GBP/JPY churns near 200.00 ahead of a quiet week

- GBP/JPY cycles 200.00 in rough churn as Yen struggles to hold steady.

- GBP and JPY settle in for a quiet week on the data docket.

- UK Retail Sales and Japanese wages both expected to rebound this week.

GBP/JPY is cycling the 200.00 major handle heading into a quiet week for both currencies, with the economic data calendar almost entirely populated with low-tier data releases through the majority of the trading week. UK BRC Like-For-Like Retail Sales are expected to recover ground in May, while Japanese Labor Cash Earnings are expected to accelerate for the year ended in April.

UK YoY BRC Retail Sales are expected to rebound to 1.2% through May, a healthy recovery but still underperforming the previous period’s -4.4% decline. April’s YoY Retail Sales figures had tumbled to its lowest level since December of 2019, and investors are hoping that May’s annualized figure is able to recover ground. UK BRC Retail Sales are slated to print early Tuesday.

Japanese Labor Cash Earnings are expected to accelerate to 1.7% for the year ended in April, forecast to rise to 1.7% from the previous period’s 0.6% increase. Wage growth remains a key driver in Bank of Japan (BoJ) policymaking as the Japanese central bank remains fearful of Japanese inflation slumping to near-zero growth figures. A firm rebound in wage growth will help bolster the BoJ’s confidence in closing the differential between Japanese monetary policy and other major central banks around the world.

GBP/JPY technical outlook

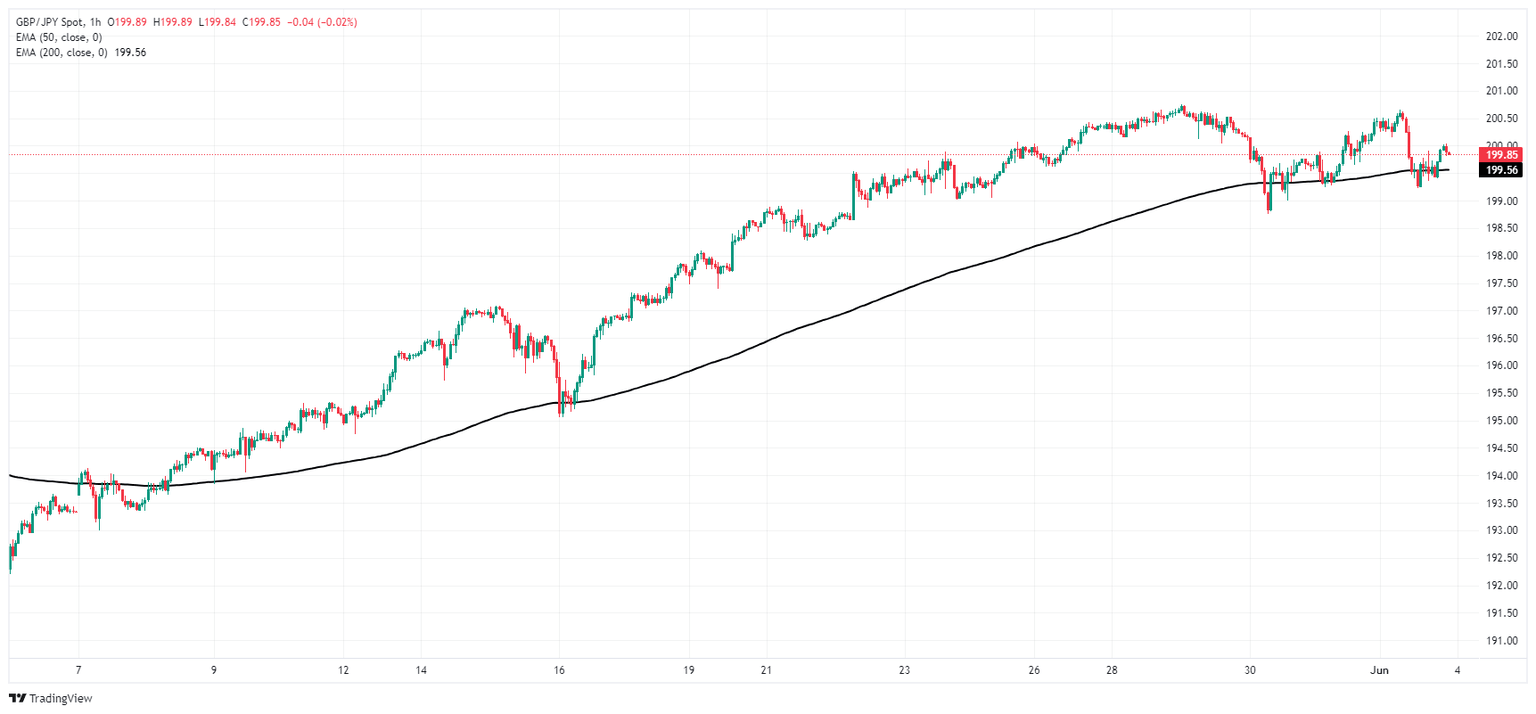

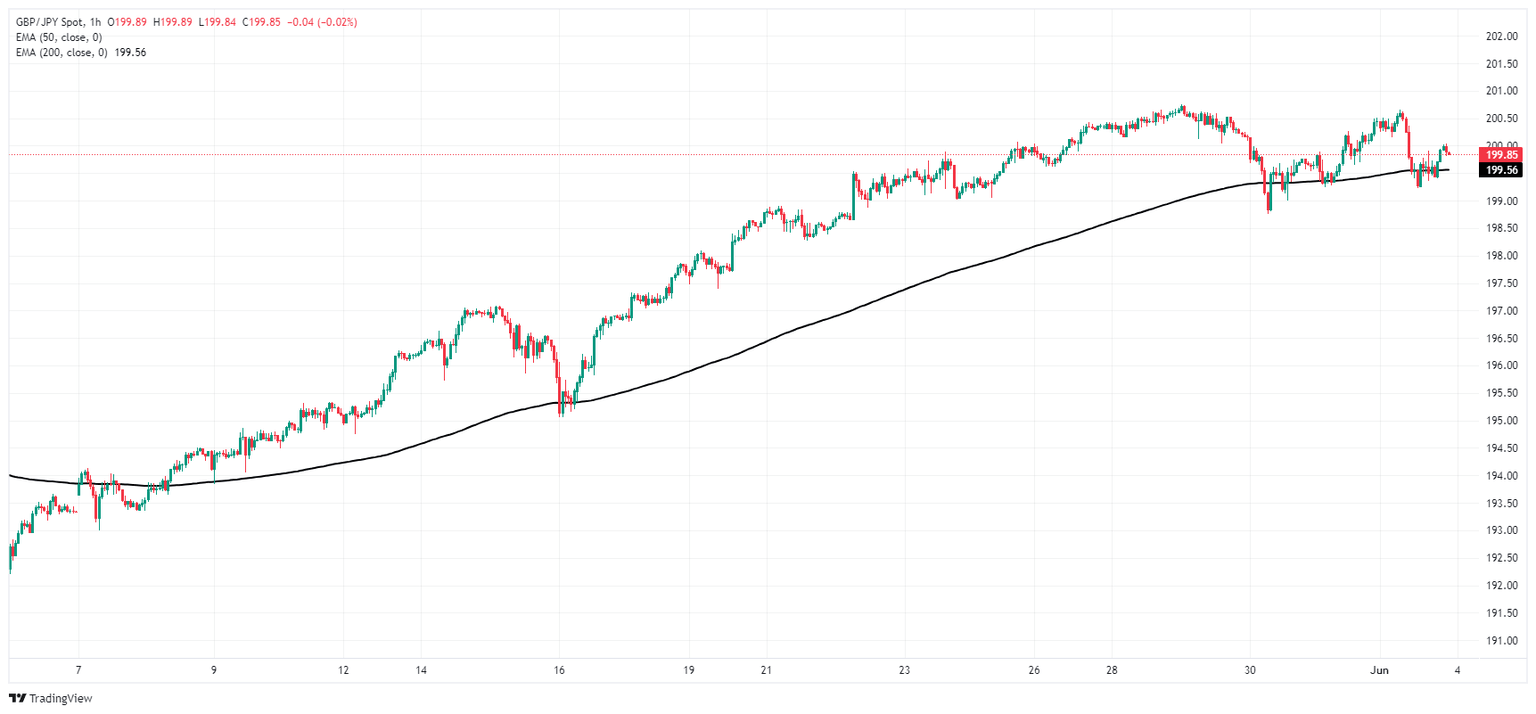

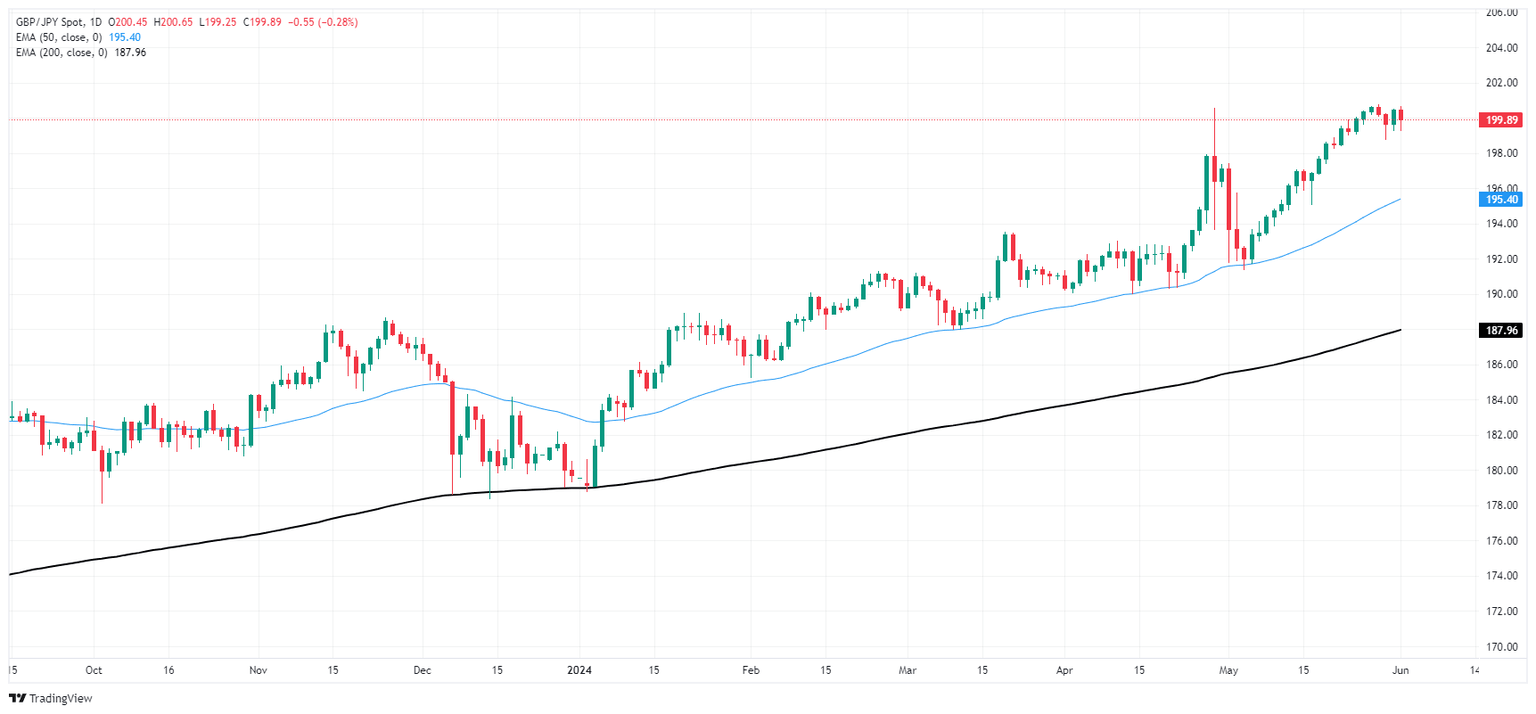

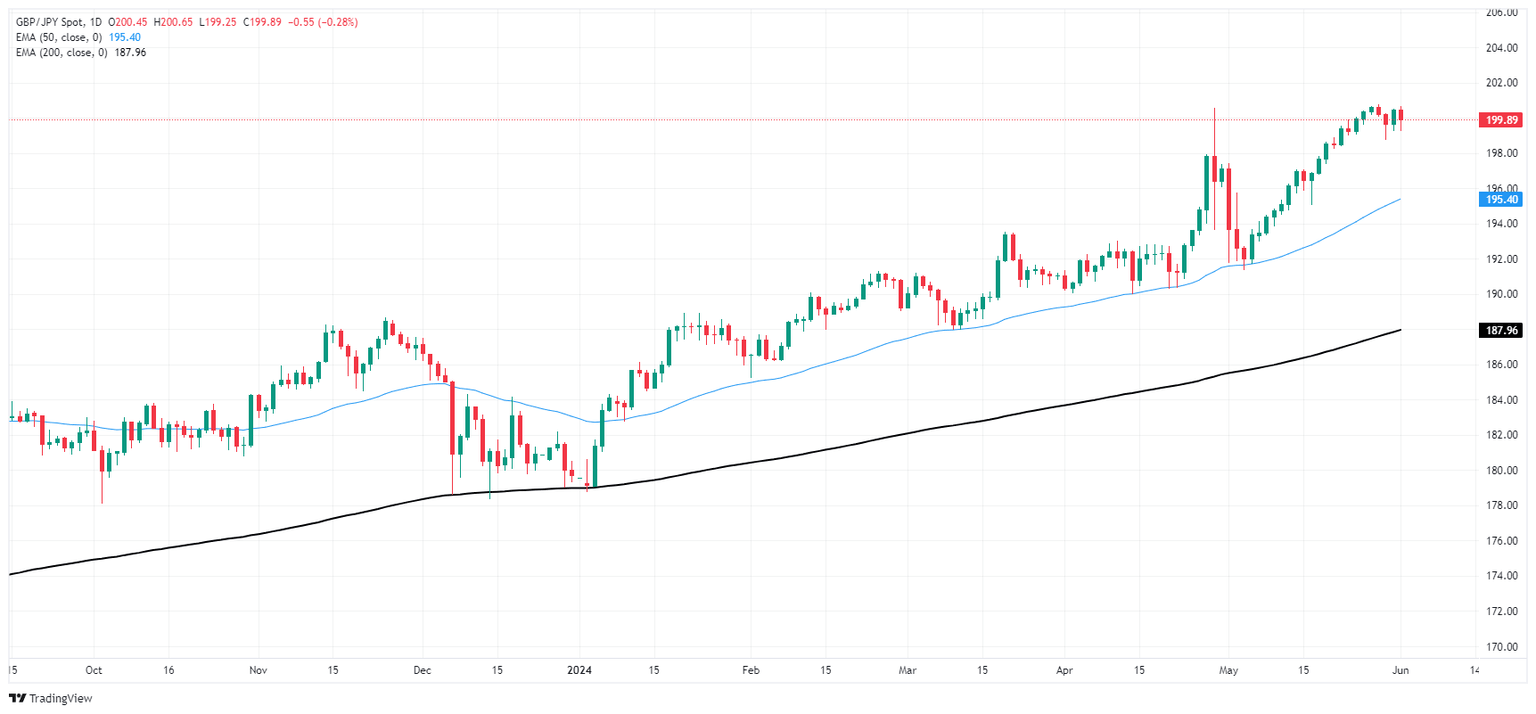

GBP/JPY has struggled in a rough range after hitting multi-decade highs at 200.75 in May, waffling between bids north of 200.00 and a near-term floor just below 199.00. The Guppy is treading water on the high side, but bulls finally appear to have run out of gas after pushing the pair into higher closes for five consecutive months.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.