GBP/CAD Price Forecast: Down leg extends within rising channel

- GBP/CAD has declined sharply within a rising channel.

- The pair is likely to continue lower as the counter-trend reaction runs its course.

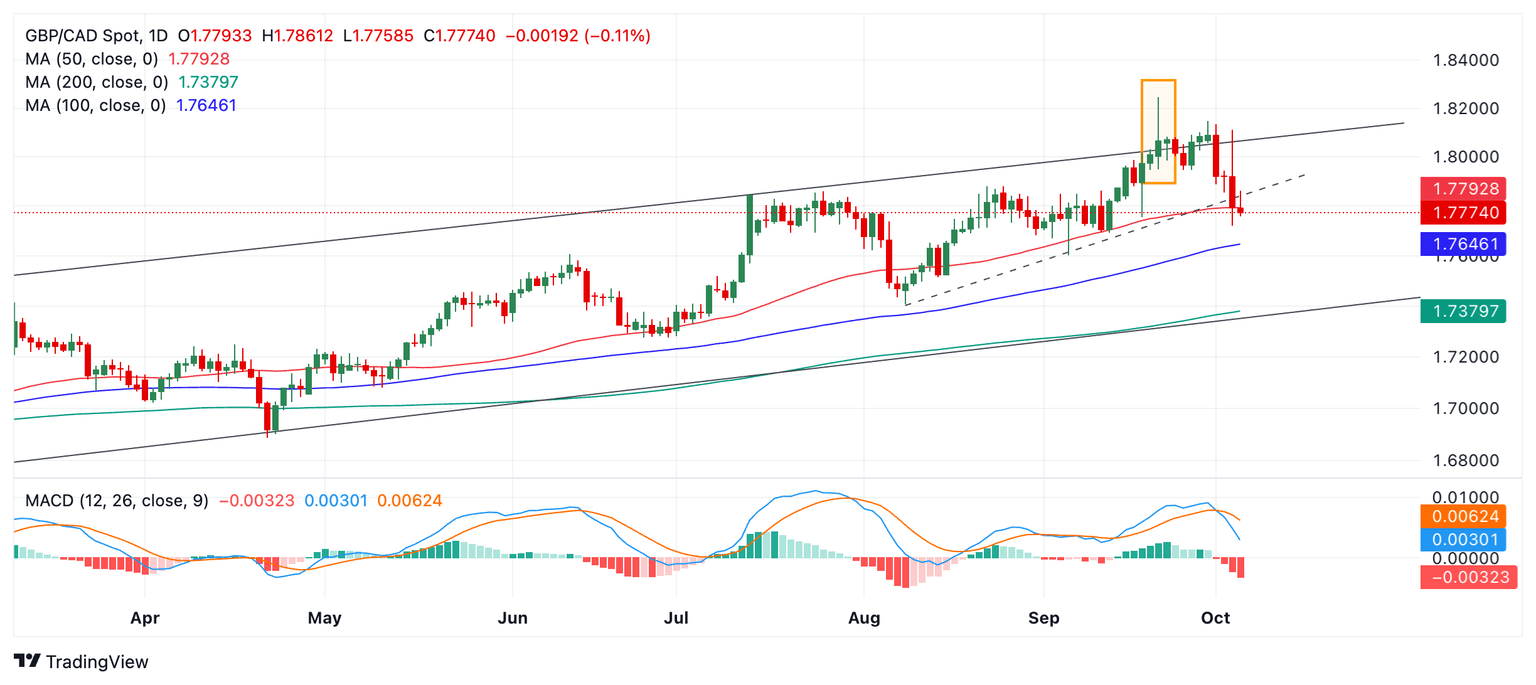

GBP/CAD is unfolding a down leg within a rising channel. It will probably continue lower to at least the blue 100-day Simple Moving Average (SMA) at 1.7641. A break below the 1.7720 October 3 low would cement bearish bets.

The pair is in a short-term downtrend and given the principle that “the trend is your friend” the odds favor a continuation of that trend.

GBP/CAD Daily Chart

Subsequent downside targets lie at 1.7603 (September 4 low) and 1.7407 (August 8 low). In the most bearish scenario price could fall to the lower channel line at 1.7375.

That said, short-holders are advised to exercise caution as GBP/CAD is in an uptrend on the medium and long-term timeframes, as it oscillates higher within an ascending channel. There is a risk, therefore, of a reversal higher occurring unless the current sell-off marks the beginning of a deeper downtrend. This is possible given its steepness.

The Moving Average Divergence Convergence (MACD) has crossed sharply below its signal line providing added bearish confirmation.

The formation of a bearish Shooting Star Japanese candlestick reversal pattern on September 20 (orange rectangle on chart above) gave the first signs of weakness. It then consolidated for a while before starting to fall properly on October 1.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.