order volumes are expected to return at the outset of the Tuesday UK session after a long bank weekend.

The Bank of England (BoE) brings its latest rate call to the table this week, slated for Thursday. Markets are broadly forecasting that the BoE will vote 8-to-1 to keep rates unchanged. Swati Dhingra, an external member of the BoE, is expected to be the single holdout looking for a rate trim from the BoE.

Early Tuesday, we will see BRC Like-For-Like Retail Sales figures from the UK for the year ended in April. Markets are expecting UK Retail Sales growth for the year to slow to 1.6% from the previous 2.5%.

UK Gross Domestic Product (GDP) are also due this week, and QoQ GDP growth in the UK is expected to rebound to 0.4% in Q1 compared to the previous quarter’s -0.3% decline.

GBP/JPY technical outlook

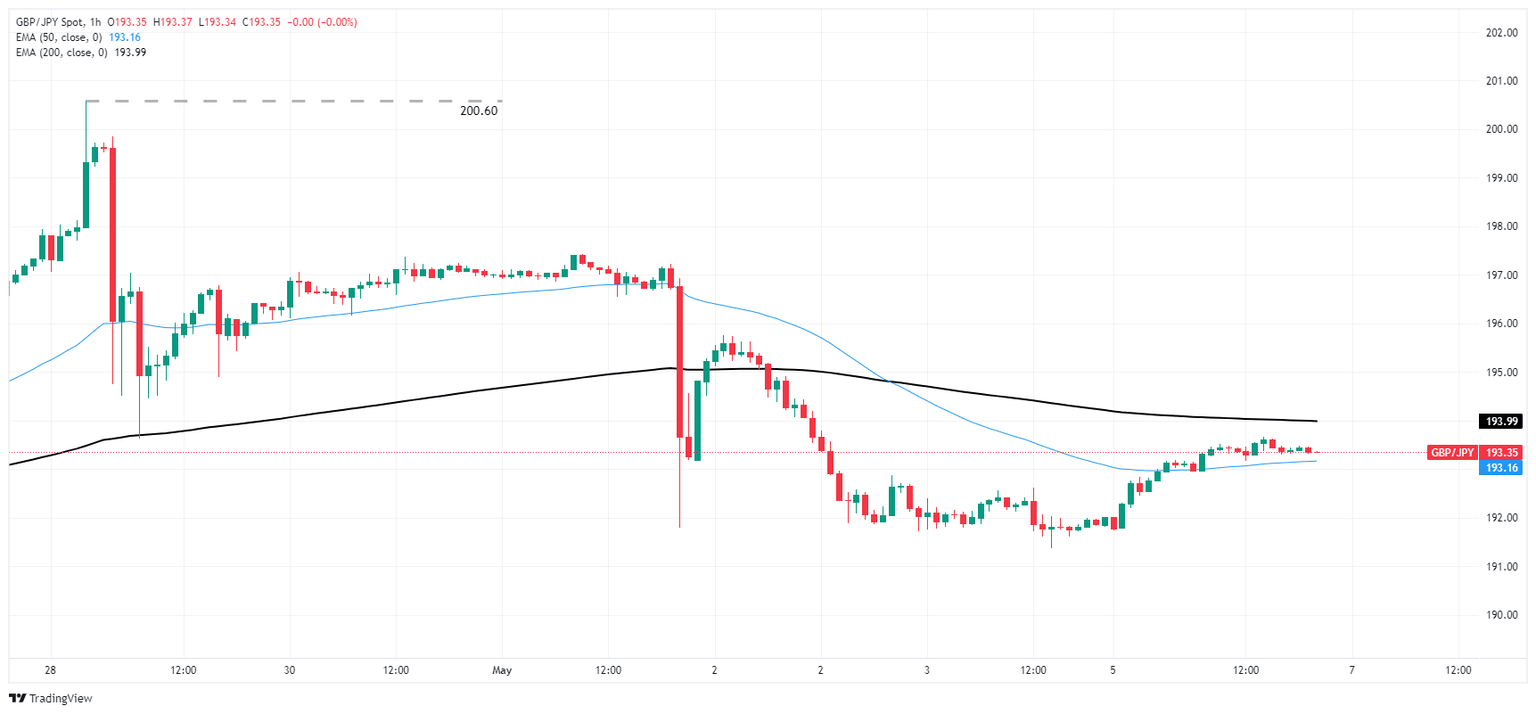

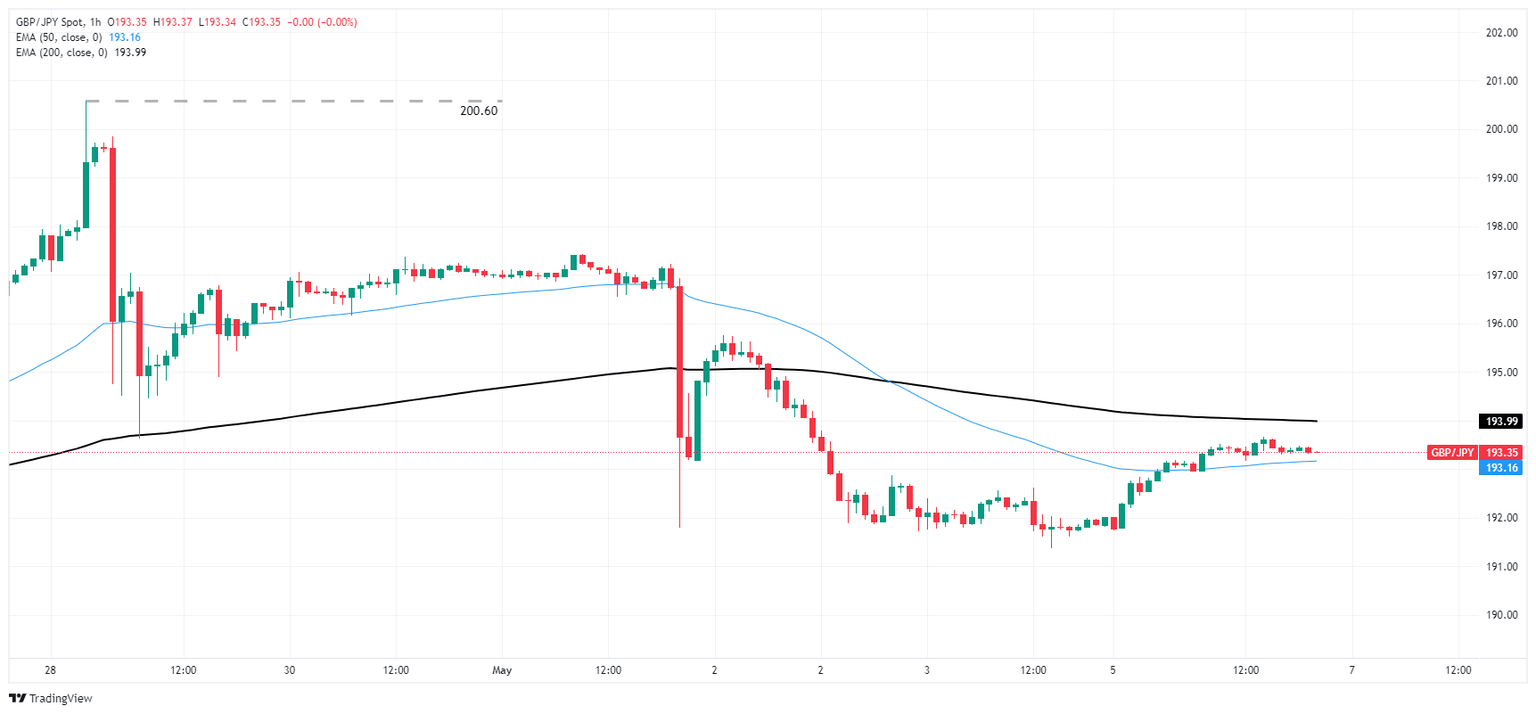

The Guppy is slowly rebounding from a recent floor following two back-to-back interventions from the Bank of Japan (BoJ) to intervene on behalf of the badly battered Japanese Yen (JPY). The GBP/JPY has declined 4.6% peak-to-trough from a 34-year high of 200.60 at the end of April.

The pair has recovered some ground, climbing back above 193.00, though the pair still remains on the low side of the 200-hour Exponential Moving Average (EMA) at 194.00.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.