GBP/JPY finding 185.20 a difficult level to beat as Pound Sterling gets squeezed into the low end

- The GBP/JPY is seeing some push-and-pull on Wednesday, close to the day’s opening bids.

- 185.20 is firming up as a technical support level as highs sag, squeezing the Guppy into the middle.

- Early Thursday sees Japanese Gross Domestic Product (GDP).

The GBP/JPY is getting knocked around in a tug-of-war as the softening Pound Sterling (GBP) gets stuck in place against the Japanese Yen (JPY), and the GBP/JPY sees a rough intraday range between 185.80 and 185.20.

Chances of a topside recovery for the GBP/JPY withered early Wednesday after the latest semi-annual Financial Stability Report from the Bank of England (BoE). The UK’s central bank continues to see an environment full of challenges and downside risks, with vulnerabilities within the financial system specifically. The only hawkish note for the Financial Stability Report was noting that the UK banking system remains well-capitalized.

Up Next: Japan foreign investment & quarterly GDP

Thursday kicks off a Japan-heavy data docket in the back half of the week with Japanese Foreign Bond and Stock Investment, as well as Japanese Foreign Reserves. Friday brings a Japanese quarterly GDP update, which is expected to hold steady at a -0.5% print for the third quarter.

Friday will close out the trading week with an update on Consumer Inflation Expectations from the BoE, which last showed UK consumers expected inflation to land at 3.6% over the following twelve months.

GBP/JPY Technical Outlook

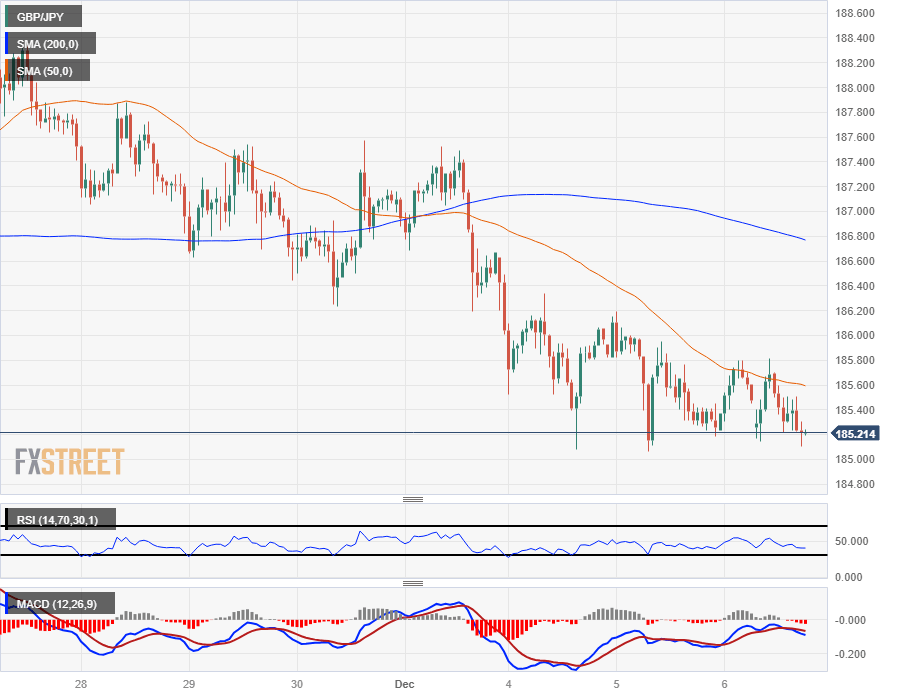

Intraday action sees the GBP/JPY getting squeezed into the end with prices getting propped up at the 185.20 level, a technical barrier firming up into likely-to-break support if Yen flows don’t reverse.

The 200-hour Simple Moving Average (SMA) is turning bearish from 186.80 as near-term momentum tilts towards the downside.

The GBP/JPY has closed down for six of the last seven consecutive trading session, and a thin downside for Wednesday looks set to chalk in a fourth straight decline with the Pound Sterling slightly back against the Yen, down roughly a tenth of a percent on the day.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.