GBP/CAD Price Prediction: Uptrend extends to upper channel line

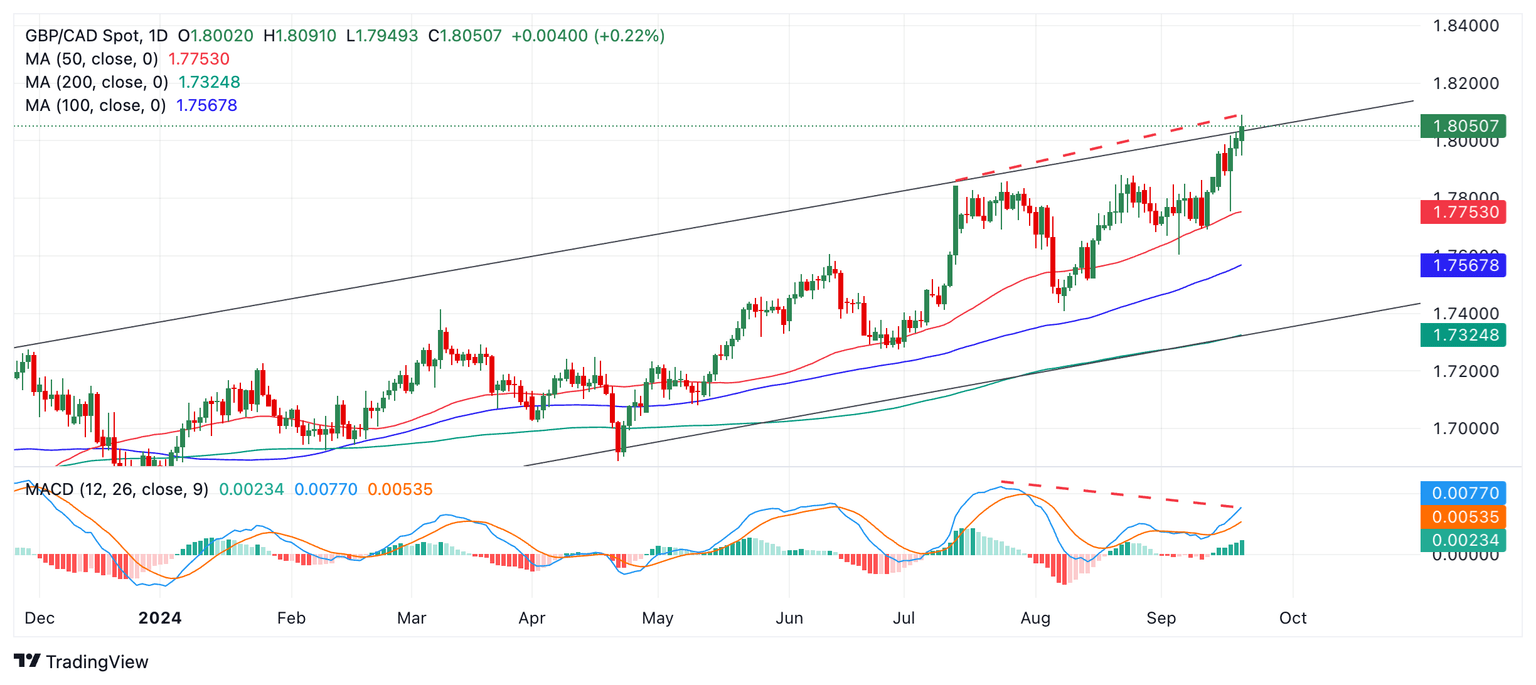

- GBP/CAD has rallied up to resistance at the upper channel line of a rising channel.

- It is at an important crossroads. The uptrend holds but price is diverging bearishly with MACD.

GBP/CAD has rallied up to a new high for 2024 and reached the top trendline of a long-term rising channel. Although it is in a strong uptrend the top of the channel is likely to exert tough resistance and there is a risk of a pullback and countertrend correction unfolding. The pair has reached a critical level.

GBP/CAD Daily Chart

GBP/CAD is showing bearish divergence with the Moving Average Convergence Divergence (MACD) momentum indicator (red dashed lines). Although price has risen to a higher high compared to July 12, the MACD is actually lower than the level it was at on July 12. This is a bearish sign and suggests a higher chance of a pull back evolving.

An initial target for such a pull back might be the 50-day Simple Moving Average (SMA) at 1.7753.

That said, price itself has not formed any kind of reversal pattern yet. It is also in an uptrend on all three major time frames – the short, medium and long-term. This suggests that overall the current is flowing north. Given it is a principle of technical analysis that “the trend is your friend” the odds favor more upside.

Given the resistance above, however, price would have to decisively break above the upper channel line to confirm a continuation.

A decisive break would be one accompanied by a long green candlestick that closed near its high well above the channel line, or three green candlesticks in a row that close well above the trendline. A close above the 1.8091 yearly high would confirm such a breakout, for example.

Such a breakout might reach a target at 1.8278 the 61.8% extrapolation of the prior move higher.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.