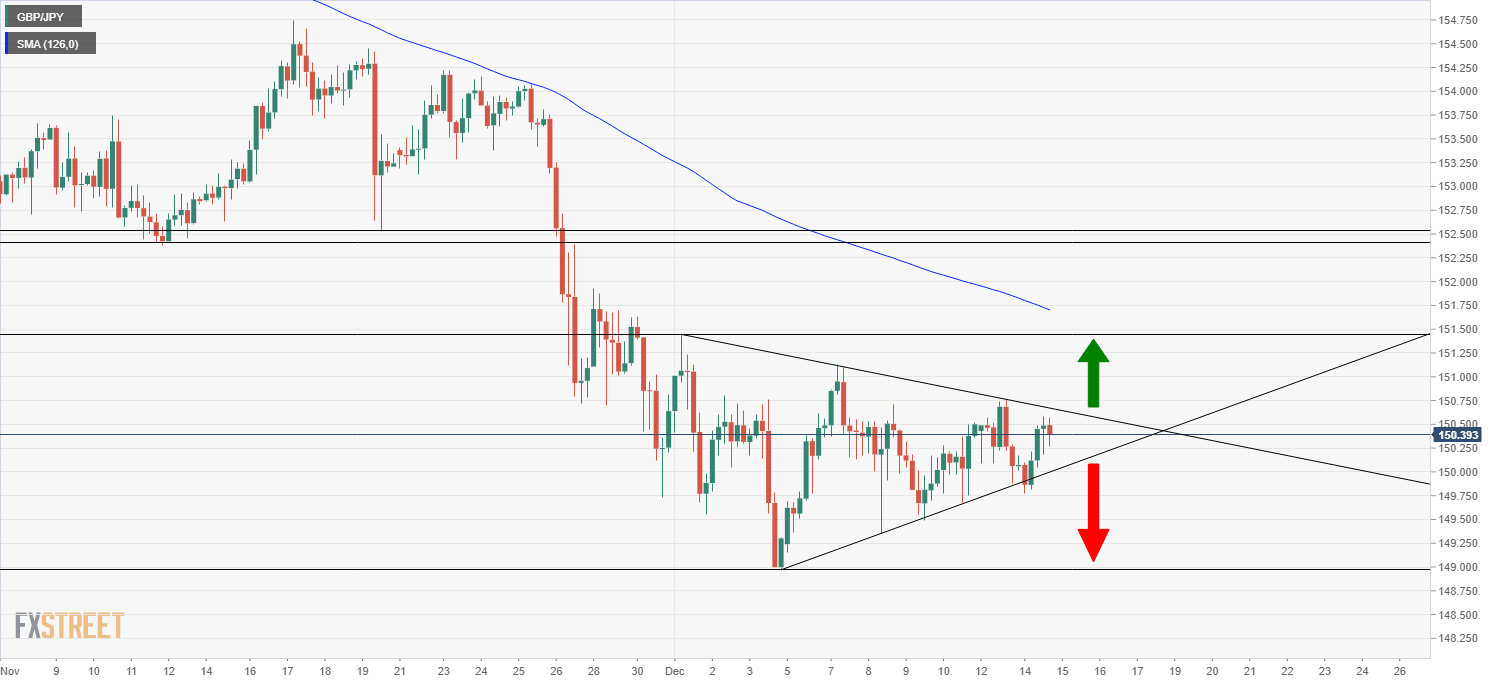

GBP/JPY continues consolidation pattern close to 150.00, potential pennant breakout possible?

- GBP/JPY hasn’t moved much on Tuesday and continues to consolidate in the low 150.00s area.

- The pair has formed a pennant this month, suggesting a technical break in either direction is on the cards.

- The main events to watch this week for the pair are Thursday’s BoE meeting and Friday’s BoJ meeting.

GBP/JPY hasn’t moved much on Tuesday, with the pair rising by about 0.2% on the day but remaining within recent ranges as it consolidates just to the north of the 150.00 level. It's been six sessions since the pair saw any meaningful volatility and trading conditions on Tuesday were subdued despite the release of the latest UK labour market report, which showed employers hiring a record number of staff in November. It also showed the unemployment rate in October dropping to 4.2% as expected, in a further sign that the UK labour market weathered the end of the government’s furlough scheme in September well.

Subdued trading conditions are not surprising given that FX markets are waiting for a barrage of central bank events later in the week before finding some direction again. The BoE sets rates on Thursday and the BoJ on Friday, with neither likely to alter policy stance. Whilst that is nothing new when it comes to the BoJ, it is a much more interesting story for the BoE; the bank was expected to hike rates by 15bps as recently as the end of November.

But since the emergence of Omicron, BoE policymakers have turned dovish, a shift that weighed on GBP/JPY and contributed to its drop from the 153.00-154.00 area to current levels around 150.00. Amid Omicron uncertainty, UK data has been largely ignored and will likely continue to be for the rest of the week; following Tuesday’s solid jobs report, UK November CPI is out on Wednesday and November Retail Sales is out on Thursday.

The technicals suggest a breakout, either to the upside or downside is on the cards. GBP/JPY has formed a pennant over the course of the month so far, with prices constricted between a downtrend linking the late November, 7 and 13 December highs and an uptrend linking the 3, 8, 9, 10 and 13 December lows. A downside break for whatever reason (like a dovish BoE surprise on Thursday) would likely see the 149.00 level tested, while an upside break would trigger a push towards the 152.00 level and the 21-day moving average just below it.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset