GB/JPY struggling to maintain control above 183.00, further downside in the crosshairs

- GBP/JPY looking down a steep hill as the pair loses ground near 183.00.

- Data-packed economic calendar for the UK in the bottom half of next week.

- GBP struggles to find a floor on mixed UK data souring investor appetite.

The GBP/JPY has struggled to develop meaningful momentum in recent weeks, and the Guppy is drifting into the low end of recent consolidation, testing the 183.00 handle ahead of next week’s United Kingdom (UK) heavy economic calendar.

This week saw employment and GDP figures for the UK come in below expectations. Wages also ticked higher, keeping inflation concerns elevated.

UK employment change numbers printed at -207K, worse than the forecast figure of -185K and far below the previous read of -66K. Meanwhile, average earnings for the quarter ending July printed at 8.5%, above the previous figure which was revised upwards to 8.4%. The UK's economy is caught between a rock and a hard place with rising wages increasing concerns of inflation coupled with a flagging employment landscape.

Up next week: Japan and UK econ data on the docket

Next week's economic calendar sees Japanese trade balance figures on Tuesday, with both Japanese exports and imports expected to decline. Japan's merchandise trade balance total for August is expected to decline further, forecast to print at ¥-659.1B.

Next week will also see UK Consumer Price Index (CPI) figures, retail sales, and the next rate call from the Bank of England (BoE), which is expected to raise the main benchmark rate to 5.5%, up 25 basis points. The BoE makes its appearance on Thursday at 11 GMT.

UK CPI for the month of August is forecast to print at 0.7% on Wednesday, with retail sales slated for Friday, and expected to show a moderate recovery of 0.5% in August. The previous month saw retail sales decline 1.2%.

Also on Friday will be the Bank of Japan's (BoJ) monetary policy statement and interest rate decision. the BoJ is broadly expected to maintain a negative policy rate of -0.1% as the central bank struggles to keep inflation above the 2% target heading into the fourth quarter.

GBP/JPY technical outlook

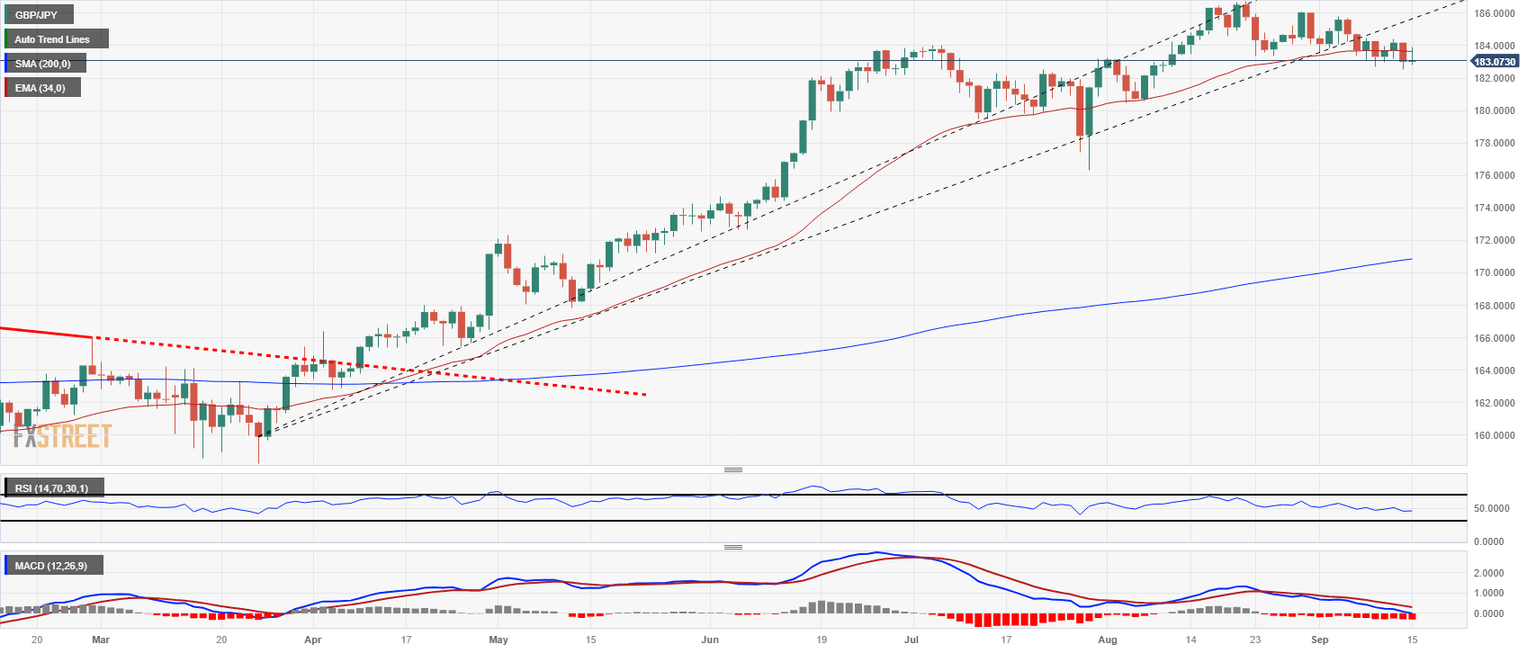

The Guppy is down to the 183.00 handle to close out the trading week, down 2% from the week’s high near 182.85.

The GBP/JPY Has struggled to develop momentum from the 34-day Exponential Moving Average (EMA) But is trading well above the 200-day Simple Moving Average (SMA) currently parked near 171.00.

The pair has traded sideways through a rising trendline from March's lows near the 160.00 major handle, and Yen bulls will be looking to develop bearish momentum from here.

GBP/JPY daily candlestick chart

GBP/JPY technical outlook

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.