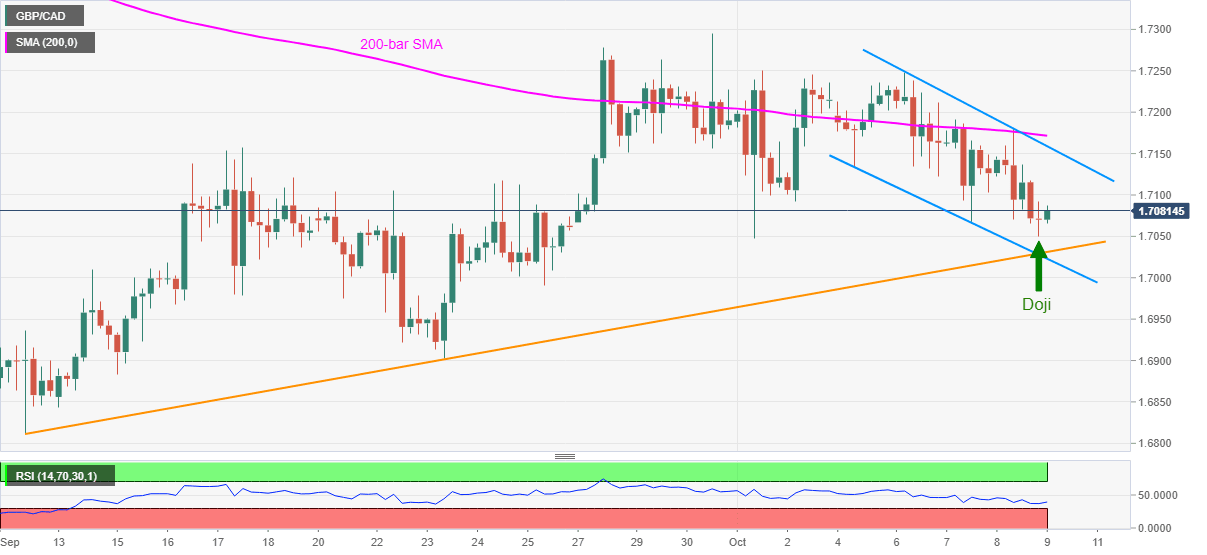

GBP/CAD Price Analysis: Doji on 4H directs pullback to 1.7100 but bears keep the reins

- GBP/CAD recovers from September 01 low while staying inside a weekly falling channel.

- Sustained trading below 200-bar SMA, bearish chart pattern battle bullish candlestick formation.

- One-month-old support line offers intermediate rest ahead of the channel’s lower line.

GBP/CAD seesaws around 1.7085 after bouncing off the lowest since the month’s start during the early Friday. In doing so, the pair respects a bullish candlestick formation suggesting corrective pullbacks inside a short-term bearish channel.

As a result, buyers may attack 1.7100 ahead of challenging the 1.7125 resistance line. Though, any further upside will be probed by the upper line of the mentioned channel, at 1.7158 now.

If at all the GBP/CAD bulls manage to cross the 1.7158 hurdle, they still need a clear break of 200-bar SMA, currently around 1.7175, to retake controls.

On the downside, an ascending trend line from September 11, near 1.7030 and the support line of the channel, around 1.7015, can offer immediate supports during the pair’s further weakness.

It should, however, be noted that the pair’s declines past-1.7015 need to conquer the 1.7000 round-figure before eyeing the September 23 low near 1.6900.

GBP/CAD four-hour (4H) chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.